-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

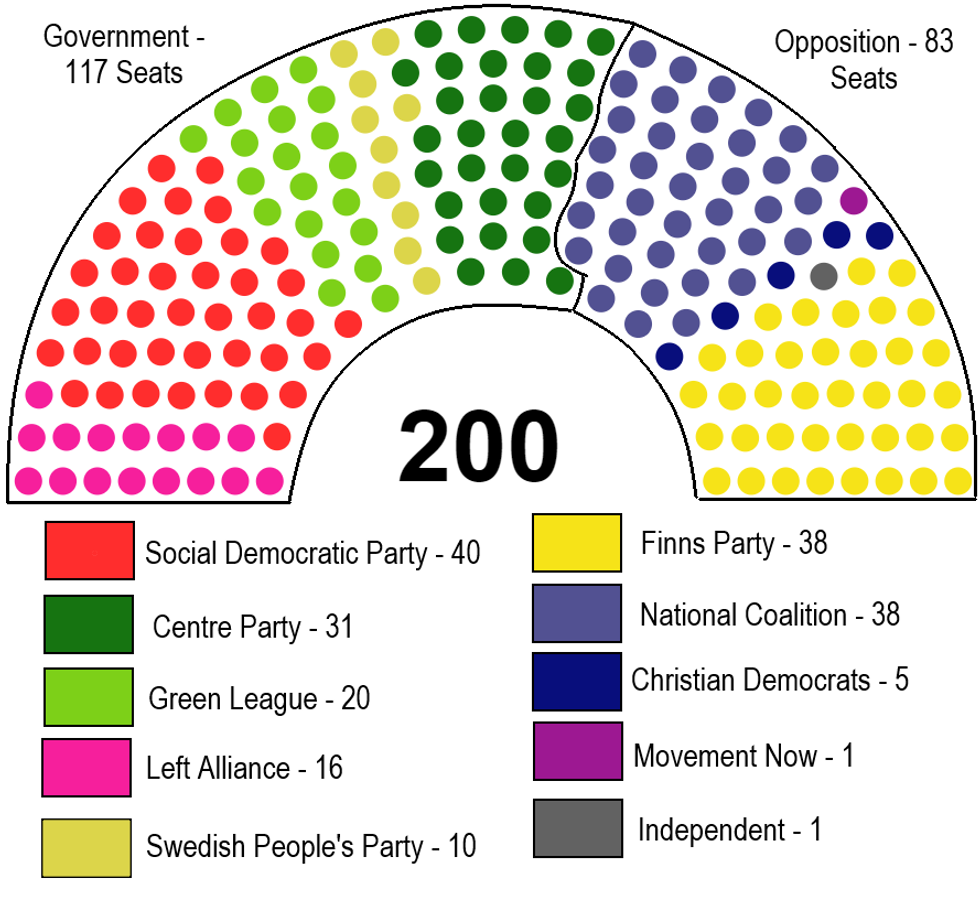

Free AccessGov't Stability Rocked By Budget Talks As Parl't Could Hold Up EU Funds

The Finnish gov't is in a precarious position after days of budget negotiations between the five government coalition parties have yet to reach a conclusive agreement. Comes as major EU focus likely to come down on Finland, with the parliament's Constitutional Committee ruling yesterday that a 2/3 supermajority will be required in parliament to approve the EU's Recovery and Resilience Fund (the COVID-19 support package).

- The centrist agrarian Centre Party (Kesk) - the second-largest party in Prime Minister Sanna Marin's coalition - has been at odds with the more left-wing parties in gov't regarding levels of gov't spending following the COVID-19 crisis.

- At an internal meeting earlier this morning, the Centre Party leadership voted to continue talks rather than pulling out of the coalition - which would rob the gov't of its majority in parliament. Party head and deputy PM Annika Saarikko stated after the meeting that "Our view is that the pieces are starting to slot into place", but that negotiations "are still not finished."

Source: Finnish Parliament, MNI

Source: Finnish Parliament, MNI

- The budget negotiations - which are held up on major ideological issues regarding the size of the deficit that the gov't should run - are also held up on an environmental issue. The Centre Party, which gains most of its support from rural areas, wants to ensure support for struggling peat farmers, while the Green Leage (Vihr) wants to see peat farming phased out due to its contribution to carbon emissions.

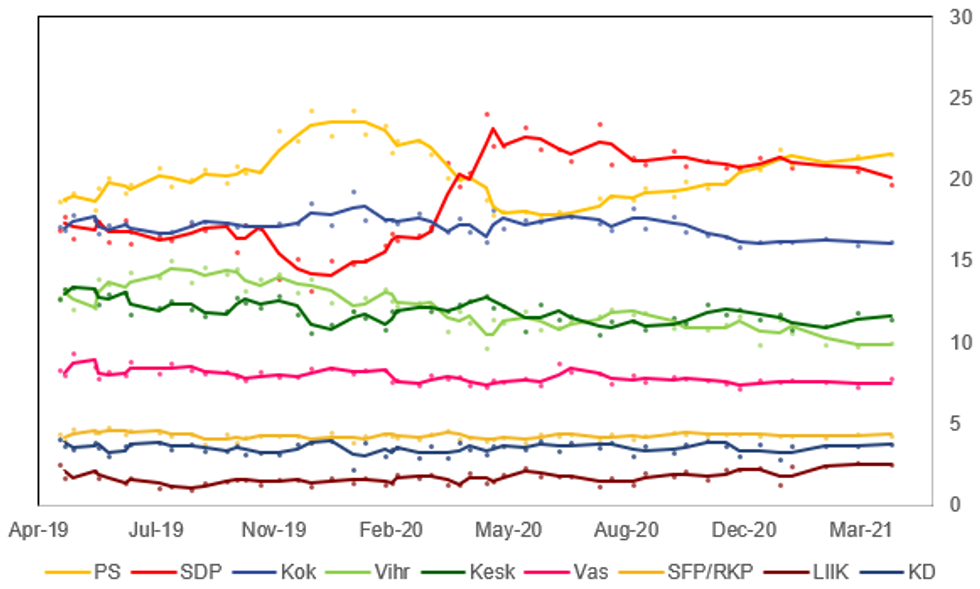

- PM Marin, from the centre-left Social Democrats (SDP) has stated she would not seek to run a minority gov't if the Centre Party pulls its support, risking a snap election. Opinion polls show that the current gov't retaining enough support to win another majority, although the Centre Party could play kingmaker in putting in a right-wing gov't involving the centre-right National Coalition Party (Kok) and the right-wing populist Finns Party (PS).

Source: Kantar TNS, Taloustutkimus, Tietoykkonen, MNI

Source: Kantar TNS, Taloustutkimus, Tietoykkonen, MNI

- Regarding the EU's Recovery and Resilience Fund, the entire package cannot be approved until all member states have submitted their approved plans to the Commission. With the Finns stating they will vote against the RRF, the gov't will have to rely on conservative National Coalition members following through on their plan to abstain in the vote to get the package approved.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.