-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

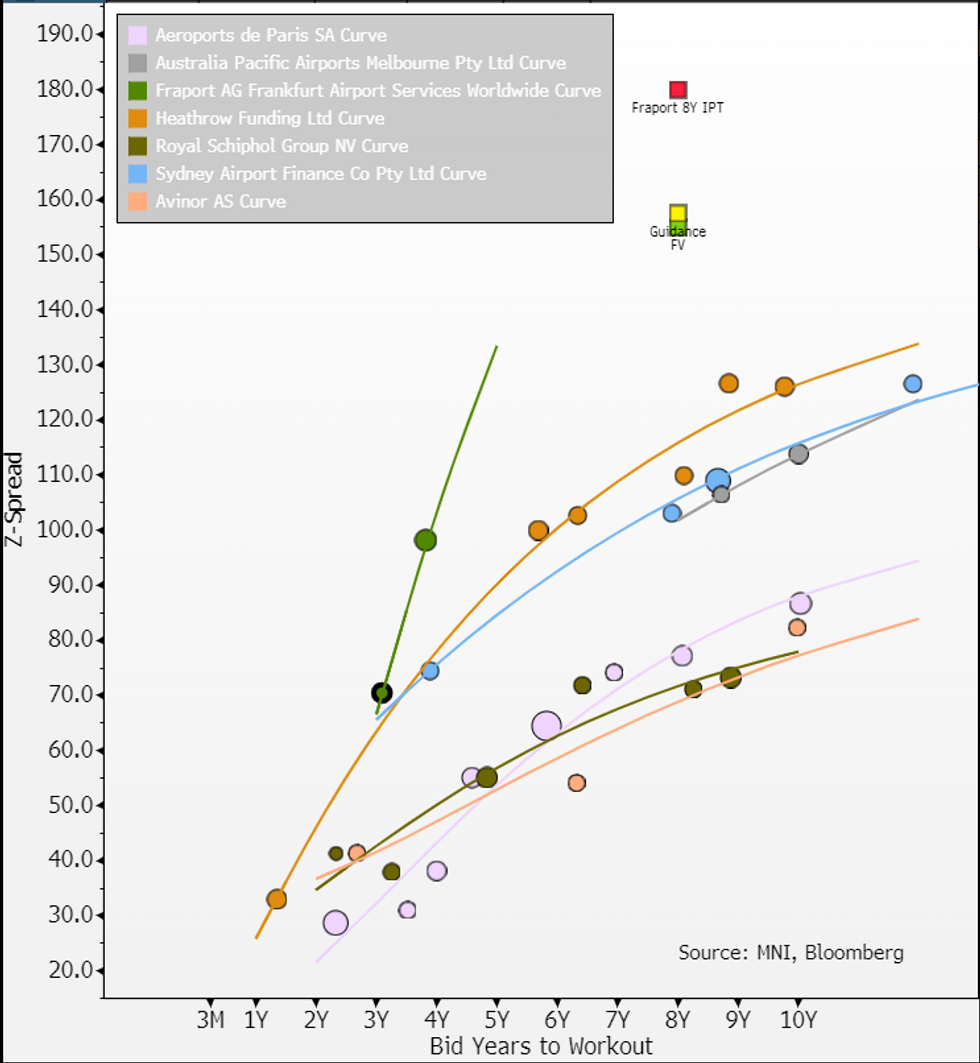

Free AccessFraport (FRAGR; unrated) Guidance & FV

exp. €500m 8Y Guidance +155-160 vs. FV+155.IPT was +185 (-20 in), books>€1.5b are healthy, FV below

- We ignore the legacy 29s (€150m from 2009) at Z+203. State of Hesse (31%) and City of Frankfurt (21%) own half the shares - hard to know if it would have received uplift for this on ratings (ADP gets 1-notch for similar 50.6% ownership from French gov.). No mention of any historical financial support in roadshow.

- Revenue at €4b has surpassed pre-covid levels of €3.7b. EBITDA margin at 30% is ~in-line with pre-covid levels -consensus expects it to stay ~flat here while headline revenue grows.

- FY24 Guidance (reaffirmed in 1Q results) is for largely flat with EBITDA expected to rise from €1.2b to €1.26-€1.36b and net profit from €431m to €435-€530m. At FY23 results it added FCF was projected to be negative & dividends continued to be suspended on debt level.

- Its 9.8x gross levered on €11.8b of debt & net 6.4x levered on €4b of cash. That is down from Covid peak of net 8.4x but still higher than 3.5x pre-covid. It targets LT max 5x net leverage.

- Maturity profile is well spread out, €1.5b due this year, and low €1b each year heading forward in a mix of mostly loans but also corp. bonds & schulds.

- We are not sure if lack of rating implies infrequent visitor - we wouldn't assume that given €2.4b in bonds outstanding & still active in primary. We are assuming it will use proceeds to refi the €650m July 24s.

For comparison; ADP (Paris airports) is similar scale (€5.5b in revenues), tad higher growth (+8% vs. +6%) & EBITDA margins (36% vs. 30%), runs 2.5 turns less net leverage (at 4.1x, targeting 3.5-4x in 2025) & gross (we see) 4.5 turns less at 5.5x. It is standalone A- rated with 1-notch for French gov. Fitch is on BBB+. Spread between the 27s below. For FV we've spread 8Y a +75bps on this year's FCF guidance & post-covid trading history (to which leverage is closer to still).

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.