-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

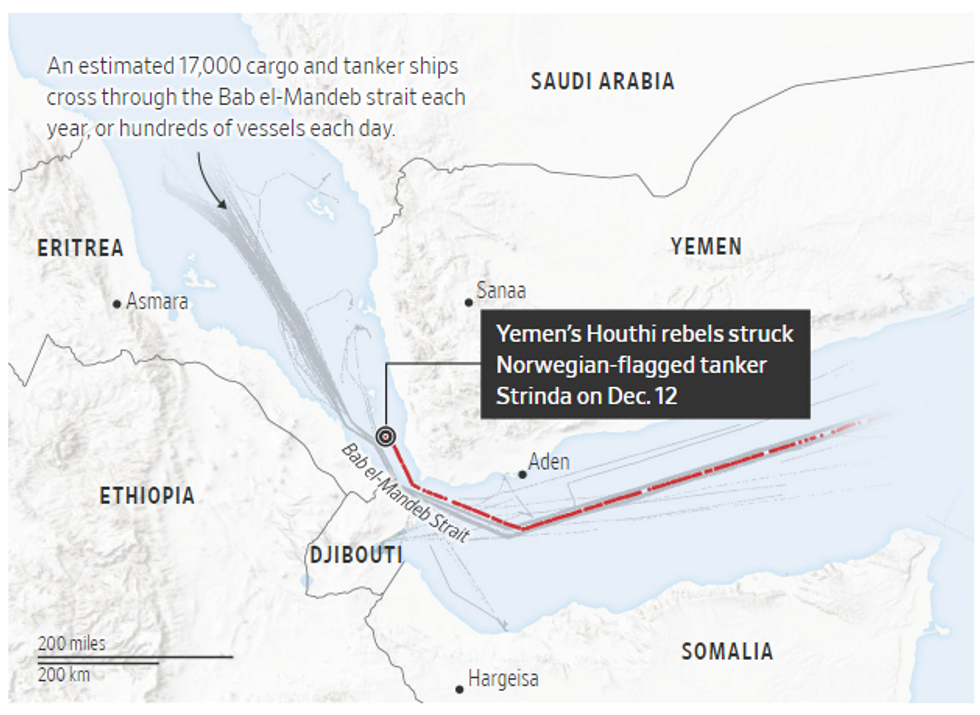

Houthi Attacks On Shipping Set To Continue Amid Regional Proxy War

There appears to be little sign of an end to the uptick in aerial attacks on shipping in the Red Sea and the Gulf of Aden, with two Liberian-flagged vessels hit by drones and ballistic missiles earlier today in the Bab al-Mandab Strait (also known as the 'Gate of Grief') between Yemen and Eritrea/Djibouti. The attacks on international shipping in the region carried out by Iranian-backed Houthi rebels have intensified in recent weeks amid the ongoing Israel-Hamas war.

- Our Commodities team noted earlier the attacks and the the impact they are having on shipping operations and oil markets in the region (see 'Mounting Vessel Attacks In Bab al-Mandab Strait This Week', 1020GMT, 'Crude Surges On Shipping Risks, Lower USD', 1424GMT 14 Dec).

- Spokesmen for the Houthi groups have said that the attacks are in response to the Israel-Hamas war and will continue until Israel's military incursion into Gaza stops. The US and its allies have pointed the finger at Iran for both arming and directing the actions of the Houthis, something denied by Tehran but running in line with Iran's efforts to isolate and weaken Israel amid the its war against Hamas.

- Yemeni Foreign Minister Ahmad Awad bin Mubarak speaking to Saudi-run Al Arabiya stated that the Houthi attacks are "...like declaring a regional and international war if there is severe damage to ships."

- Global and regional military powers, notably the US and the UK, have committed to an increased force presence in the waters around the Strait. Meanwhile, shipping companies are bolstering their own private security operations as well as seeking military consultation on how to combat drone and missile attacks.

Map of Bab al-Mandab Strait and Surrounds

Source: WSJ, MarineTraffic. Note: Ship traffic for Dec. 11

Source: WSJ, MarineTraffic. Note: Ship traffic for Dec. 11

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.