-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

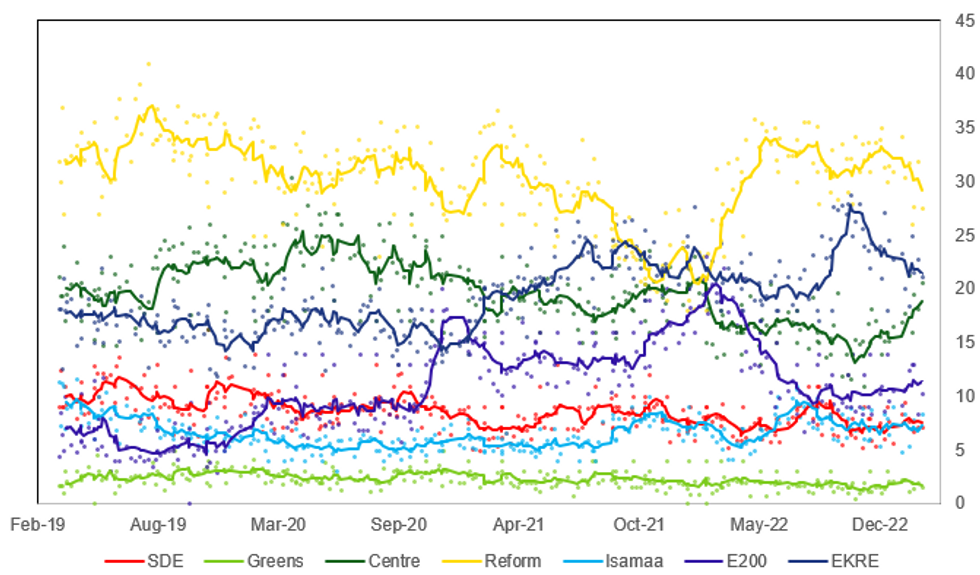

ESTONIA-Election On Knife-Edge As PM Kallas' Coalition Not Sure Of Majority

The Estonian election, taking place on Sunday 5 March, sits on a knife-edge as Prime Minister Kaja Kallas' governing coalition is not certain to retain its majority in the 101-member Riigikogu (parliament). Should Kallas' centre-right liberal Reform Party not be involved in the next gov't, a shift towards more gov't spending would be probable as would a drop off in Estonia's vocal support for Ukraine.

- The main threat to Reform would be an unwieldy but potential coalition between the two parties vying for second place, the right-wing nationalist Conservative People's Party (EKRE) and the agrarian populist Centre Party (EK). The Centre Party has historically picked up votes from Estonia's Russian-speaking minority and supported closer links with Moscow. However, it has reined in this stance significantly since the invasion of Ukraine and now advocates for continued support for Kyiv (alienating some of its support base).

- The EKRE also advocates continued backing for Kyiv, but has taken a tougher line on accepting Ukrainian refugees. Party head Martin Helme has made the case that reduced spending on refugees and immigrants can boost welfare spending (those on lower incomes and retirees are key voter bases for the EKRE).

- Reform currently governs with the centre-left Social Democrats (SDE) and centre-right Isamaa (Fatherland). This coalition could fall short of a majority, but the liberal centrist Estonia 200 (E200) could prove a viable alternative partner. In this scenario we would expect to see broad policy continuity on spending and Tallinn's stance on the war.

Source: Norstat, Turu-uuringute, Kantar Emor, MNI

Source: Norstat, Turu-uuringute, Kantar Emor, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.