May 27, 2024 09:05 GMT

IFO Softer Than Expected, But Continues To Signal Recovery

GERMAN DATA

German’s IFO Business Climate index was softer than expected at 89.3 (vs 90.4 cons), steady versus April after last month’s reading was revised a tenth lower. That leaves the index at the highest level since May 2023.

- Both the current assessment (88.3 vs 88.9 prior) and expectations (90.4 vs 89.7 prior) components fell short of consensus estimates.

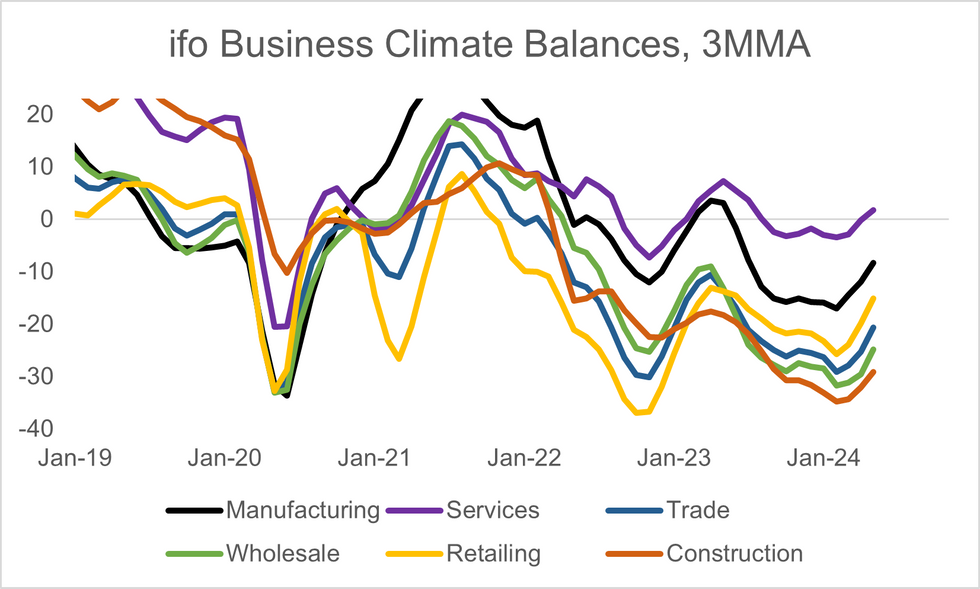

- In contrast to last week’s flash PMI, the services business climate component softened to 1.8 in May (vs 3.2 prior). However, the 3mma of this series continued to climb (to 1.8 vs -0.1 prior) as February’s very weak reading dropped out of the calculation.

- On services, the press release noted the fall “was due to somewhat worse assessments of the current business situation. However, expectations improved a bit. Companies reported additional orders”.

- The other sectors (manufacturing, trade, wholesale, retail and construction) all improved in May, though remained in contractionary territory.

- The improvement in the manufacturing outlook was consistent with last week’s firmer-than-expected flash PMI prints.

- Overall, the survey continues to signal a gradual recovery in economic activity, aided by both improving current conditions and future expectations.

193 words