July 24, 2024 07:22 GMT

July Flash Services PMI Beats, But Inflation Pressures Evident

FRANCE DATA

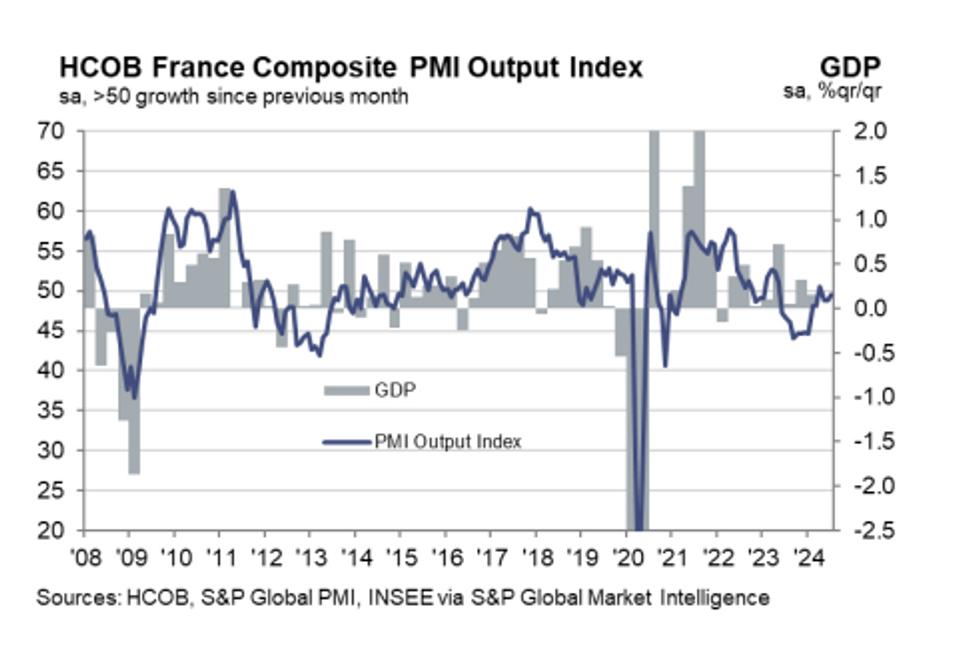

The French services PMI rose back into expansionary territory in the July flash round, at 50.7 (vs 49.7 cons, 49.6 prior). In contrast, manufacturing was weaker-than-expected at 44.1 (vs 45.9 cons, 45.4 prior). These dynamics add strength to the ongoing narrative that services activity is driving the Eurozone’s (gradual) economic recovery, while industry remains weak.

EGB futures have moved away from highs as a result of the services beat and worrying prices paid components (see below), with Bunds last +3 at 132.33 (vs a pre-data high of 132.47).

Key notes from the release:

- “Weak sales performances and delays from customers drove the slump in factory production, anecdotal evidence showed. On the other hand, business activity at services companies rose for the first time since April. The Olympic Games, as well as the end of the election period, were given as reasons for higher output”.

- “The latest survey data showed another month of job creation, extending the current period of rising employment to six months. Hiring was restricted to just the service sector”

- “July survey data signalled a marked intensification of cost pressures across France, led by a sharp acceleration in input price inflation at manufacturers”.

- “Higher commodity and raw material prices were commonly linked to the rise. In turn, selling charges were increased at the fastest rate for three months as companies endeavoured to pass on some of the burden of higher costs to their clients”.

Keep reading...Show less

244 words