-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

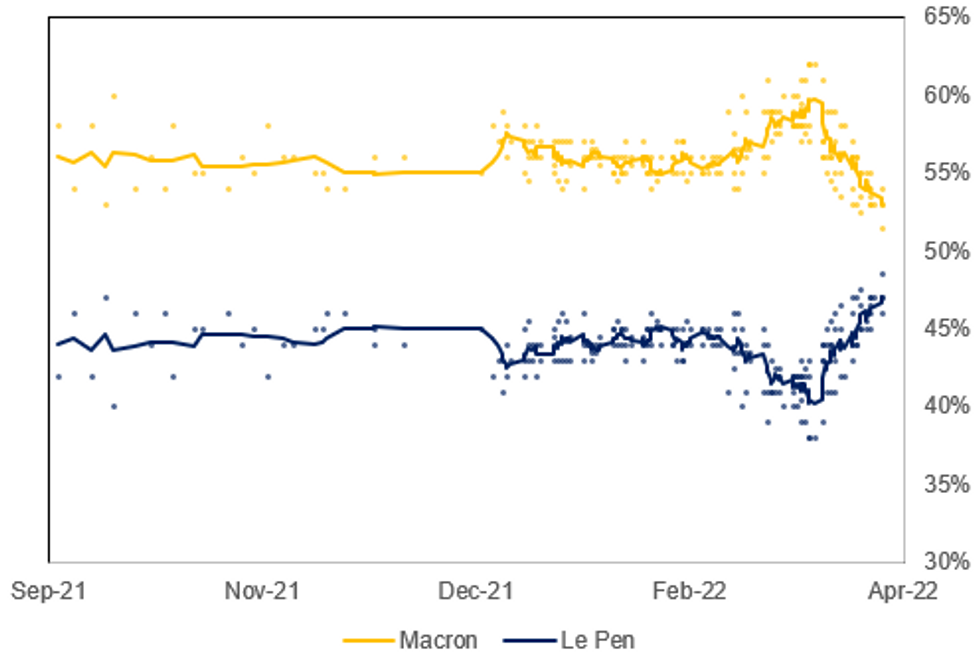

Le Pen Closes In But Macron Still Strong Favourite

The latest opinion polling from France ahead of the first round of the presidential election on 10 April shows right-wing Rassembelement National (RN) leader Marine Le Pen gaining on incumbent President Emmanuel Macron in a hypothetical second round match-up.

- The latest poll from Harris Interactive from 4 April shows Macron with 51.5% support to Le Pen's 48.5%, within the margin of error for either candidate to potentially win.

- First round polling continues to show a Macon-Le Pen contest on 24 April, repeating that of the 2017 election, as the most likely outcome. Macron polls around 26-28% in the first round, with Le Pen around 21-23%. Third-placed far-left candidate Jean-Luc Melenchon polls around 14-17% and would require a major upset to make the run-off.

- Betting markets continue to have Macron as the strong favourite to win re-election, even if the implied probability of his victory has come down in recent days. A week ago on 29 March, Macron's implied probability of winning the election stood at 91.7% according to data from Smarkets. At present this number stands at 80%. Le Pen's implied probability of winning has risen from 7.1% to 17.5% in the same period of time.

- There is the prospect, though, that the close polling comes to benefit Macron. In the event of polls showing Macron set for a comfortable win, many moderate voters from the centre-left and centre-right, who may usually vote Socialist, Green or Les Republicains may have stayed at home on election day risking a shock. However, with Le Pen closing in on Macron, more of these moderate voters are likely to show up at the polls to vote for Macron in order to keep the far-right Le Pen out of the Elysee Palace.

Source: Harris Interactive, Opinionway, Ifop-Fiducial, Ipsos-Sopra Steria, Elabe, BVA, Odoxa, MNI.

Source: Harris Interactive, Opinionway, Ifop-Fiducial, Ipsos-Sopra Steria, Elabe, BVA, Odoxa, MNI.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.