-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

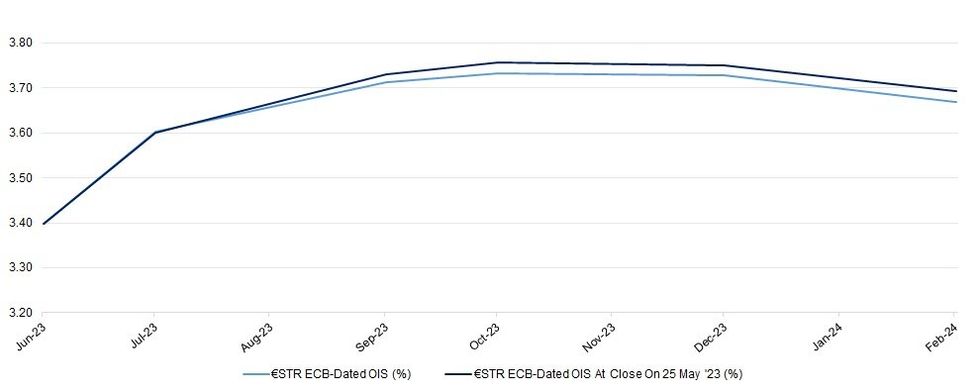

Free AccessECB Pricing Off Recent Extremes As Bonds Stabilise

ECB-dated OIS eases back a touch from levels seen late yesterday, with terminal rate pricing sitting just below 3.85% in deposit rate terms, as core global FI markets stabilise a little, alowowing an early uptick to unwind and more.

- ECB speak since late yesterday hasn’t really moved the needle.

- Chief economist Lane noted that although he expects inflation to turn the corner, it is not at that stage yet. He also flagged optimism re: a slowing in services inflation but wouldn’t be drawn on specifics re: timings.

- Knot provided some hawkish overtures (relative to the views across the Governing Council), warning that there are no signs that underlying inflation is abating. He also signalled the need for rate hikes in June & July, while he remains open to the possibility of another hike in September, although was cognisant of the delayed feedthrough from already enacted tightening.

- Finally, Vujcic pointed to inflation returning to 2% over the next two years, while flagging continued momentum in both core and food inflation. He stressed that the transmission of monetary policy has been effective, while pointing to the need for further data to draw any meaningful conclusions on lending dynamics.

- The regional docket is thin for the remainder of the day, which will leave focus on U.S. data releases. Further out, a raft of ECB speak is once again slated for next week, while the summary covering the most recent ECB meeting and preliminary Eurozone CPI data for May (both due Thursday) headline next week’s regional release docket.

| ECB Meeting | €STR ECB-Dated OIS (%) | Difference Vs. Current Effective €STR Rate (bp) |

| Jun-23 | 3.399 | +25.1 |

| Jul-23 | 3.603 | +45.5 |

| Sep-23 | 3.712 | +56.4 |

| Oct-23 | 3.732 | +58.4 |

| Dec-23 | 3.728 | +58.0 |

| Feb-24 | 3.669 | +52.1 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.