-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessGlobal Morning Briefing: Eyes on Flash PMIs

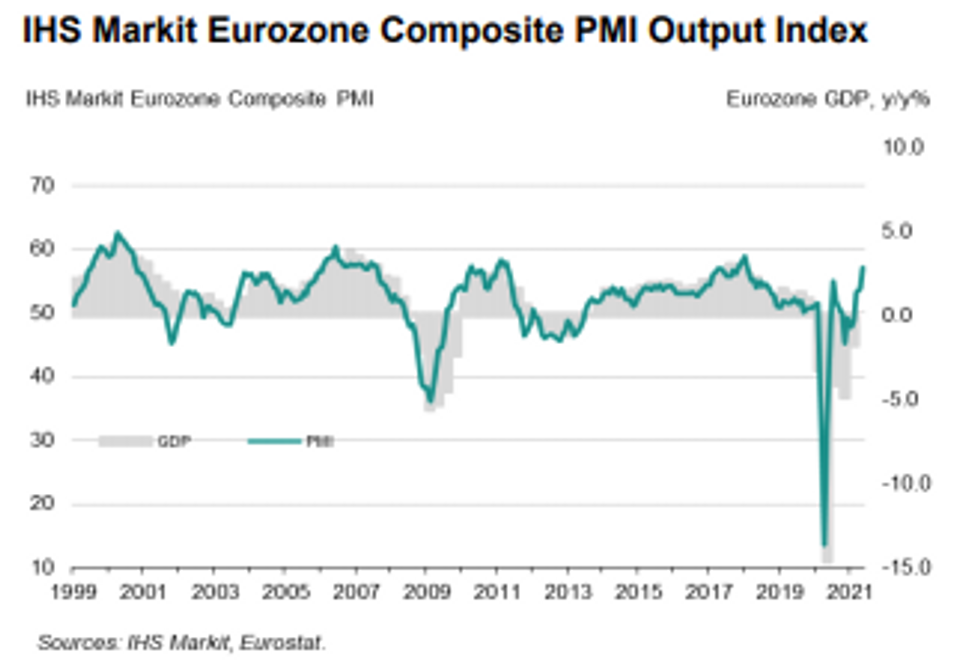

The main data releases Wednesday are the flash PMIs for France (0815BST), Germany (0830BST), the EZ (0900BST) and the UK (0930BST) as well as for the US (1445BST).

Services PMIs in Europe seen higher

The flash services PMIs for France, Germany and the EZ are forecast to improve further in June, likely driven by the faster progress of the vaccination programs and low infection rates ahead of the summer, which both allows for international travel to resume within the EU. The French index is projected to rise to 59.6, while the German index is seen at 55.5. The flash EZ services PMI is expected to tick up to 57.8 in June. Last month's upticks were driven by sharp increases of new business, linked to the easing of restrictions. Moreover, optimism regarding the outlook increased markedly.

Source: IHS Markit

The UK's services PMI posted strong readings in the past few months as well, reflecting the reopening. The positive mood is likely to continue as the flash services PMI is expected to rise to 63.0. However, the spread of the delta variant poses a downside risk going forward.

Europe's manufacturing PMIs forecast to edge lower

All four manufacturing PMIs are expected to ease slightly in June as the ongoing supply bottlenecks are weighing on business activity. Moreover, material shortages and logistical issues are likely to continue to drive up input prices. Nevertheless, the manufacturing PMIs remain comfortably above the 50-mark, signalling expansion. May's reports also noted an increase in the rate of job creation as output and new orders continue to rise.

The French manufacturing PMI is forecast to drop to 59.0, while the German index is seen at 63.0 and overall EZ flash manufacturing PMI is anticipated to edged lower to 62.0 in June. The UK's index jumped to a record high in May and markets expect it to ease to 64.0 in June.

US flash IHS PMIs expected to tick down

Both the flash services and manufacturing PMI are forecast to ease slightly in June to 69.9 and 61.5, respectively. Nevertheless, both indicators remain well above the 50-mark. The services PMI rose to a record high in May due to a sharp expansion of new orders and output which triggered an increase in employment as well. However, firms noted difficulties in filling vacancies as well as higher input costs which are passed on to consumers. May's manufacturing PMI increased markedly as well, driven by new orders and production. However, the survey noted that supply chain disruptions persisted and led to a higher backlog and rising input prices. This trend is likely to continue in June.

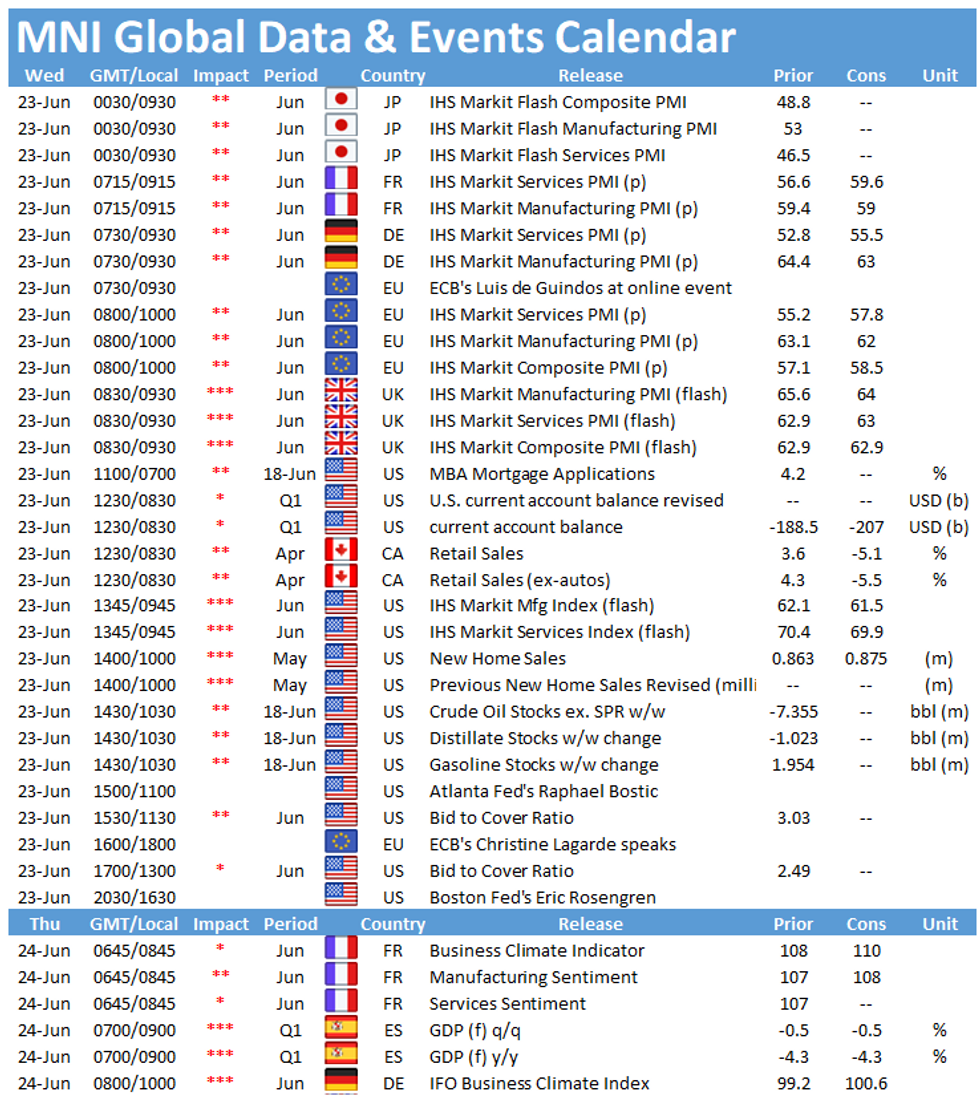

The events calendar throws up a busy schedule on Wednesday. The main speakers to follow include ECB's Luis de Guindos and Christine Lagarde as well as Fed's Michelle Bowman, Atlanta Fed's Raphael Bostic and Boston Fed's Eric Rosengren.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.