-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

FX Options Monitor: Election Risks Yet to Appear in the Tails

Full document here: http://enews.marketnews.com/ct/uz9535976Biz45425808

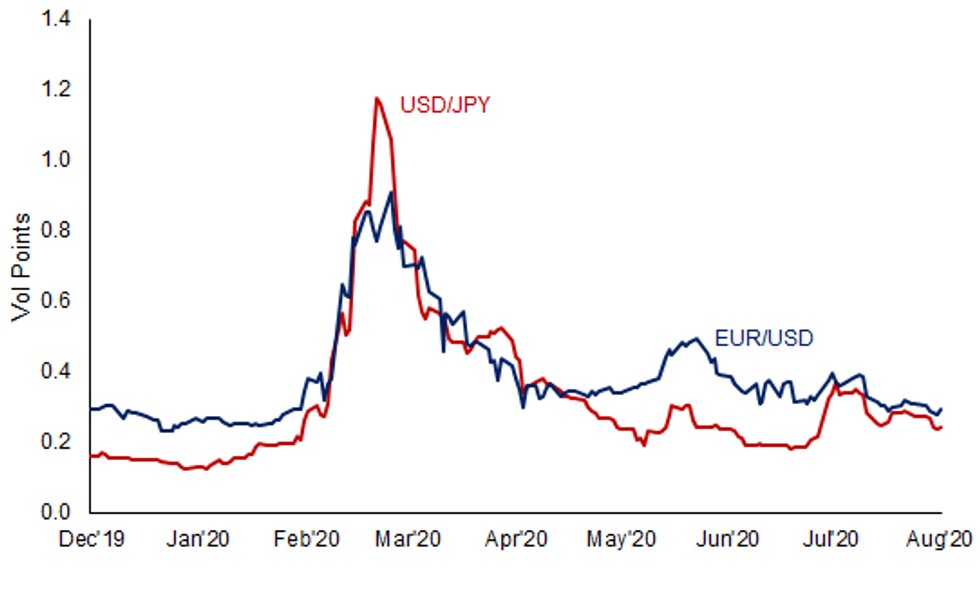

Figure 1: USD/JPY, EUR/USD 25d 3m Butterfly Option

Source: MNI/Bloomberg

Source: MNI/Bloomberg

With 3m FX options now capturing the November 3rd elections in the US, currency markets are yet to show any material signs of stress or concern over the date of the election, with betting odds continuing to favour Joe Biden over the incumbent Donald Trump. This comes despite their contrasting policy views and leadership styles, but may be (partially) explained away by the wait until end-January for the new President to be sworn in.

Nonetheless, considerable policy uncertainty on both sides of the aisle as well as the ongoing disagreements over the next wave of Coronavirus aid support could make these contracts look underpriced in the coming months and as Congress returns on September 7th.

Abe resignation fails to move the volatility needle

The biggest news of the week came with the unexpected resignation of the Japanese PM Abe, which helped fuel a surge in JPY futures trading and a spell of JPY strength intraday, although this seems to have abated ahead of the close.

In options space, this translated to a flurry of USD/JPY put options trades, with well over $2 in puts trading for every $1 in calls after Abe's press conference. Put strikes layered between Y104.00 – Y105.00 drew the most attention but strikes at Y101.00 and Y99.00 also drew very healthy interest, suggesting some managers are looking to protect against a run higher in JPY in the coming months.

Despite the run higher in options volumes, implied volatility covering the near-term Japanese leadership contest as well as the November Presidential election look contained.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.