April 26, 2024 10:00 GMT

Danone (BNFP; Baa1, BBB+; S) {BN FP Equity}

CONSUMER STAPLES

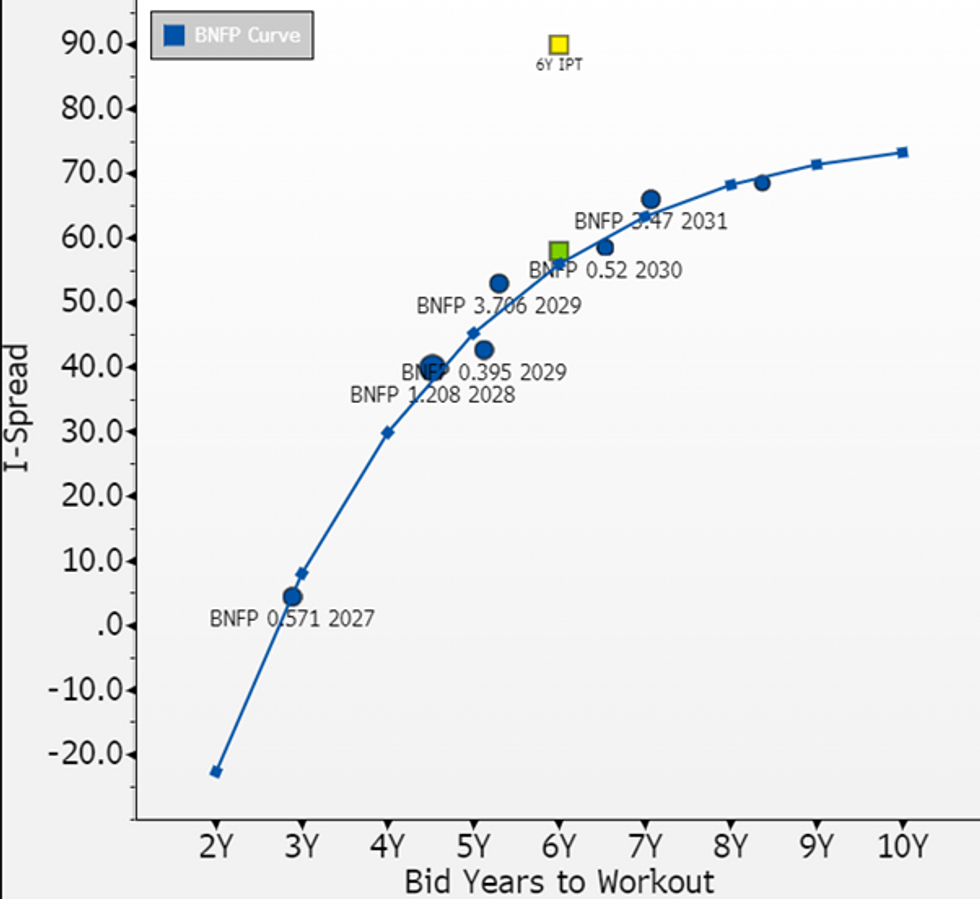

The parent of dairy, water & nutrition brands including Activia & Alpro is out with benchmark 6Y IPT at +90 vs. FV of +58. Hard to get excited about BNFP secondary; spread pick is 10bps around the 6y into recent upgraded & now equal rated brewer Carlsberg. On the 28s there's 50bp+ pickup into Aussie eqv. Tesco WOWAU 28s. BNFP 1Q results below, UoP is left open, should visit primary soon enough with €4b in € lines rolling off in next 1.5yrs.

- Slight beat at organic growth of +4.1% (c+3.5%) driven in equal parts by volume (+1.2%) and price (+2.9%). All geographies & segments grew; notable strength in APAC at +9% & in Water segment at +8.1%.

- It kept FY guidance unch for organic +3-5% growth with "moderate" improvement in EBIT margin - analyst have taken that guidance & looking for FCF in low €2b with dividends of ~€1.3b. BS in shape at ~2x levered to end last yr, relative lows vs. past years. See no rating changes in near term.

180 words