April 29, 2024 10:03 GMT

Hedge Funds Add to Shorts In TU & TY Futures In Latest CFTC CoT

US TSY FUTURES

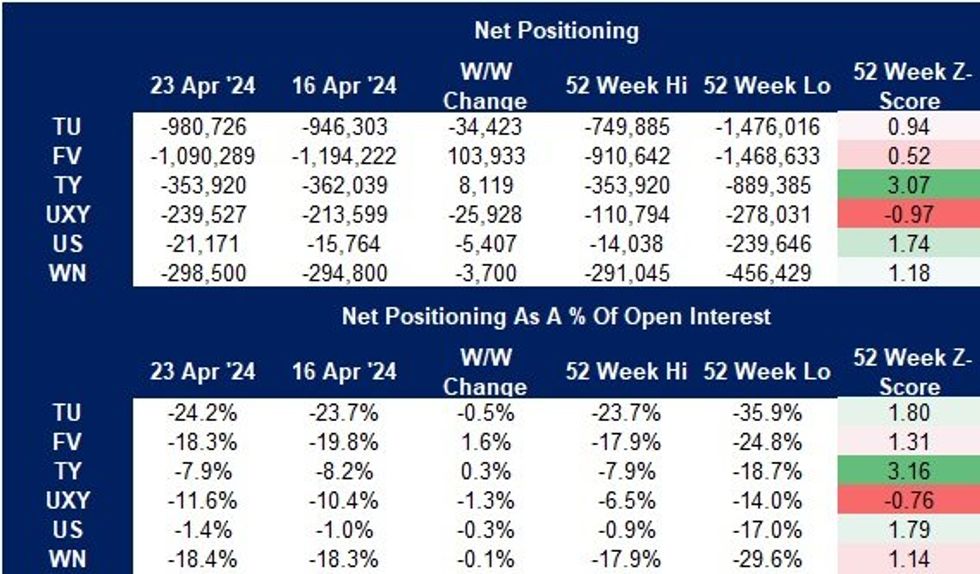

The latest CFTC CoT report points to a modest extension of non-commercial net shorts across TU, UXY, US & WN futures, while there was a reduction of non-commercial net short positioning in FV & TY futures.

- A reminder that hawkish Fed repricing has dominated in recent weeks, although this hasn’t necessarily been felt in positioning across all Tsy futures.

- Basis trade positioning and adjustments will continue to skew the CFTC CoT figures.

- The recent trend of short reduction in TY futures extended, leaving short positioning at the shallowest level seen in the last 52 weeks (in both outright and net % of OI terms).

- Net long setting by asset managers and dealers more than offset short setting from hedge funds in the TY contract.

- The report shows that hedge funds extended net shorts in TU futures to a fresh record level.

- The report covers the period through April 23, so won’t include the adjustments surrounding PCE & GDP data.

Source: MNI - Market News/Bloomberg/CFTC

Source: MNI - Market News/Bloomberg/CFTC

177 words