-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI NBP Review - March 2023: More Of The Same

Executive Summary:

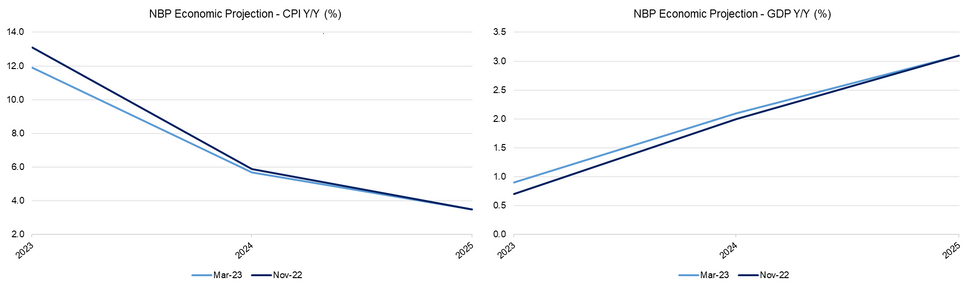

- The NBP left interest rates unchanged while staff unveiled only cosmetic changes to macroeconomic forecasts

- The central bank remains in wait-and-see mode as the Monetary Policy Council chose not to call an end to the rate-hike cycle

- Governor Glapinski reiterated the main tenets of his previous press conferences, voicing his “personal hope” that rate cuts could be possible in Q4

Full review document including a summary of sell-side views here:

MNI NBP Review - March 2023.pdf

The National Bank of Poland kept interest rates unchanged at this week’s monetary policy meeting and communicated that it remains in a wait-and-see mode, disappointing observers looking for a formal end to the tightening cycle. The new macroeconomic projections failed to impress, with staff offering only marginal tweaks to the expected GDP and CPI paths. During his press conference, Governor Adam Glapinski reiterated that he hopes for a quick cooling of price pressures after a February peak, which may see headline inflation reach single-digit levels towards the end of this year.

The rate announcement was in itself distinctly uneventful. Yet again, the Monetary Policy Council said that it expects a gradual return to the official +1.5%-3.5% Y/Y inflation target, which will be supported by the already tight monetary conditions. The focus was on the updated macroeconomic projections, which were cited in the statement. Also on this front, the central bank failed to offer any major surprises. Staff shifted the expected CPI path slightly lower and revised the GDP growth path marginally higher, with the outlook for 2023 undergoing largest revisions. All in all, the new forecasts did not constitute any major change to the central bank’s overall assessment of the economy.

Our assessment of this week’s NBP marathon is that the central bank remains roughly where it was before – in a wait-and-see mode but with a dovish bias. We stick with our view that the bar is prohibitively high for the NBP to resume raising interest rates and only a notable inflationary shock could result in such an outcome. While Governor Glapinski insisted that the Council will only reduce interest rates when there is clear evidence that inflation is falling towards the target, his personal hope was that the central bank could cut rates in 4Q2023. From his comments, we infer that the NBP will remain data-dependent going forward, but could pull the trigger on monetary easing at the end of the year if disinflation proceeds in line with staff projections or faster.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.