-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMalaysia PM Anwar Prepares For First Electoral Test Since Taking Office As State Polls Loom

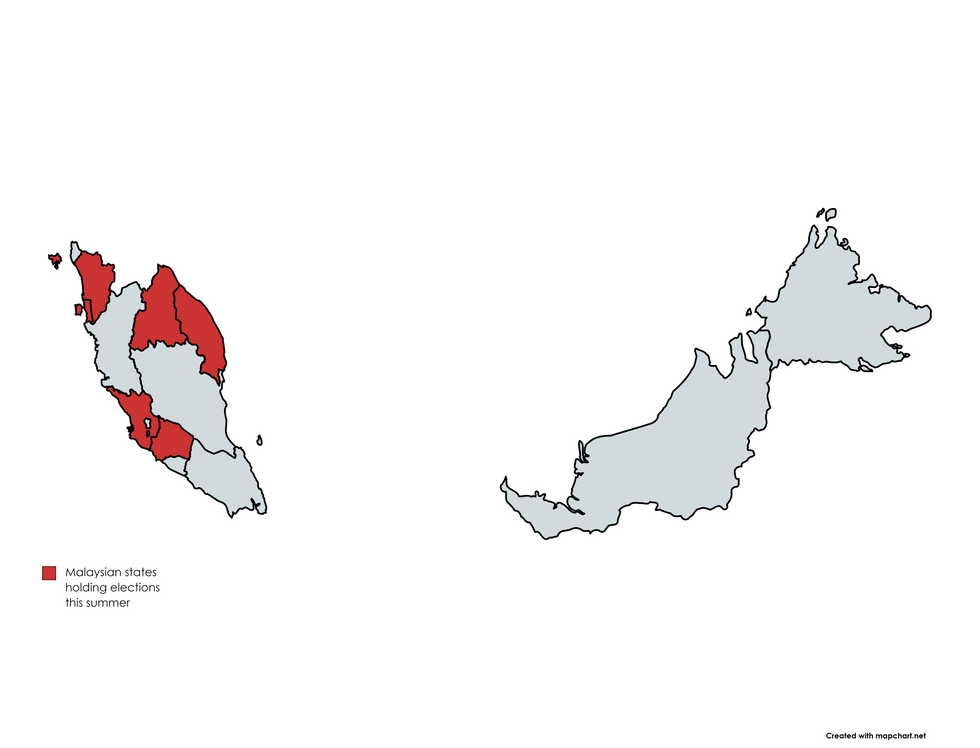

Prime Minister Anwar Ibrahim and his Pakatan Harapan alliance are preparing for a suite of state elections this summer, after the states of Selangor, Kelantan, Terengganu, Negeri Sembilan, Kedah and Penang moved to dissolve their legislatures. All of them refused to hold elections alongside last year's general election and allowed their assemblies to serve full terms.

- The election will be the first big test for Prime Minister Anwar Ibrahim since he took power late last year. The Election Commission (EC) is yet to convene to determine the date of the elections, as well as the timelines for the nomination of candidates and campaigning. All six state elections are expected to be held on a single day, which must be within 60 days from the dissolution of the first assembly, i.e. on August 21 at the latest.

- Anwar's Pakatan Harapan controls three of the contested state assemblies - in fact, Penang, Selangor and Negeri Sembilan are the only three states governed by the bloc. Losing even one of them would be a big reputational setback for Pakatan Harapan. The other three states are ruled by Parti Islam Se-Malaysia (PAS), a member party of former Prime Minister Muhyiddin Yassin's conservative Perikatan Nasional alliance.

- As a reminder, Anwar's Perikatan Nasional failed to win majority in last year's general election but formed a national unity government with former rivals from Barisan Nasional to prevent front-runner Perikatan Nasional from coming to power. There are concerns that a big win for the opposition would apply pressure to the fragile unity government and could revive historic tensions between its constituent political blocs.

- Although the ringgit has ticked higher this week, on a month-to-date basis it has been the worst performer in emerging Asia save for the Chinese yuan and Thai baht. The New Straits Times ran a report last week, where local economists noted that the upcoming state election may have added some pressure to the MYR.

Fig. 1. Malaysian states holding elections this summer

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.