May 24, 2024 08:14 GMT

GDP Increase Appears Externally Driven

GERMAN DATA

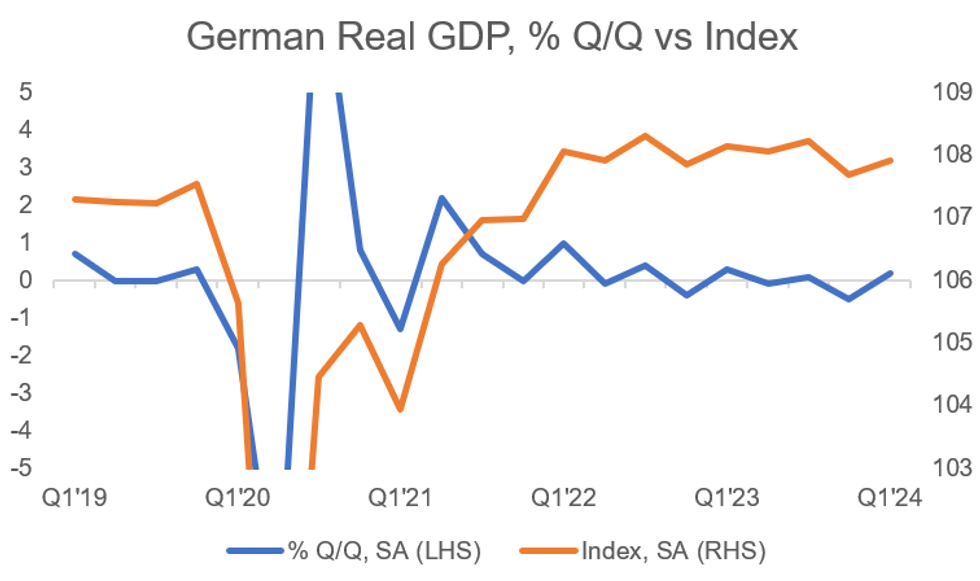

German real GDP in Q1 2024 was unrevised from the preliminary estimate at +0.2% Q/Q (vs -0.5% prior) and -0.2% Y/Y (vs -0.2% prior).

- Overall, stronger exports and construction investment drove the print. This reaffirms the picture that the slight recovery was at least partly externally driven. Also, as telegraphed by Q1 employment figures, GDP per hour worked was down -0.8%Q/Q - pointing towards weak productivity in the quarter.

- Looking at the individual categories of GDP by expenditure, private consumption was weaker amid lower food spending (-0.4% Q/Q vs +0.4% prior, revised from +0.2%) and government expenditure was also down -0.4% Q/Q. Both contributed negatively. Private consumption is expected to increase going further into the year amid rising real wages.

- Stronger investment (+1.2% Q/Q vs -2.1% prior, revised from -1.9%) was driven solely by construction (amid good weather towards the beginning of the year) . Equipment investment declined by 0.2% Q/Q. Other fixed assets also declined, by 1.1% Q/Q.

- Net exports also contributed positively, with exports at +1.1% outperforming imports at +0.6%.

- Gross value added meanwhile, which allows an industry split, inclined 0.3% Q/Q (vs -0.5% prior). Mirroring the GDP release, construction saw the strongest uptick at +2.5% Q/Q (highest rate since Q1 2023, -2.0% prior). Manufacturing GVA increased 0.2% Q/Q (vs -1.7% prior) while energy production pulled down overall industrial GVA excl. construction (-0.4% vs -0.7% prior). The public sector grew significantly at 1.1% Q/Q (vs +0.2% prior) while inflormation and communication industry GVA printed weak, at -0.9% Q/Q (vs +0.2% prior).

- Productivity was low, as indicated before by MNI, with real GDP per hour worked at -0.8% Q/Q (vs +0.7%). While this mirrors the Q1 employment release seeing hours worked increasing strongly, the figure is only seasonally, not calendar adjusted. Q1'23 real GDP/hour worked also was much weaker than the respective overall print, so a calendar effect might have also had a negative empact.

MNI, Destatis, Bloomberg

MNI, Destatis, Bloomberg

327 words