-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Colombia Central Bank Preview - April 2022: Gradual Tightening Process

MNI BanRep Preview - April 2022

Executive Summary

- All surveyed analysts are anticipating the Colombian Central Bank to continue tightening policy at their April meeting with the most likely outcome another 100bp increase to the overnight lending rate to 6.00%.

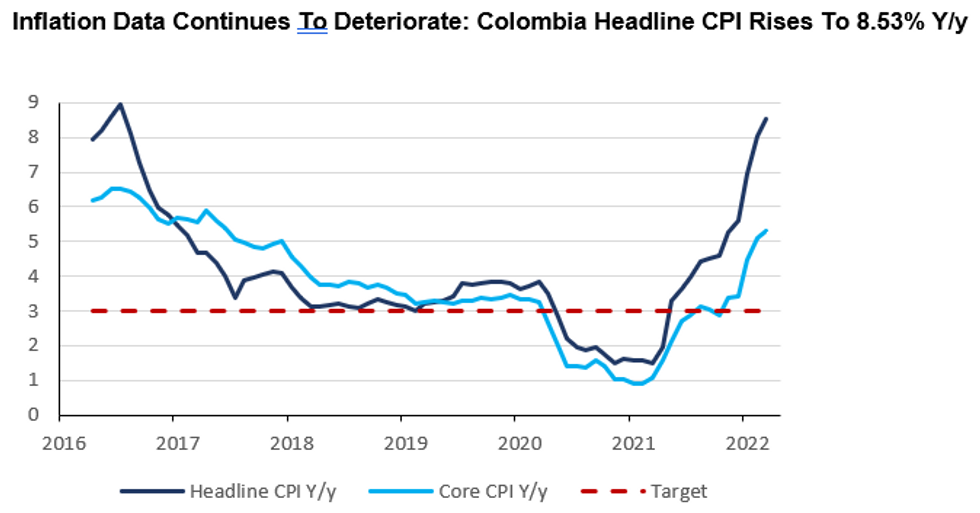

- Continued price pressures have seen the annual headline CPI rate exceed 8.5% alongside rising inflation expectations.

- Despite the split views among the BanRep board, the ongoing conflict in Ukraine and associated risks to global growth should continue to negate the need for even bolder action at this juncture.

Click to view the full preview: MNI BanRep Preview - April 2022.pdf

While March CPI figures did continue to provide evidence of an upward trend, the month-on-month increase was only marginally above expectations at 1.00% versus 0.96%. However, short-term inflation expectations have deteriorated further and there continues to be evidence of a contamination of medium-term expectations.

Additionally, one could argue that there has been a minor shift in central bank communication since March. For instance, the moderation of food prices, which was expected in May, has now been described as “much more uncertain,” by Governor Leonardo Villar, talking in a webcast event organized by the Center for Global Development on April 13. This in turn makes it harder to control inflation expectations and bring inflation down.

Given that the two dissenters in March, voting for a larger 150bp increase to the overnight lending rate, expressed their concern that the inflation environment may become more difficult, the Governors’ comments cannot entirely rule out bolder action on Friday, or failing that, an even tighter 4-3 split vote for a 100bp hike.

With all this said, global uncertainties have not abated, and the repercussions of the Russia-Ukraine conflict are likely to remain both prolonged and uncertain. At this juncture, the board are likely to favour another 100bp hike, especially given how the board still consider this magnitude as significant.

Source: MNI/Bloomberg

Source: MNI/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.