April 26, 2024 10:56 GMT

Labour Market Continues Firming Despite Headline Unemployment Uptick

SPAIN DATA

The Spanish unemployment rate increased in Q1 2024, coming in at 12.29% (vs 11.92% cons; 11.76% in Q4). Employment meanwhile decreased by 139.7k to 21.3mln (vs -6.5k prior). However, looking at the seasonally-adjusted figures, the Spanish labour market seems to continue to firm.

- Looking at the details of the release, while the number of employed persons fell in all sectors in the first quarter (services -56.1k, industry -38.5k, agriculture -27.6k, construction -17.5k), these were largely regular seasonal falls, as seasonally-adjusted employment rose 0.54% in Q1 (vs +0.52% prior).

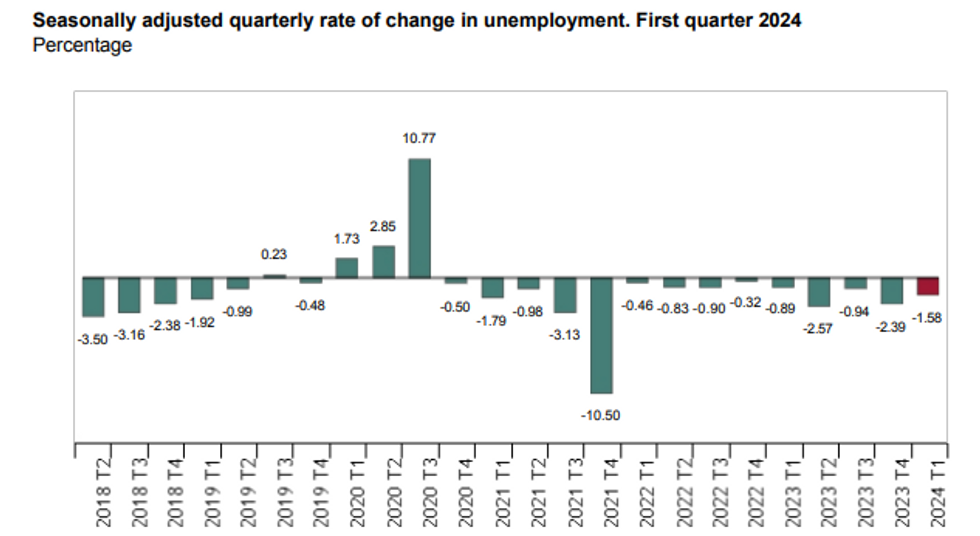

- Unemployment increased by 117.0k to 2.98m (vs +104.7k prior), with the uptick being broad-based across sectors, but also seasonally-driven (SA unemployment decreased 1.58%, the 14th consecutive decline, vs -2.39% prior).

- Looking ahead, data from INE's quarterly business confidence survey indicates the Spanish labour market is set to continue its recent strength: "13.1% of business establishments managers considers that employment, referring to personnel hired in their business, will increase in the second quarter of 2024, while 7.8% believe that it will decrease."

INE

INE

180 words