-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessFund Flows

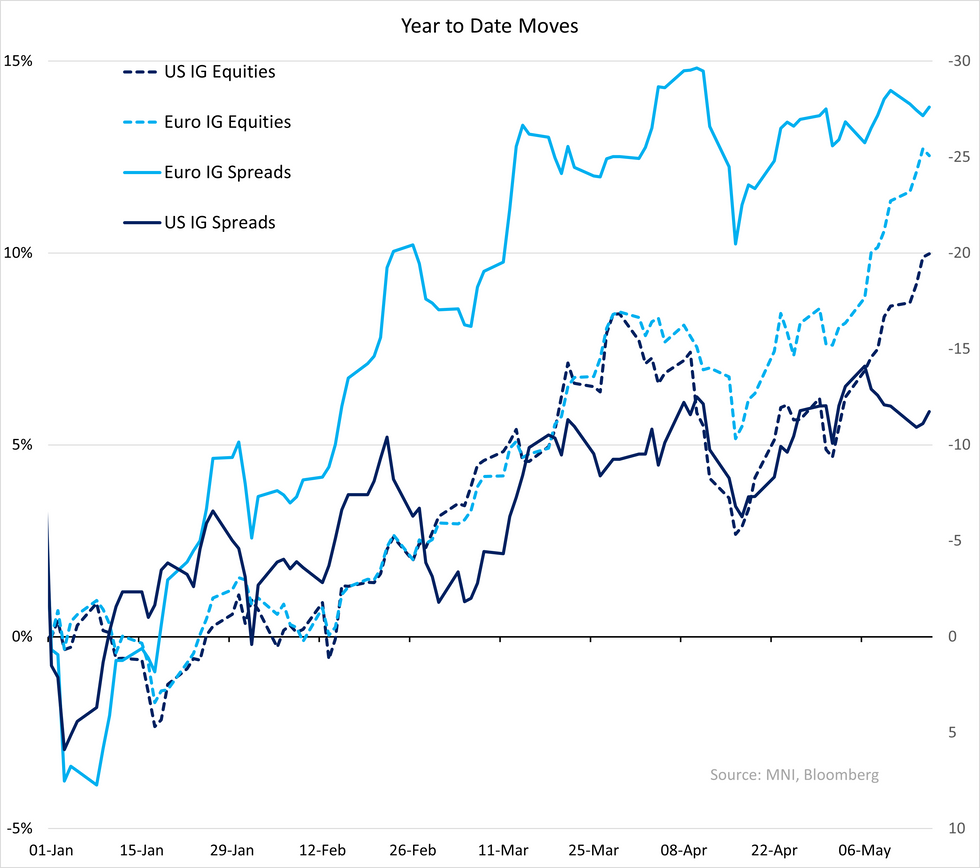

- IG across €/$ & £ saw negligible outflows for the week ending Wednesday. €HY saw small outflows while $HY saw strong inflows. Little evidence of that divergence in HY spreads/yields for secondary; BB & B spreads held flat across both regions while yields moved in.

- Again, hard to be concerned about flat flows; though we saw some widening on supply (see Autos) headline €IG spreads end +1 (corps +2, fins flat) through a bumper week of supply – that mirrors $IG's resilience from last week. Supply Expectations for next week (bbg surveyed) are at €25b for €/£ IG & HY (incl. covered), a tad lower than the ~€30b expected this week (actual €45b) while $IG is flat at $25b vs. this week’s $25-$30b (actual $28b).

- There has been plenty of coverage this week on pickup in reverse yankee supply. We won't add to that & note the main drivers are MPol expectations driving rate differentials, €IG spread outperformance (below), cross currency/hedging costs & general pick-up in US corporate supply.

- Outside credit, US equity inflows & govvie inflows continued across both regions. Rates are coming back out from post April US retail sales rally/weakness but still -10bps in on the week, Bunds will end little changed.

- Our credit matched equity baskets are holding flat, surprising resilience through the US April retail sales miss; control at -0.3% MoM (vs. c+0.1%) after strong March (1.1% to 1%). On a real (headline) basis our economist only saw a partial reversal to March levels & may be helping limit read-through for now. We would note we are seeing similar (& broad) weakness in Bloomberg tracked US card data for April (again nominal).

- Finally Refinitiv reported on April fund flows in Europe; Mutual funds saw +€15.7b vs. ETFs +€11.4b with bonds and money market funds leading gains. Mixed asset & equity funds saw outflows. They have highlighted the move towards ETFs & away from mutual (passive saw smaller inflows than ETFs & active saw outflows) - potential signs of rotation there but Corporate bond funds did not seem to make the cut for top 10 inflow or outflows (somewhat in line with the muted flows we've seen this month).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.