-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessJPY Extends Gains On Remarks From Ex-FX Off'l, RSI Comes Under Scrutiny

The yen has extended gains as BBG ran comments from Japanese FinMin FX czar Nakao, who dubbed currency intervention a "possibility."

- Nakao's comments came with a caveat that "coordinated intervention is generally very difficult unless there's a very excessive movement in the market, or a kind of crisis mode."

- The latest leg lower has allowed USD/JPY to sink past yesterday's low to a fresh session trough at Y135.13. It has now clawed back some of these losses and trades at Y135.52, 74 pips lower on the day.

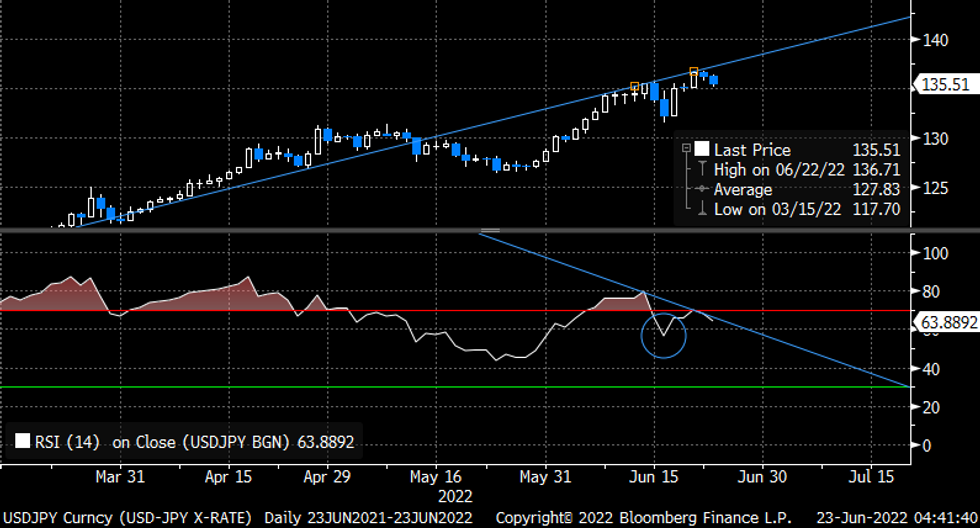

- As USD/JPY pulls back from recent 24-year highs, one can spot a bearish divergence unfolding on the daily chart of price action plotted alongside the RSI. This occurs when price keeps making higher highs, but its RSI fails to follow suit and prints a lower high.

- Watch this space, as the RSI may soon generate a more powerful bearish signal. On the previous swing higher, the indicator moved into overbought territory, but failed to repeat that on a second attempt. If it now dips past the recent fail point (56.2 or blue circle in the chart), a failure swing top will be confirmed.

- Options trades appear to be getting more bullish on the yen as well, with USD/JPY 1-month risk reversal extending this week's losses today.

- Still, it is worth paying close attention to fundamentals. Relative yield dynamics, largely driven by monetary policy matters, have been a key driver of JPY price action in the recent weeks.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.