-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

Macron Looks To Bolster Euro Parliament Campaign w/New PM & Reshuffle

Re resignation of PM Elisabeth Borne on the evening of 8 Jan comes as President Emmanuel Macron seeks to bolster the prospects of his centrist Renaissance-led alliance ahead of the 9 June European Parliament elections. French media reports suggest that Education Minister Gabriel Attal is set to be named as Borne's successor. At 34 years of age, Attal would be the youngest prime minister of the French Fifth Republic.

- Macron's second term in office has been dogged by political and legislative instability, with the lack of a majority for his centrist alliance in the National Assembly severely limiting his ability to pass new laws.

- Indeed, the difficultiesthe gov't faced in passing an immigration bill in Dec 2023 - with the gov't requiring the support of the conservative Les Republicains - (LR) has been seen as a major factor in Macron's decision to enact a reshuffle.

- While Macron will be keen to avoid 'lame duck' status in the remainder of his term until 2027 and reinvigorate his party before the EP elections, there will also be an eye on the future. Renaissance and its predecessor En Marche were created as political vehicles for Macron's presidential runs in 2017 and 2022.

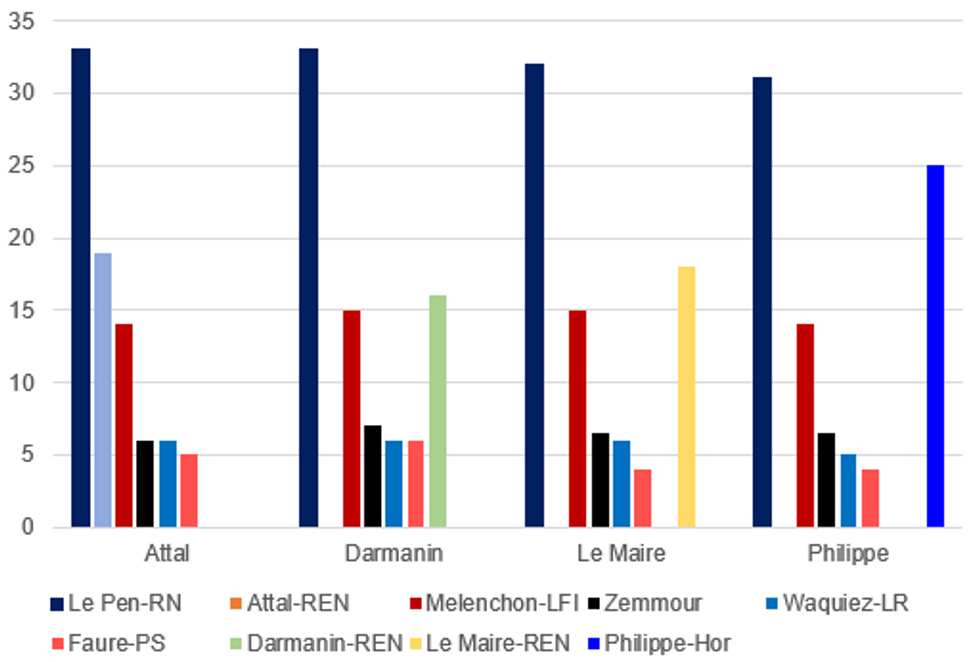

- As such, establishing an heir apparent to contest the 2027 election will be crucial for Macron and his bloc given that right-wing nationalist RN leader Marine Le Pen comfortably leads early opinion polling. The promotion of Attal, who trails only Horizons party leader Edouard Philippe in polling among the main centrist parties, could come as an effort to give the Education Minister Macron's 'seal of approval' in the run up to the election.

Source: Ifop, MNI. Fieldwork 24-25 Oct 2023. 1,179 respondents

Source: Ifop, MNI. Fieldwork 24-25 Oct 2023. 1,179 respondents

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.