-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessIowa Win Cements Trump's Frontrunner Status, Attention Turns To NH

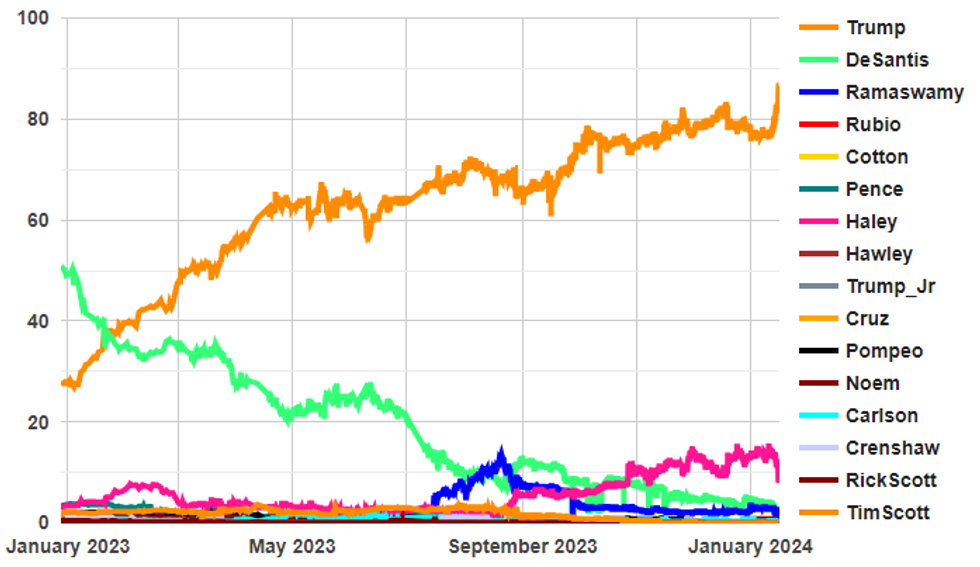

A commanding victory in the first-in-the-nation Iowa caucuses has cemented former President Donald Trump's frontrunner status for the Republican 2024 presidential nomination. Trump won 51.0% of caucus-goer's votes, compared to 21.2% for Florida Governor Ron DeSantis - a surprise second place performance - and 19.1% for former South Carolina Governor Nikki Haley. Tech entrepreneur Vivek Ramaswamy came in a distant fourth place with 7.7% of the vote. Following this result he withdraw from the race and offered his endorsement to Trump.

- Attention now turns to the 23 Jan primary in New Hampshire, a state with a very different Republican voter profile compared to Iowa (more moderates, fewer evangelicals). Given the state's more moderate profile, a strong result for Haley is seen as critical for her staying in the race as a viable candidate.

- The Iowa second place gives the DeSantis campaign some succor. After some poor polling in the run-up to Iowa there had been speculation about DeSantis' continued ability to run. This result will likely keep his campaign running for the short term at least.

- Political betting markets make Trump a runaway favourite, with a record-high 86.4% implied probability of taking the nomination, compared to 8.7% for Haley and 2.3% for DeSantis according to data compiled by electionbettingodds.com.

Source: electionbettingodds.com, Betfair, Smarkets, PredictIt, Polymarket, MNI

Source: electionbettingodds.com, Betfair, Smarkets, PredictIt, Polymarket, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.