-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessEurozone Issuance Deep Dive: April 2021

For the full document click here:

April Outlook

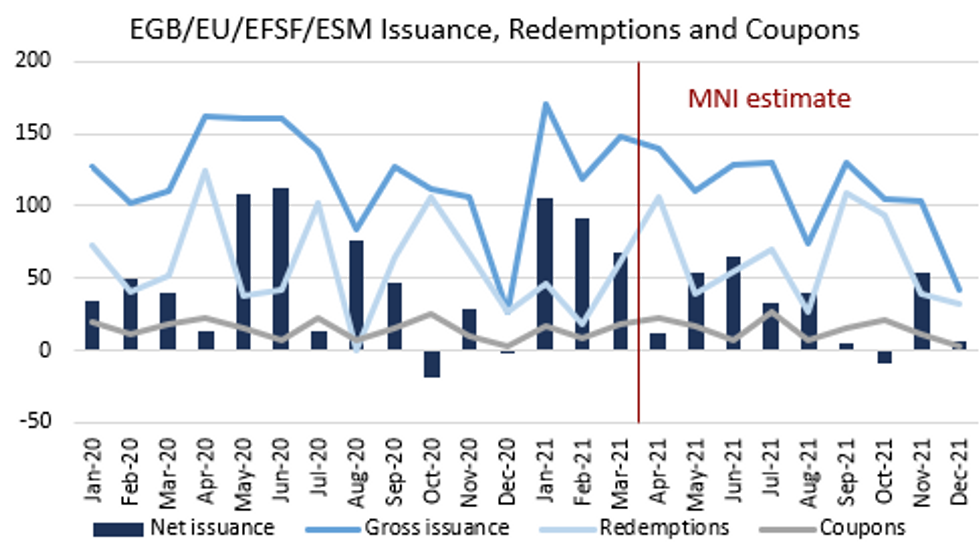

- The MNI Markets team expects gross issuance to be slightly lower in April than in March. We look for E140.2bln of issuance, down from E148.1bln in March.

- However, April sees the second most redemptions of any month in 2021 and the second most coupon payments, too.

- In total coupons + redemptions for April are E128.4bln (the highest combined total for 2021).

- This means net issuance will be just E11.8bln for April, down from E67.6bln in March.

- We think there is a good chance of syndications in April from Finland, Ireland, Portugal, Slovakia, the EU via its EFSM programme (and possibly SURE), the EFSF and around a 50% chance of a Spanish syndication. The Netherlands has already announced a DDA.

EGB/EU/EFSF/ESM Issuance, Redemptions and CouponsMNI Market News

EGB/EU/EFSF/ESM Issuance, Redemptions and CouponsMNI Market News

March Review

- A total of E144.2bln of EGB and EU issuance took place in March 2021. This is an increase of over 31% over the E109.8bln cash raised in March 2020.

- Note that after the heavy issuance of ultra-long bonds in January and February, there were no bonds issued with a longer than 30-year maturity in March.

Contents

- See page 2 for a comparison of issuance with last year for both March and Q1

- See page 3 for links to the MNI policy team's interviews with debt officials.

- See pages 3-12 for country-by-country overviews of issuance so far this year, plans for the rest of the fiscal year and MNI's expectations of April issuance for each country.

- See pages 13-14 for overviews of the 2021 calendar year in comparison to 2020.

- See page 15-22 for bond and T-bill auction calendars for 2021.

- See page 23-25 for a schedule of coupons and redemptions by country for 2021.

For the full document click here:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.