-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Swing States Called Late

EGBs-GILTS CASH CLOSE: Cautionary Trading Into The Weekend

Core FI spent Friday consolidating gains made Weds-Thurs, with the UK and German curves a little flatter. Periphery spreads a little tighter as well.

- Trading has been cautionary despite generally positive equities, with safe havens remaining underpinned by concerns over COVID spikes, and potential ECB easing in December, which was a key theme among speakers this morning. Brexit negotiations also entering crunch time.

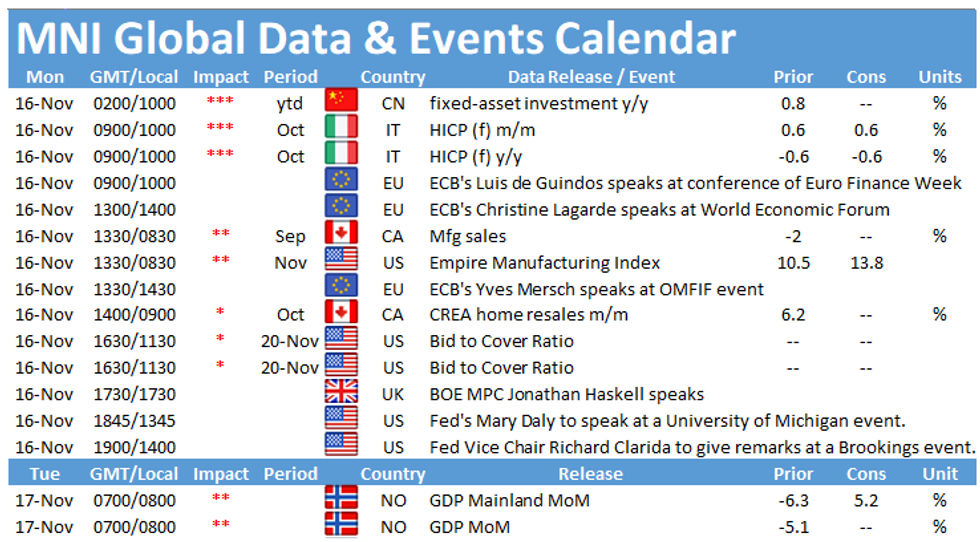

- Next week's schedule includes UK data (CPI, retail sales, public finances), and multiple central bank speakers (Lagarde, Bailey, Haldane) among others, as well as crucial Brexit talks.

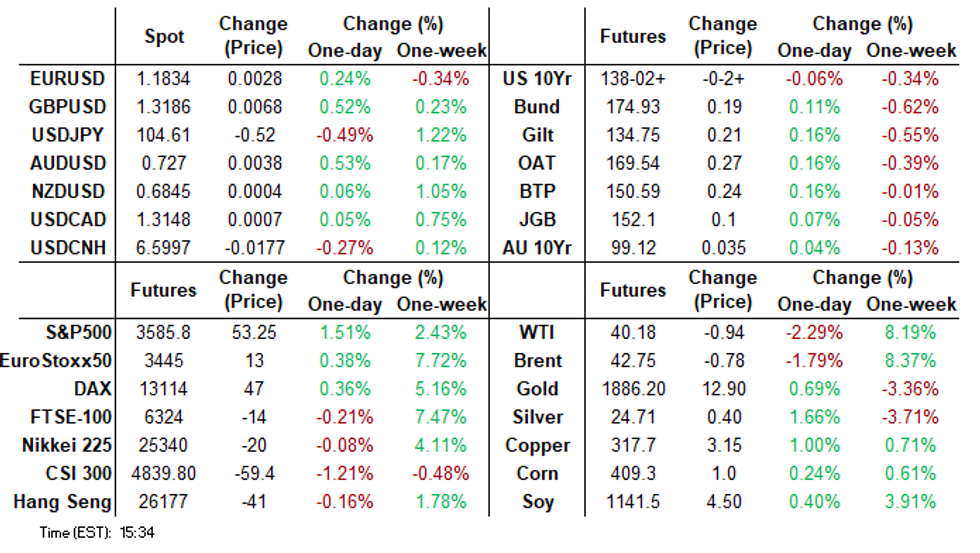

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.4bps at -0.727%, 5-Yr is down 0.6bps at -0.736%, 10-Yr is down 1.1bps at -0.547%, and 30-Yr is down 1.6bps at -0.128%.

- UK: The 2-Yr yield is up 0.9bps at -0.027%, 5-Yr is unchanged at 0.015%, 10-Yr is down 1bps at 0.338%, and 30-Yr is down 0.6bps at 0.926%.

- Italian BTP spread down 0.8bps at 121.2bps

- Spanish bond spread down 1bps at 65.8bps

- Portuguese PGB spread down 0.6bps at 63.4bps

- Greek bond spread down 3.7bps at 130.4bps

US TSY SUMMARY: Ready For A Change?

Swing states were called: Trump takes N. Carolina, Biden takes Georgia, final electoral count: Biden 306, Trump with 232. And yet, President Trump has not conceded. President Trump is scheduled to have his first press conference since the election at the WH Rose Garden this afternoon (after 1600ET) to discuss Operation Warp Speed as virus cases continue to rise globally).

- Tsy futures traded mostly weaker after the closing bell (Dec Ultra-bond bucked move), with equities trading near highs (ESZ0 +56.0) after remaining Much more sedate trade Fri, lighter volumes: TYZ<910k, only 57% 20D avg.

- Eurodollar futures were mildly weaker for the most part, lead quarterly EDZ0 holds -0.005 after 3M LIBOR set +0.00100 to 0.22200%, +0.01612 on week after falling to new all-time low of 0.20500% Monday of this week. November options expire.

- CBOE vol index VIX was notably weaker late: -2.29 at 23.06 vs. 22.74 session low.

- The 2-Yr yield is up 0bps at 0.177%, 5-Yr is up 1bps at 0.4014%, 10-Yr is up 0.7bps at 0.8881%, and 30-Yr is up 0.2bps at 1.6402%.

US TSY: Short Term Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.09%, volume: $165B

- Secured Overnight Financing Rate (SOFR): 0.09%, $912

- Broad General Collateral Rate (BGCR): 0.07%, $350

- Tri-Party General Collateral Rate (TGCR): 0.07%, $323

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $29.858B submission

- Updated NY Fed operational purchase schedule, $40.2B from 11/16-11/30

- Mon 11/16 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Tue 11/17 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/17 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Wed 11/18 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 11/19 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 11/20 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Mon 11/23 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/24 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Mon 11/30 1010-1030ET: Tsys 20Y-30Y, appr $1.750B

- Mon 11/30 Next forward schedule release at 1500ET

FOREX: JPY in Demand Despite Equity Market Progress

Despite the uptick in US equities Friday, haven currencies were in demand, prompting JPY to climb to the top of the G10 pack. USD/JPY made decent progress below the Y105.00 handle as markets further reversed the reflation trades placed at the beginning of the week. Despite the JPY strength, however, the week's lows are yet to be tested at 103.19.

- GBP traded well, but GBP/USD failed to make any meaningful attempt on the 1.32 handle, with near-term Brexit risks still clearly the driver. Some saw the departure of key PM aide Cummings as paving the path for a smoother Brexit deal, keeping attention on forthcoming Brexit negotiations in the coming week.

- USD was mixed, with a lack of key drivers Friday. Data was ineffectual, with the October PPI report mixed.

- The upcoming week sees the frequency of tier 1 data pick up, with industrial production & retail sales numbers from China & the US, UK & Canadian inflation and Australian jobs numbers. Speeches from various ECB, Fed and BoE members are due throughout the week.

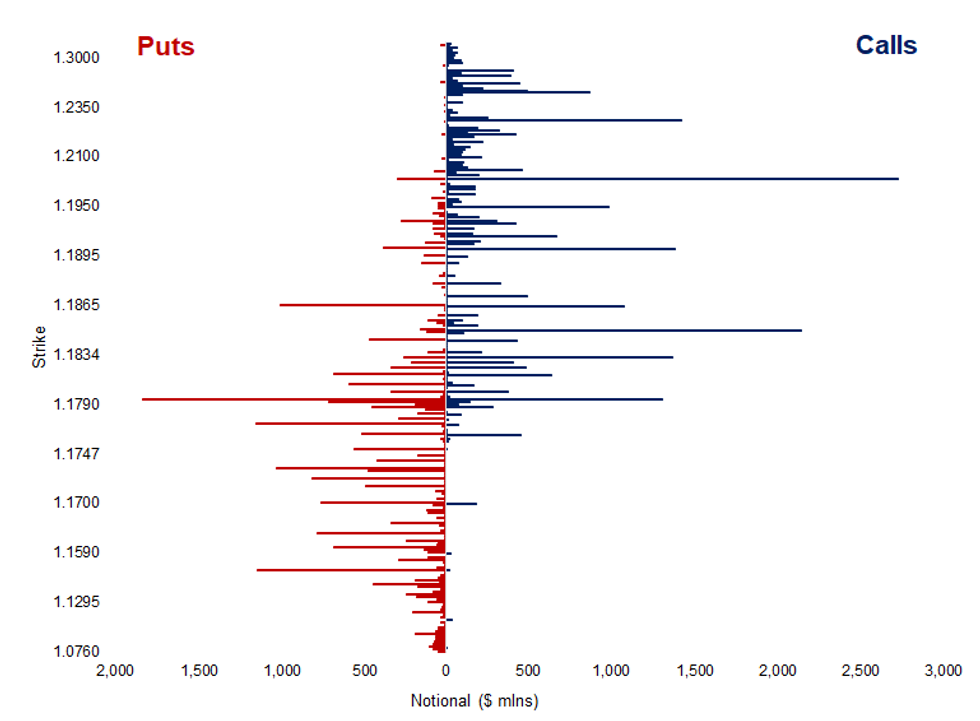

Expiries for Nov16 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1500(E1.1bln), $1.1820-30(E592mln)

USD/JPY: Y103.40-50($740mln), Y104.45-55($500mln), Y104.70-75($743mln), Y105.00($1.5bln), Y105.35($620mln), Y106.00-10($660mln)

EUR/GBP: Gbp0.8925-35(E590mln)

EUR/JPY: Y123.00(E1.25bln)

USD/CNY: Cny6.64-65($1.1bln)

Decent FX Options Activity This Week Favours EUR Upside Protection

FX options turnover this week has been strong, with Monday unsurprisingly proving to be the busiest session of the week in terms of volumes. GBP vols continue to trade at a premium over other pairs, with the ever-present risk of a breakdown in Brexit negotiations clearly fuelling.

- In contrast, front-end EUR/USD vols hit multi-month lows this week, rivalling the lowest levels seen since the beginning of the COVID crisis. The 1m contract captured the December 10th ECB rate decision this week, but the continued pressure on implied vols (in spite of uptick in realised) indicates that markets have bought into Lagarde's signal that the ECB are unlikely to move on rates, leaning more on PEPP and TLTRO tools.

- EUR/USD options trade this week has favoured upside protection, with call notional topping that of puts since the Monday open. Trades this week saw sizeable interest in 1.20 and 1.1850 call strikes, although 1.18 puts also saw decent activity.

EQUITIES: Monday's Highs a Way Off, But Progress Made

Relative to Monday's volatility, Friday trade was far more subdued, although all three major US indices made decent progress into the close. The S&P 500 traded within 80 points of the Monday high, with the energy and industrials sectors outperforming as the dust settles after the on/off nature of reflation trades this week.

- COVID-sensitive stocks including MGM Resorts, Norwegian Cruiselines and Live Nation Entertainment outperformed, rallying as much as 8%.

- The VIX extended the post-election declines, dropping back below 25 points and on track for the lowest close since August.

PIPELINE: Strong Week

Total $44.35B high-grade debt priced over 3 sessions. Headliners: $7B Bristol-Myers Squibb 6pt Monday; $12B Verizon 5pt Tuesday; $5.75B JP Morgan fix-FRN 3pt Thursday.

- Date $MM Issuer (Priced *, Launch #

- Not new issuance Friday, may price next week:

- 11/?? $Benchmark Rep of Italy, 5Y, 30Y

- 11/?? $Benchmark BNG Bank 5Y Reg S

- -

- $10B Priced Thursday

- 11/12 $5.75B *JP Morgan fix-FRN: $2.75B 6NC5 +65, $1.4B 11NC10 +90, $1.6B 21NC20 +87.5

- 11/12 $1.5B *Societe Generale PNC10 5.375%

- 11/12 $1.45B *Pacific Gas & Electric 1Y FRN 3M LIBOR +137.5

- 11/12 $800M *Equitable Financial Life $500M 3Y +32, $300M 10Y +90

- 11/12 $500M *Inner Mongolia Yili 5Y Reg S +125

COMMODITIES: WTI Gradually Erasing Week's Gains

Both WTI and Brent crude futures traded lower Friday, opening a gap with the week's best levels at $43.06 for WTI. The naming of Hurricane Iota provided little support for the energy complex, the latest weather system contributing to 2020's storm season being the busiest in 15 years.

- Precious metals and gold outperformed, with spot bullion higher by close to $15 /oz to near the 100- and 50-dmas at 1904.90 and 1906.53.

- Meanwhile, industrial metals saw further support, prompting copper futures to record the best close of the week and near the multi-year highs at end-October.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.