-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessIt's Probably A Hold In June, But ... (1/2)

Notwithstanding a strong upside nonfarm payrolls surprise Friday, the most likely outcome for the June 13-14 FOMC meeting is the rate hold that was hinted at at the May meeting.

- Data and events since early May have - on balance - actually leaned to a hike decision. That includes stubborn core ex-housing services PCE prices (with some Fed officials suggesting that concerns over housing inflation are resurfacing, see our note here) and still-strong jobs growth (pending today's NFPs). Economic surprises have tilted to the upside overall. The two biggest lingering uncertainties - the debt ceiling and banking crisis - have respectively been resolved and have abated. Pricing still remains for a decent change of a 25bp June 14 hike.

- But other data have left room for doubt, and we can't help but notice that the more dovish readings this week have seemingly had a more outsized reaction vs the hawkish data (Thursday's unheralded downward revision in Unit Labor Costs eclipsed the very strong ADP private payrolls data for example).

- As we noted in the May FOMC meeting review, the bar to a June hike was set pretty high by Powell and co, and if there is any ambiguity, the default decision will be a hold as the Fed bides time to get more information about the trajectory of the economy. That's both because most FOMC members, including the very senior leadership, genuinely believes that in its modal scenario it has caught up with the inflation tide, and the risks are more finely balanced between over- and under-tightening. There's also a hint of hoping for a "soft landing" while inflation drifts back toward target.

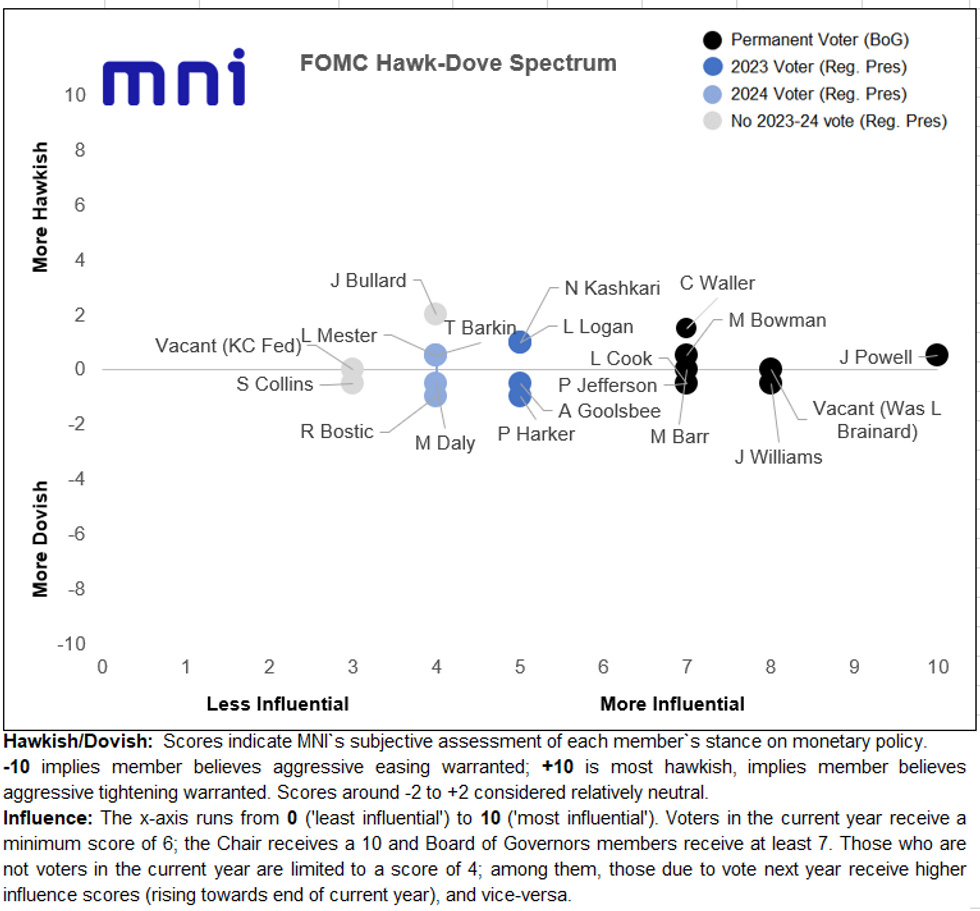

- Some officials disagree: we'd eye Mester, Bullard, Kashkari, Logan, Bowman, and Waller as the most likely candidates to back a June hike. (Ironically, Logan was one of the first - back in February - to signal she could support a "skip".)

- But that's a minority of 6 out of 17 active participants (noting the vacant seat for Brainard and, effectively, the KC Fed), and while we think Powell is genuinely willing to listen to arguments, he has seemed amenable to "skip" a meeting. Williams and Jefferson are also on board with a hold, and as it stands they will have support from others including Harker, Daly, Cook, Goolsbee, Bostic, and Collins.

- Barkin sounds uncomfortable with the inflation outlook but we'd guess he's agnostic about whether a hike is necessary this month or can wait until July. Barr is neutral but will go with the Chair's decision - as our Policy Team noted in yesterday's excellent article on the divisions within the FOMC on the June decision, the Fed hasn't seen a governor dissent since 2005 - which is why soon-to-be Vice Chair Jefferson's call for a "skip" was an important development.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.