-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMarket On Lookout For NBP Rate Decision

The clock is ticking on the release of the National Bank of Poland's monetary policy decision, which may cross the wires at any point from now. The NBP typically leads with the announcement of the decision itself and follows with the full statement, which this time around should include the main takeaways from the new inflation projection prepared by the central bank's staff. Click here to see our full preview of today's decision, including a summary of sell-side views.

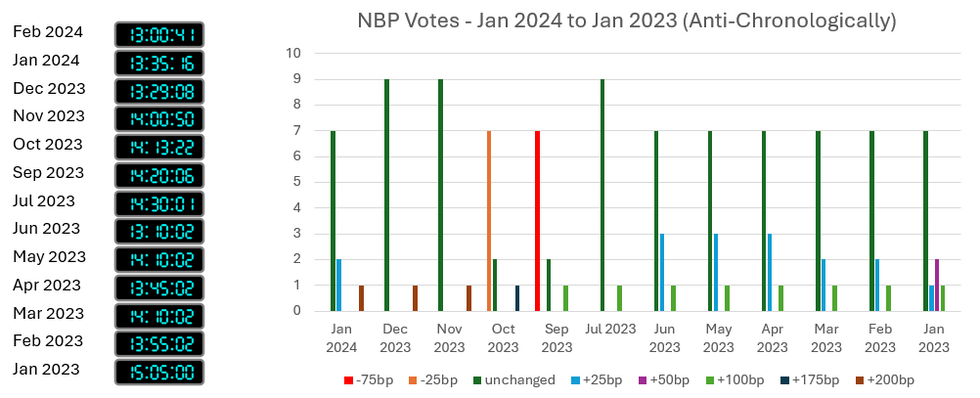

- There is no fixed time for the release of the rate decision. The central bank used to give an advance warning before publishing its decision and statement but ceased this practice at the past few meetings. The average time for the release of the rate decision between January 2023 and February 2024 was 13:57:16GMT/14:57:16CET.

- For reference, the figure below illustrates the times when Bloomberg ran headlines with NBP rate decisions (mind the occasional discrepancies with Reuters). Meetings are arranged anti-chronologically from the most recent one to the January 2023 decision.

- The chart on the right hand-side shows the distributions of votes in the MPC, going backwards from the Jan 2024 meeting, i.e. the most recent one for which the exact vote split is known. The vertical axis represents the number of votes in favour of a given policy outcome.

- Due to the nature of the MPC's rules of procedure (members vote on motions to change rates, while a failure to adopt any motion implies keeping rates on hold), we counted abstaining members as voting for unchanged rates. Occasionally, the total number of votes is greater than 10, if a member voted in favour of more than one motion.

Source: MNI - Market News/NBP

Source: MNI - Market News/NBP

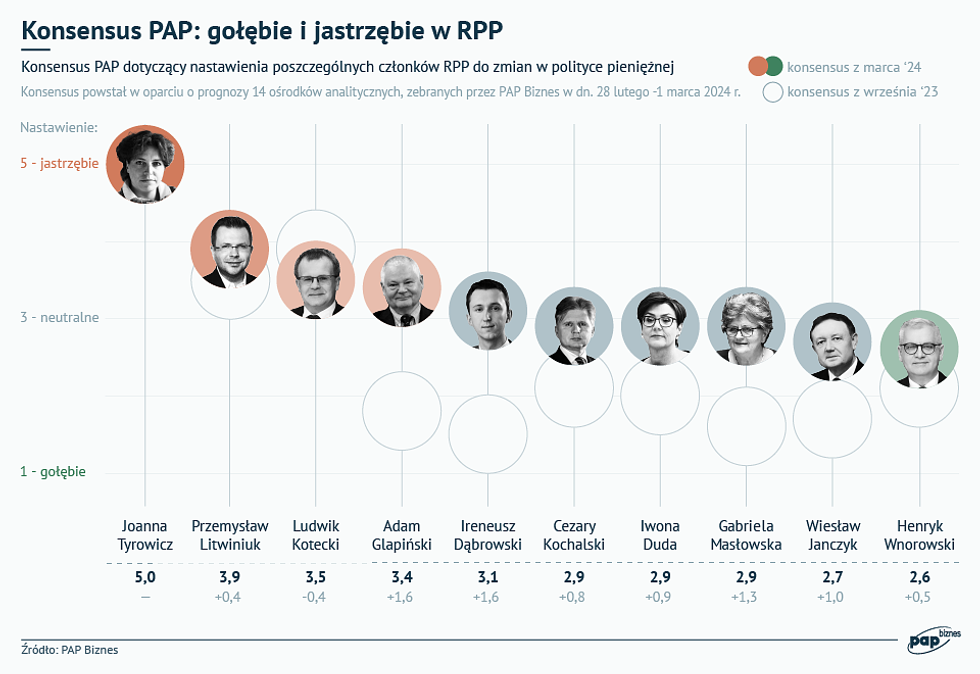

Heading into this week's monetary policy meeting, PAP newswire released its poll of economists regarding the monetary policy biases of individual MPC members. It is worth pointing to notable hawkish shifts in the policy orientations of Governor Adam Glapinski as well as Ireneusz Dabrowski, previously seen as the most dovish MPC member.

- In the PAP poll, respondents rank each policymaker on a scale from 1 (most dovish) to 5 (most hawkish). Each circle represents a given MPC member, while empty circles represent their previous perceived policy orientations, based on the results of a poll conducted in September 2023.

Source: PAP Biznes

Source: PAP Biznes

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.