-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMarket Insight: USD Momentum Very Elevated, EUR Likely Key To Any Turnaround

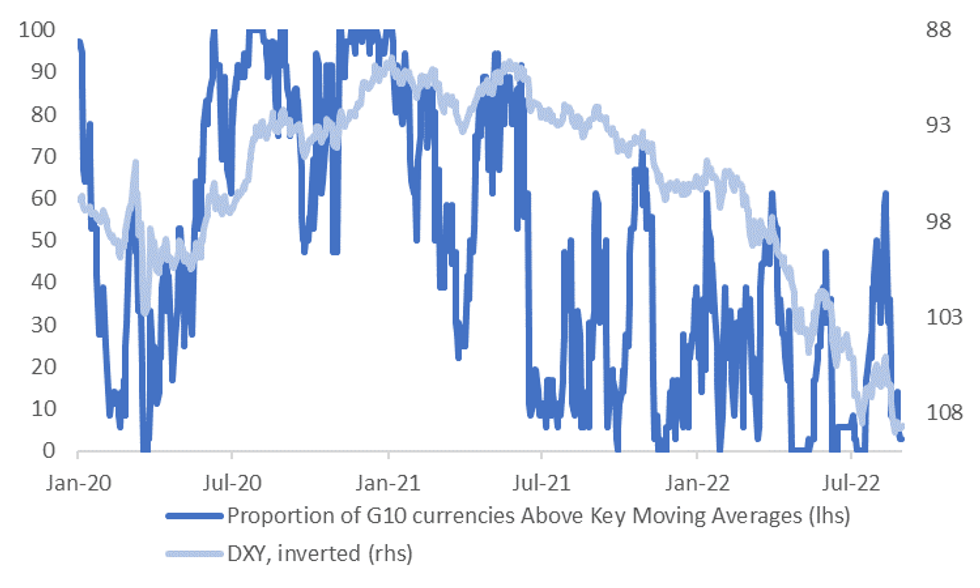

USD momentum remains very strong, at least relative to key moving averages (MA). The first chart below plots the DXY index, which is inverted on chart, against the proportion of G10 currencies which are above key MAs against the USD. This metric looks at whether each G10 currency is above or below its 20, 50, 100 and 200 MA against the USD (see this link for more details on this metric).

- Presently, the G10 currencies only have 1 out of a possible 36 MAs firmer against the USD. This is NOK, which is on the strong side of its 50 day MA.

- Obviously, we are close to the zero bound on this metric, which we have hit on a number of occasions in 2022.

- Interestingly, the DXY has peaked not long after we have hit this zero bound on a number several times this year. This may reflect upside USD momentum running out of steam, or profit-taking flows on long USD positions.

- The exception though was back in late April/early May when the index kept moving higher, although we were at lower levels in the DXY back then compared to now.

- Ultimately shifts lower in the DXY from these peaks have proven to be short lived, before the uptrend resumes once again.

Fig 1: G10 FX Moving Average Momentum & DXY Trend

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

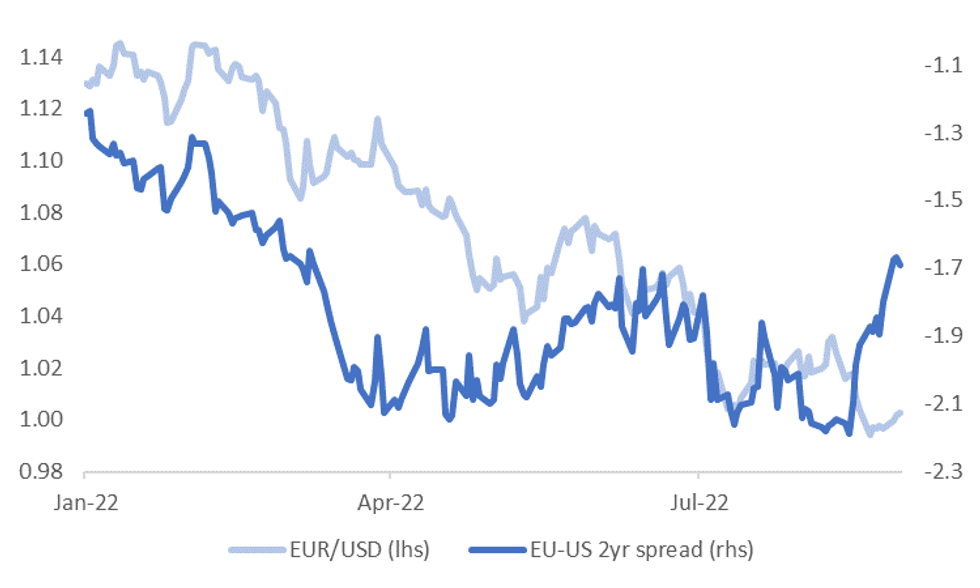

- In the current context, any turnaround in USD momentum is likely to be quite EUR dependent. The euro's weight in USD indices is quite high and correlates well with the rest of the G10 bloc.

- Some macro drivers have turned less bearish for the EUR, at least in a relative sense. The second chart below plots EUR/USD against the 2yr swap spread with the US.

- Outright spreads are still heavily in favor of the USD (-170bps), but momentum has tilted the other way (+50bps from recent lows). It's a similar backdrop for the relative terms of trade, given recent falls in EU gas prices.

- The 20-day MA for EUR/USD comes in at 1.0111 (versus current spot at 1.0040). Also note we have key event risk later today, with the EU CPI due.

Fig 2: EUR/USD & EU-US 2yr Swap Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.