-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free Access“Easy” Gains Behind Us?

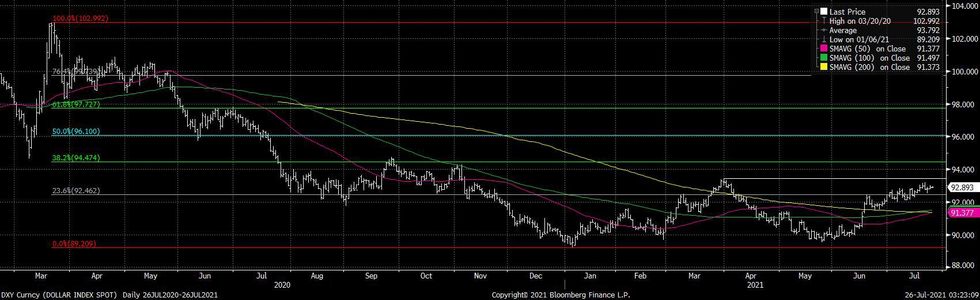

While the resilience and YtD rally witnessed in the broader USD (DXY +3.3% YtD and +4.2% from its YtD trough) has caught many off guard (a reminder that the clear consensus at the start of '21 was for a weaker USD), most, if not all, of the "easy" gains may be in the rear-view mirror for the greenback.

- The aggregate net USD short held within the speculative community since the early part of '20 has unwound, per the latest weekly CFTC CoT report covering the week ending 20 July, if we measure the USD-equivalent value of the futures contracts covered by the report (EUR, GBP, JPY, CAD, AUD, NZD, MXN, BRL & RUB). Levered funds' net positioning has also reverted to net long terms in recent weeks, while asset managers have seen a relatively sharp liquidation of a portion of their net short position, although that investor group's positioning remains comfortably in net short territory (at $36.9bn or 20.6% of open interest). As an aside, asset managers have not been cumulatively net long of USD since '17.

- U.S. economic outperformance has failed to materialise in recent weeks (at least vs. expectations, as evidenced by the Citi U.S. economic surprise index's lack of momentum in moving away from 0), with the fate of the Biden administration's fiscal spending agenda becoming evermore important re: the near-term economic health of the U.S.

- Looking ahead, the key domestic points of interest for the USD over the next month or so include the latest FOMC decision (Wednesday 28 July), U.S. Q2 advance GDP reading (Thursday 29 July), June's labour market report (Friday 6 August) & the Fed's annual Jackson Hole Symposium (Thursday 26 - Saturday 28 August).

- From a technical perspective, the DXY hasn't looked back since breaching its 200-DMA in June, and is close to registering a golden cross formation (whereby the 50-DMA moves above the 200-DMA). Still, the YtD high (93.437) represents the next major target for DXY bulls.

Fig. 1: DXY Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.