-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessESTONIA-No Confidence Vote Looms For PM (1/2)

Earlier, the conservative Isamaa (Fatherland) party confirmed that it had begun conversations with other opposition parties with the aim of bringing a vote of no confidence in Prime Minister Kaja Kallas and her gov't. In Estonia, the support of 21 lawmakers in the 101-member Riigikogu (parliament) is required to initiate a vote of no confidence. Currently, no single opposition party has that number of seats, meaning cross-party cooperation will be required.

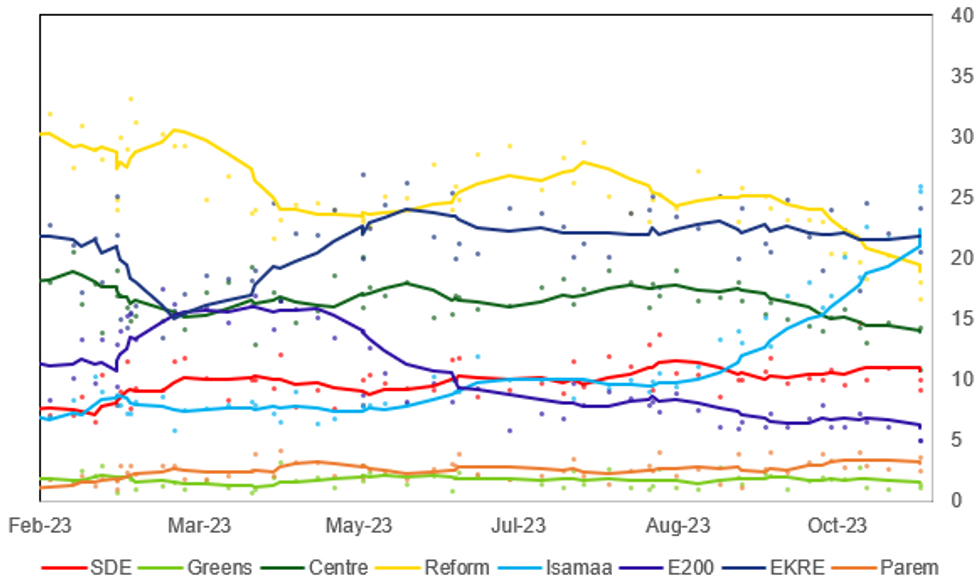

- A vote is likely, and it comes at a difficult time for Kallas. The PM's tripartite gov't holds a comfortable majority, with 60 seats in total among her liberal conservative Reform Party, the centrist Eesti 200 (Estonia 200, E200), and the centre-left Social Democrats (SDE). However, polling support for the governing parties is plummeting and E200 is in the process of electing a new leader, with one of the candidates actively supporting the party's withdrawal from gov't.

- The two polls carried out in Nov have Reform averaging 17.4%, and E200 on 5.1%. This is down from 31.2% for Reform and 13.3% for E200 in the 5 March general election. For Reform, a scandal involving Kallas' husband continuing to hold a stakein a firm that maintained operations in Russia following the invasion of Ukraine and subsequent EU sanctions has hit support. For E200, many supporters have abandoned the upstart party after it went into coalition with Reform, seen as a party of the establishment. The 16.7% support garnered for Reform in the 6 Nov Norstat poll was the lowest recorded by the party since June 2015.

Source: Norstat, Kantor Emor, Turu-uuringute AS, MNI

Source: Norstat, Kantor Emor, Turu-uuringute AS, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.