May 31, 2024 12:17 GMT

Fund Flows & Q1 Fundamentals

CREDIT MACRO

- $IG/HY turned to small outflows (as ETF flows were indicating), €IG/HY still running small inflows & £IG with sizeable outflows. As we said last week, hard to care too much about outflows here after a (mostly technical driven) rates sell-off (core PCE later today the key fundamental) weighed on total returns (€IG -0.2% YTD) and heading into seasonally weaker supply month.

- €IG primary metrics we track was evidence of that; book cover weaker but NICs still came in with secondary moving tad tighter. $IG did see a pickup in NICs to ~mid-singe digit session avg's. Supply was €5b/$7b lower in IG across both regions & versus expectations (bbg) €IG/HY (incl. covered) came in at €21b (c~€16.5b) & $IG in range at $19b (c$15-20b). Local expectations are firmer next week at ~€23b.

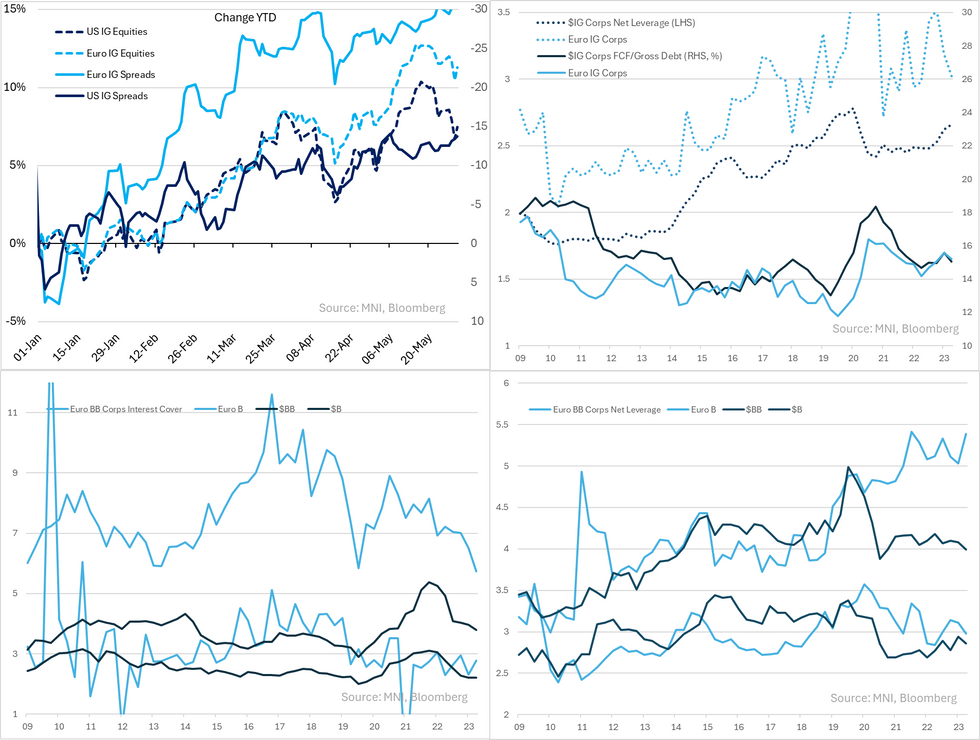

- Bloomberg has also updated Q1 fundamentals for their indices (the ones we use/refer to). Its a clean trimmed metric (top/bottom 10% taken out) & summary is there is little change in corp. BS's with improvement in earnings margins. HY included below, ICR's for € Single B's did fall sharply (smaller €100b index).

- Re. the supply slow down we've mentioned, $IG estimates that have started rolling in for June look very low. As flagged last week some of this is on opportunistic supply from earlier being taken out, some on where rates are here/cuts ahead pushing supply back. Seasonally (pre-covid 5yrs) €IG tends to see a more aggressive slow down than $s and tends to be later in July/August - we see about €10b fall in June avg's before sharp drop-off (~halving from May levels) into July/August.

284 words