-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessImpressive Services PMI Helps Push Eurozone Back Into Growth

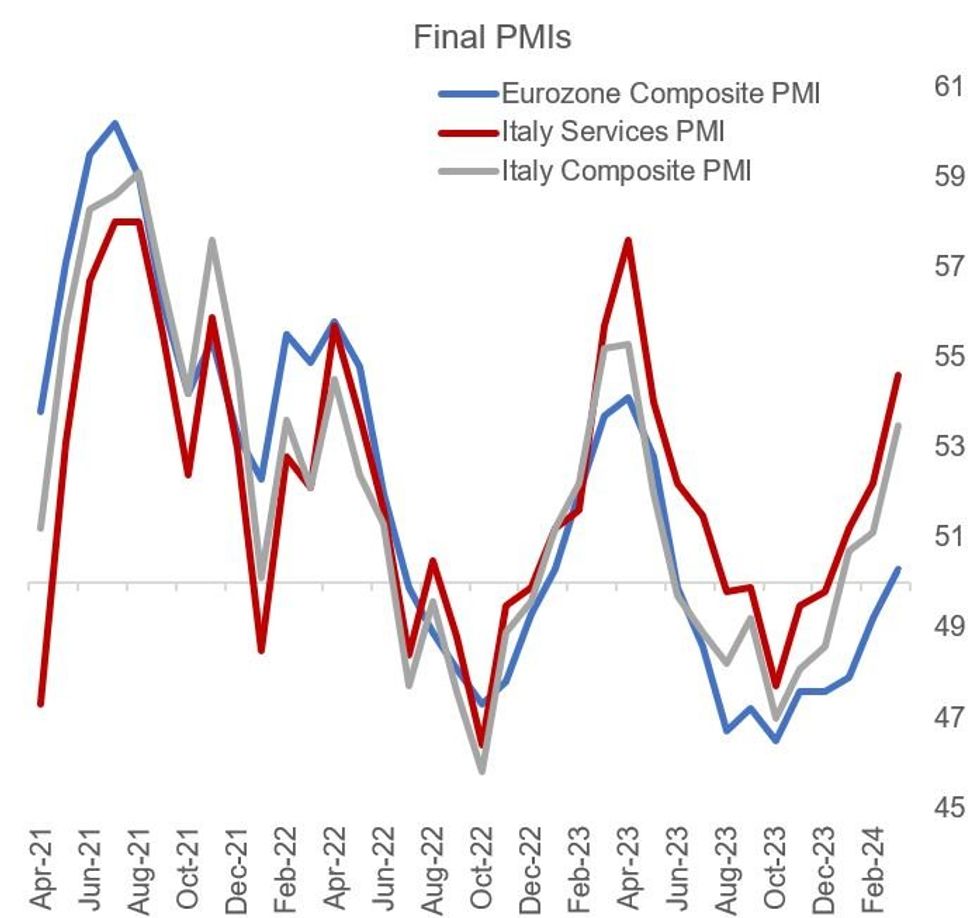

Italian Services PMI impressed in March, with a sharp rise to 54.6 from 52.2 in February leaving the index well above the 53.1 expected. This was the 5th successive increase and the 3rd month in a row in expansionary territory above 50, with strength evident across the survey sub-indices, accompanied by elevated input/output costs.

- This brought the composite Italian PMI reading up to 53.5 from 51.1 in February, and alongside a strong Spain survey and upward revisions to finals elsewhere helped push the Eurozone final composite above 50.0 for the first time since May 2023 (was 49.9 in the flash) - indicating regional activity is recovering from a trough in 2H 2023.

- The Italy report from S&P Global noted that "in anecdotal evidence, service providers noted increased client interest and an influx of new customers as a driving factor behind the expansion." Other highlights:

- "Demand for Italian services also saw an improvement in March, thereby continuing the trend of new business growth which began in January. Survey respondents linked the uplift to improved overall demand conditions and increased interest from clients. "

- "output the strongest for nearly a year"

- "renewed increase in new export business with new business from abroad rising for the first time since last July. Though only marginal, the rate of expansion was the quickest in ten months."

- "Service sector firms across Italy responded to increased inflows of new work by raising workforce levels in March. This thereby marked the fifth successive month of job growth, with companies hiring part-time staff in particular.

- "Against a backdrop of improved demand conditions, service sector firms across Italy were increasingly confident that activity would rise over the coming 12 months in March."

- "input costs rose for the forty-sixth month running in March....Overall, the rate of input price inflation has been little changed in each month of the first quarter and remained elevated. Subsequently, firms raised their selling prices at a sharper pace in March. The rate of charge inflation was the strongest in just over a year and solid overall."

Source: S&P Global, MNI

Source: S&P Global, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.