July 01, 2024 03:45 GMT

Iron Ore Testing 20-day EMA Resistance, Firmer China Property Equities Helping

IRON ORE

Metals bulletEM BulletHomepagemarkets-real-timeCommoditiesBulletMarketsEmerging Market NewsForeign Exchange Bullets

The active SGX iron ore contract is firmer in the first part of Monday dealings. We were last near $108/ton (a touch above the 20-day EMA). We haven't been able to breach the $110/ton level since early June, which is likely needed to establish more bullish momentum. The 50-day EMA is near this level. Recent lows rest just under $102/ton.

- Earlier we had the Caixin manufacturing PMI print firmer than forecast at 51.8, versus 51.5 forecast and 51.7 prior. This contrasts with the official print from yesterday which remained in contraction territory at 49.5. This continues the recent run of mixed data, although the Citi China EASI is in negative territory and close to multi month lows.

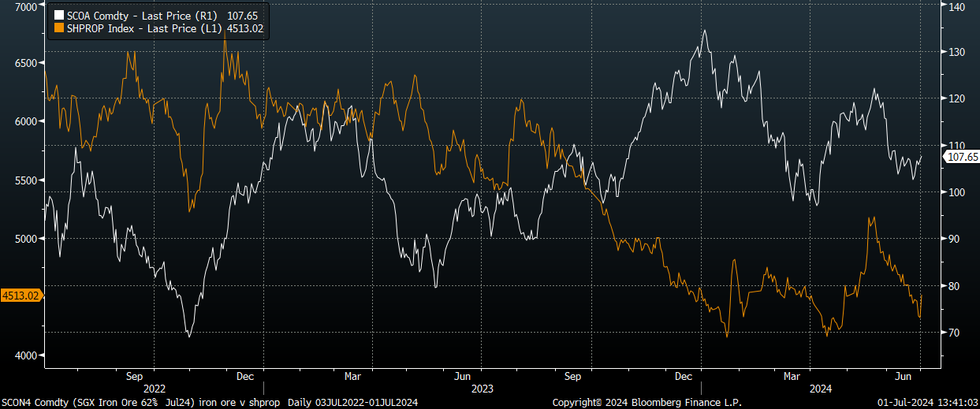

- For June, preliminary data for home sales improved in y/y terms relative to the May read, albeit still comfortably negative at -17%y/y (May was -34%), per BBG. This has seen real estate equities bounce, with such trends better correlated with iron ore in recent months, see the chart below.

- Elsewhere, iron ore inventories continued to climb at China ports to the end of June. The rate of ascent has slowed in terms of inventories, but is still at multi year highs, a potential upside cap on prices amid a mixed activity backdrop for China.

Fig 1: Iron Ore Spot Prices & China Property Equities

Source: MNI - Market News/Bloomberg

Keep reading...Show less

236 words