-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: PBOC Support Pledge Triggers Risk-On Flows

- The PBOC vows to ramp up support to the economy through monetary policy tools, which helps revive risk sentiment in the Asia-Pac session.

- Offshore yuan drops in reaction to an in-line PBOC fix but recovers amid broader pick-up in sentiment, with USD/CNH poised to snap a five-day winning streak.

- Risk-on flows take hold in G10 FX space, core FI reverse earlier gains, while regional equity markets (outside of Australia)creep higher.

BOND SUMMARY: Core FI Lose Allure As Sentiment Recovers

Recovery in broader risk appetite pulled the rug from under core FI as the PBOC pledged a more proactive approach to supporting domestic economy via monetary policy tools.

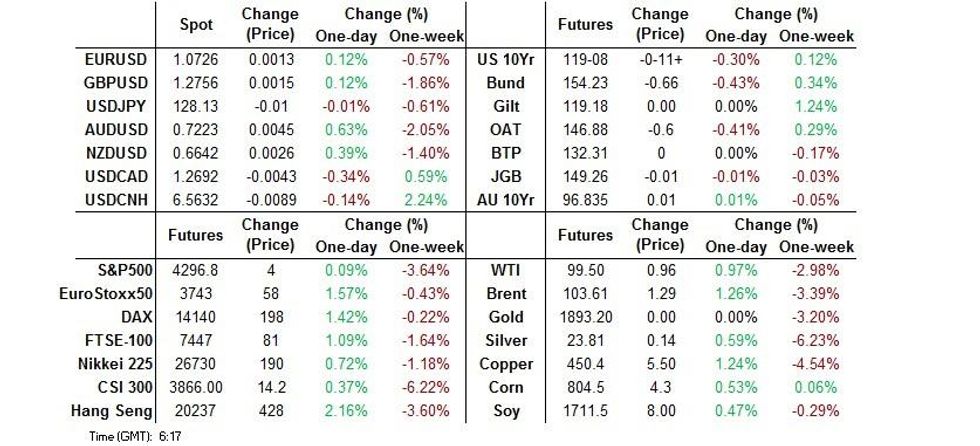

- T-Notes reversed earlier gains and sank into negative territory. TYM2 last changes hands -0-09+ at 119-10, pulling back from its earlier session high of 119-26+. Eurodollar futures deal 0.5-5.5 ticks lower through the reds. Cash U.S. Tsy yields bounced in the Tokyo afternoon and last sit 1.9bp-4.0bp higher, with the curve running a tad flatter. Looking ahead, durable goods orders, Conf. Board Consumer Confidence & new home sales provide local data highlights on Tuesday, with 2-Year Tsy auction also up today.

- JGB futures dipped as the BoJ conducted its regular Rinban operations and the final iteration of pre-announced fixed-rate JGB purchases. The contract extended losses after the Tokyo lunch break and last operates at 149.26, a tick shy of previous settlement. Cash JGB yields recovered towards neutral levels, albeit 30s still outperform. Japan's unemployment rate unexpectedly slipped in March, but the data is unlikely to move the needle on Thursday's BoJ policy meet. Re: today's Rinban ops, they yielded the following offer/cover ratios:

- 3- to 5-Year: 1.80x (prev. 2.32x)

- 5- to 10-Year: 2.71x (prev. 2.40x)

- 25+ Year: 5.20x (prev. 4.73x)

- 10-Year JGBis: 4.63x (prev. 2.08)

- Aussie bond futures sold off late doors in tandem with major peers, YM last +5.0 & XM +10.0 (both near session lows). Bills run -1 to +9 ticks through the reds. Cash ACGBs caught a bid as Sydney trading resumed after the ANZAC Day, but trimmed gains later in the day. Yields sit 0.8bp-4.2bp at typing, curve runs steeper as the short-end leads gains. Domestic headline flow was sparse, with all eyes already on the quarterly CPI report, due for release on Wednesday.

FOREX: PBOC Pledges More Monetary Policy Support, Risk Switch Flicked To On

The PBOC soothed the nerves by vowing to increase its support for the economy via monetary policy tools and promote healthy and stable development of financial markets. Risk sentiment gradually firmed as a result, with U.S. e-mini futures moving into the green.

- Antipodean currencies staged a comeback as the broader risk backdrop improved, with regional liquidity boosted as Australia and New Zealand returned from holidays. With participants already awaiting the release of Australian CPI data on Wednesday, AUD/USD overnight implied volatility printed a fresh multi-week high.

- Safe havens lost their initial appeal, even as the yen outperformed in early Tokyo trade, which allowed USD/JPY to show at its worst levels in a week. Japan FinMin Suzuki reiterated that officials are watching FX moves with "vigilance," but also denied last week's report of his alleged talks with U.S. Tsy Sec Yellen on a joint currency intervention. Separately, former MoF FX czar Watanabe told BBG that the government likely does not intend to intervene now.

- The greenback was the main casualty of newly reduced demand for safer assets. It underperformed all of its major peers, while the dollar index (DXY) extended its pullback from yesterday's cycle highs.

- Offshore yuan took a hit as the PBOC fix fell virtually in line with expectations, indicating the central bank's reluctance to use this tool for pushing back against redback depreciation. It regained poise as the session progressed, with participants mulling PBOC comments. Spot USD/CNH plunged into negative territory, which sets it on track to snap a five-day winning streak.

- U.S. Conf. Board Consumer Confidence, new home sales & flash durable goods order as well as comments from ECB's de Cos & Villeroy will provide interest going forward.

FOREX OPTIONS: Expiries for Apr26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-10(E802mln), $1.0725-50(E2.1bln), $1.0785-05(E2.6bln), $1.0800-05(E1.0bln), $1.0900-10(E560mln)

- USD/JPY: Y125.00($1.2bln), Y126.00-20($1.2bln), Y126.75-80($850mln), Y128.00($575mln)

- AUD/USD: $0.7150-70(A$771mln), $0.7220(A$1.2bln), $0.7350-70(A$1.1bln)

- USD/CAD: C$1.2675($655mln), C$1.2785($575mln)

ASIA FX: Asia EM Space Welcomes Prospect Of More Supportive PBOC

China's central bank vowed to play a more supportive role, which helped repair market confidence damaged by the worsening local outbreak of Covid-19. Local developments provided additional incremental support to a number of Asia EM currencies.

- CNH: Offshore yuan took a hit as the PBOC set the mid-point of permitted USD/CNY trading band in fairly close proximity to the sell-side estimate, which was interpreted as a sign of limited readiness to further lean against redback depreciation (reminder that the People's Bank trimmed the FX RRR on Monday). The PBOC's pledge to increase support for the economy via monetary policy tools initially amplified selling pressure on the yuan, but the currency regained poise later in the session as these comments seemingly inspired a broader recovery in risk appetite. In addition, Bloomberg trader sources cited heavy dollar selling by the overseas branches of Chinese banks, which contributed to a sharp pullback in spot USD/CNH, which is poised to snap a five-day winning streak.

- KRW: Spot USD/KRW showed above the KRW1,250.00 mark for the first time since the outbreak of the Covid-19 pandemic, but retreated thereafter as market sentiment improved. South Korean economy remained resilient in Q1, advance readings showed, as GDP grew 3.1% Y/Y against consensus forecast of +3.0%.

- IDR: The rupiah went bid as Indonesian government clarified that the surprise ban on palm oil exports will be limited to certain processed products and will not affect crude palm oil. Regional impetus provided conducive environment for the rupiah's continued recovery from multi-month lows printed on Monday.

- MYR: The rally in spot USD/MYR observed over the last week ground to a halt and the rate moved away from cycle highs. Malaysian Health Ministry prepares to announce looser Covid-19 rules on Wednesday, pending Cabinet approval.

- PHP: The Philippine peso strengthened as BSP Gov Diokno said that the central bank may consider raising its benchmark policy rate in June (his earlier comments flagged potential for a rate hike in the second half of the year). The official said that recent peso depreciation is in line with regional trend and not a concern for Bangko Sentral.

- THB: Spot USD/THB kept pushing higher after clearing key resistance from THB34.000 and completing an ascending bull triangle pattern on Monday. The rate printed its best levels since July 2017.

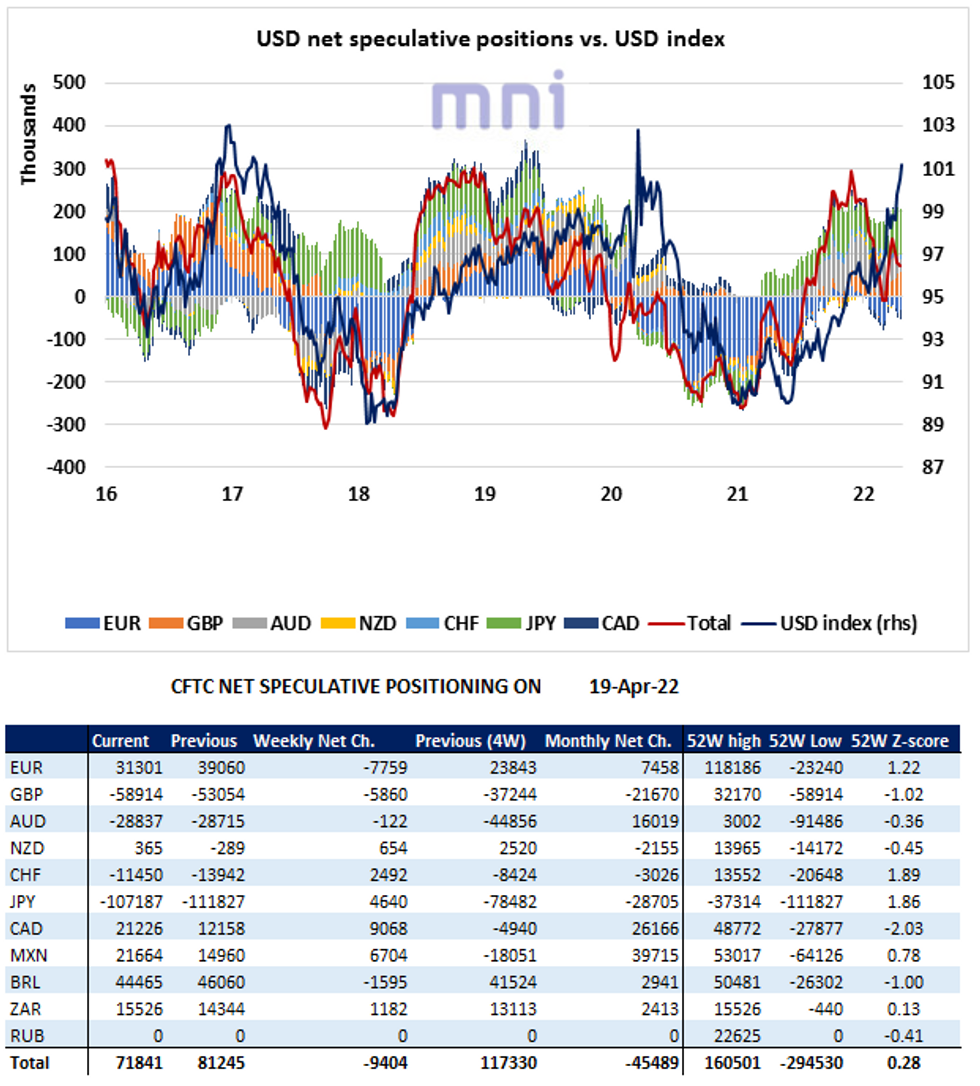

FOREX: USD Net Long Specs Fall Despite Suring Dollar

- Net long specs on the US Dollar ticked lower in the week ended April 19 despite the USD spike, decreasing by 9.4K to a total of 71.8K contracts.

- Speculative positions against the Yen continue have been growing rapidly, currently standing at November 2018 highs (+107.2K) as investors have become increasingly bearish on JPY amid monetary policy divergence.

- The global risk off environment triggered by the renewed geopolitical tensions has been supporting ‘safe-haven’ assets such as the US Dollar.

- In addition, hawkish comments from Fed policymakers continue to levitate US ST bonds yields, pushing preference for the greenback.

- Last week, St. Louis President Bullard mentioned that a potential 75bps hike cannot be ruled out given the current level of inflation.

- The DXY index broke above the 101 level last week and is gradually approaching the 102 resistance.

- Key resistance to watch on the topside stands at 102.98, which was the high reached in March 2020 following the Covid19 shock.

- On the downside, support to watch stands at 100, followed by 99.7290, which corresponds to the 76.4% Fibo retracement of the 89.21 - 102.98 range.

Source: Bloomberg/MNI.

EQUITIES: Mostly Higher In Asia; Chinese Equities Rebound As PBoC Wades In

Major Asia-Pac equity indices are mostly higher following a positive lead from Wall St. and PBoC pledges of support for the Chinese economy, putting regional equity indices on track to snap a collective three-day streak of lower closes as seen in the MSCI Asia Pacific Index.

- The Australian ASX200 remains the sole index in the red today, dealing 2.0% lower at typing on losses in virtually every constituent sub-index. Energy and material names were notable underperformers, likely facing drag from energy and commodity prices having declined over the weekend (and over Monday’s Anzac Day national holiday).

- The CSI300 reversed earlier losses of as much as -0.6%, and sits 1.4% better off at typing. Chinese stocks received a boost early in the session after the PBoC renewed pledges to increase support for the economy while promoting the health and stability of financial markets, coming after Monday’s sell-off left Chinese benchmarks within ~10% of COVID-era lows by the close of the session. High-beta equities and tech stocks were notable beneficiaries of the improvement in sentiment, with Chinese liquor stocks leading gains (particularly Kweichow Moutai), while the ChiNext trades 2.0% higher at typing.

- The Hang Seng Index outperformed, adding 1.9% at typing. China-based technology stocks outperformed, with the Hang Seng Tech Index sitting 5.4% firmer, operating a touch below session highs at writing. On the other hand, the financials sub-index struggled, bucking the broader trend of gains in the index as Chinese authorities appear to be widening a crackdown on corruption in the industry.

- U.S. e-mini equity index futures deal 0.2% to 0.3% higher apiece at typing, reversing losses earlier in the session on tailwinds from aforementioned PBoC messaging.

GOLD: A Little Higher In Asia; One-Month Low Remains Level To Watch

Gold is ~$4/oz firmer at writing to print $1,902/oz, extending a move away from 1-month lows made on Monday (at $1,891.7/oz) as nominal U.S. Tsy yields and the USD (DXY) have ticked lower in Asia-Pac dealing, with the former broadly continuing to back away from recent cycle highs.

- To recap, the precious metal closed ~$34/oz lower on Monday, with the move lower facilitated by a broad uptick in U.S. real yields and the USD (DXY).

- Heightened worry in recent sessions re: Fed tightening in the upcoming May 4 FOMC is evident, with gold extending a pullback from near the $2,000/oz mark despite a notable rise in geopolitical risks re: stagflation, as well as events (and consequences) surrounding China’s ongoing COVID outbreak and the Russia-Ukraine conflict.

- May FOMC-dated OIS continue to price in a shade over 50bp of tightening, possibly locking in expectations for a 50 bp hike for that meeting, with the pre-FOMC media blackout having kicked in.

- From a technical perspective, the pullback from recent highs at $1,998.4/oz (Apr 18 high) continues to represent a bearish threat. Gold has held key support at $1,890.2/oz (Mar 29 low and bear trigger) for now, although a break below that would open up further support at $1,878.4/oz (Feb 24 low).

OIL: WTI Reaching For $100; Beijing Lockdown Speculation Simmers

WTI is ~+$1.10 and Brent is ~+$1.40, printing $99.60 and $103.70 respectively and operating around session highs at typing.

- To recap, both benchmarks rose from worst levels on Monday to ultimately close between ~$3.50 to ~$4 lower apiece, with downward pressure coming from elevated worry re: impacted Chinese energy demand as well as a continued rally in the USD (DXY), with the latter hitting two-year highs during the session.

- Looking to China, the COVID outbreak in the nation’s capital has expanded, with 33 fresh cases reported for Monday, spurring authorities to announce mass testing for most of Beijing’s population (~21mn). Some media reports have pointed to limited stockpiling behaviour amongst residents in preparation for a lockdown (a possible scenario given current “dynamic COVID-Zero” posture), although no such measures have been announced so far.

- Elsewhere, RTRS and BBG source reports have pointed to Russian oil giant Rosneft’s difficulty in awarding a tender for at least ~37mn bbls of Urals crude for May and June after demanding prepayment in roubles, giving a glimpse into the potential for disruptions in Russia crude supplies as European buyers continue to stay away.

- A note that this comes amidst BBG source reports of some Asian buyers shunning Russian Sokol-grade crude in the country’s east primarily over marine insurance concerns after sanctions were imposed on a Russian tanker company used to ship the crude, highlighting another possible avenue for supply disruption.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 26/04/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 26/04/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/04/2022 | 1245/0845 |  | CA | BOC Deputy Lane panel talk | |

| 26/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/04/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/04/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/04/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/04/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/04/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.