-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - US CPI, BoC Decision Up Next

MNI US OPEN - Kyiv Ready for Ceasefire, Russia Sceptical

MNI China Daily Summary: Wednesday, March 12

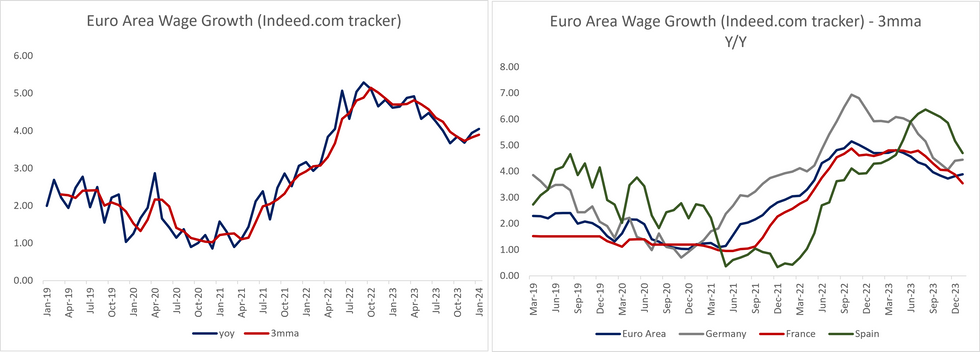

Indeed Wage Tracker Accelerates For 2nd Month In A Row

Ahead of this mornings anticipated ECB Q4 Negotiated Wages release, yesterday's update to the Indeed.com Eurozone wage tracker showed a second consecutive monthly increase in the 3mma Y/Y rate.

- The January print rose to 3.89% Y/Y (3mma) vs 3.83% in December and 3.73% in November. We note the tracker still sits some way off the 5.15% Y/Y peak seen in October 2022, though.

- At a country level, the 3mma Y/Y rate increased in Germany to 4.45% (vs 4.41% prior). This comes after yesterday's German negotiated wages series rose to 3.29% Y/Y in December (vs 3.15% in November).

- The French and Spanish continued to soften though, the former to 3.55% Y/Y (vs 3.89% prior) and the latter to 4.71% Y/Y (vs 5.18% prior).

- Overall, the stalling of the Eurozone and German trackers at rates between 4-5% Y/Y will be of concern to the ECB, particularly with productivity and hours worked operating below pre-covid trends.

- The data only began in 2019 so we don't have a great deal of "normal" pre-pandemic conditions to compare - but the 3mma was running around 2.0-2.5%, so the levels that we currently see are notably above levels that would be sustainable with a 2% inflation target.

There is significant attention on today's negotiated wages release and given the potential policy implications, it could be market-moving. An ECB working paper released yesterday noted that "collective agreements in the euro area as a whole as well as on average in the five largest economies, cover more than 75% of total employees". As such, it will be an important barometer to gauge where total compensation ended in Q4 '23 (since total compensation will feed into the unit labour cost calculation for Q4 '23).

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.