-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI ASIA MARKETS ANALYSIS - Stocks Bounce As US$ Sheds Gains

EGBs-GILTS CASH CLOSE: Safe Havens Benefit From COVID Headlines

Thursday saw a risk-off move into safe havens in the morning and the late afternoon, while periphery spreads came in from early wides (Greece excepted).

- COVID lockdown concerns boosted Bunds and Gilts early, and the suspension of the Brexit talks at the Frost/Barnier level (due to a participant from the EU side testing COVID-positive) helped buoy them later on.

- Focus on Brexit will continue Friday as we enter another key phase, with EU budget wrangling also getting attention, particularly in the case of peripheries.

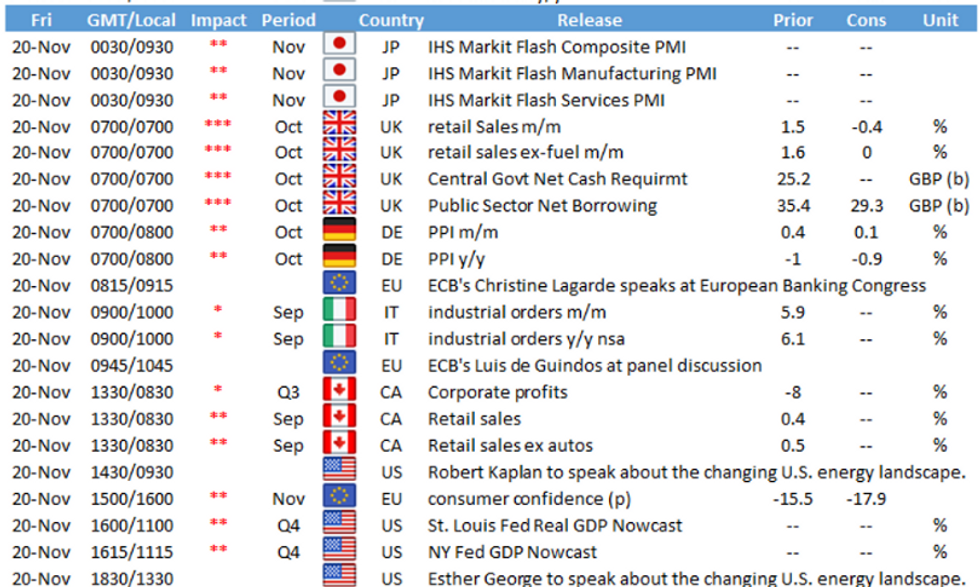

- Friday's docket is headed by UK Oct retail sales. ECB speakers also feature (incl Lagarde and Weidmann). Closing Levels / 10-Yr Periphery EGB Spreads:

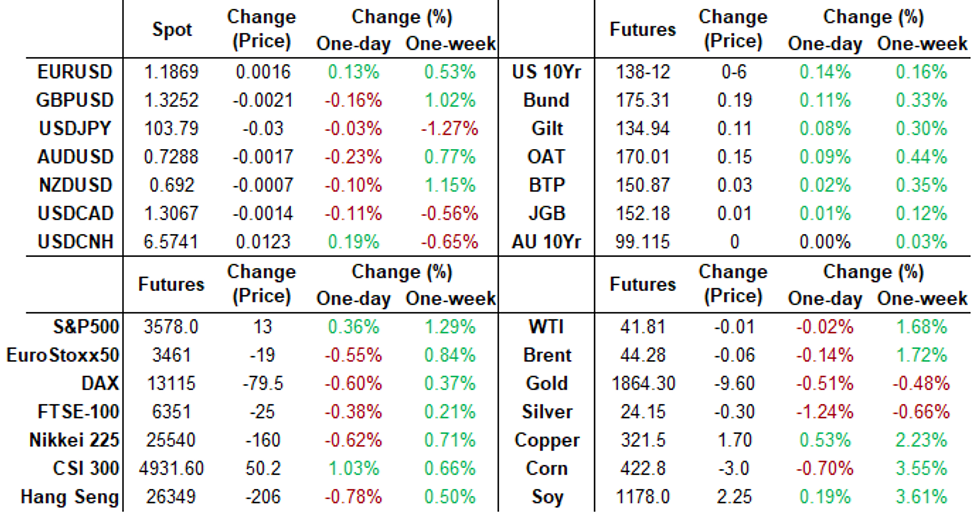

- Germany: The 2-Yr yield is down 0.8bps at -0.735%, 5-Yr is down 1bps at -0.748%, 10-Yr is down 1.7bps at -0.571%, and 30-Yr is down 2.5bps at -0.174%.

- UK: The 2-Yr yield is down 0.3bps at -0.029%, 5-Yr is down 0.8bps at 0.008%, 10-Yr is down 1.4bps at 0.323%, and 30-Yr is down 1.1bps at 0.92%.

- Italian BTP spread up 0.4bps at 121.3bps

- Spanish bond spread up 0.6bps at 64.1bps

- Portuguese PGB spread up 0.2bps at 60.6bps

- Greek bond spread up 4.4bps at 126.2bps

US TSY SUMMARY: Subdued Rally For Rates, US$ Reverses Early Bid

Despite the breadth of the move, the risk-off rally in rates was rather subdued Thursday, COVID-19 spread and concern over stricter quarantine measures supportive for rates though equities managed to break session range late to trade modestly higher.

- Long end outperformed coming into the session with two-way flow from bank portfolios overnight, light fast$ and prop buying shorts to intermediates vs. bank and swap-tied selling. Decent deal-tied hedging.

- Tsys maintained decent support all session, heavy volumes a little deceiving as Dec/Mar futures rolling picked up in earnest, TYZ/TYH over 320,000 by the bell.

- Equities surged to new session highs late, apparently on the back of fiscal relief hopes after Senate Majority Leader Mitch McConnell "agreed to resume negotiations with Democrats over a potential new Covid-19 bill as cases continue to surge around the country, Senate Minority Leader Chuck Schumer said" CNBC.

- The 2-Yr yield is down 0.4bps at 0.1693%, 5-Yr is down 1bps at 0.3857%, 10-Yr is down 1.6bps at 0.8537%, and 30-Yr is down 2.3bps at 1.5771%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00013 at 0.08238% (-0.00087/wk)

- 1 Month -0.00100 to 0.14550% (+0.00912/wk)

- 3 Month -0.01112 to 0.21263% (-0.00937/wk)

- 6 Month -0.00138 to 0.25550% (+0.00950/wk)

- 1 Year -0.00012 to 0.33863% (-0.00075/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $60B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $163B

- Secured Overnight Financing Rate (SOFR): 0.07%, $941B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $318B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $9.870B submission

- Next scheduled purchases:

- Fri 11/20 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

FOREX: US$ Shed Early Gains

USD shed early gains from late morning through the second half, finishing weaker as equities bounced to session highs on hopes of fiscal relief negotiations resuming. Earlier, covid spikes and lockdown risk kept currency underpinned on safe haven. All eyes today were on EM and especially the CBRT.

- CBRT didn't disappoint and hiked 475bps to 15% as economists expected.

- USDTRY dropped 20 big figures on the release and made an attempt at the 100d MA situated today at 7.5063 (printed 7.5151 low so far).

- SARB kept their rate unchanged at 3.5% as expected, which provided initial gains for the Rand, but the move quickly reversed.

- SARB noted data dependency, and USDZAR is now stable at 15.50 at the time of typing.

- Cable fell from 1.3212 down to 1.3196, following report that one of Barnier's Brexit negotiator tested positive for Civid and that talks were on hold for a short period of time.

- Cable quickly recovered, with the downside initial dip looking to have been mostly algo and FM led. Cable at 1.3275.

- EURUSD up 0.0024 (0.2%) at 1.1877

- USDJPY down 0.01 (-0.01%) at 103.81

FX OPTIONS: Expiries for Nov 20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1850(E652mln), $1.1900(E966mln)

- USD/JPY: Y103.20-25($630mln-USD puts), Y103.75($642mln), Y104.00($965mln),

- Y105.46-50($1.3bln), Y106.50($1.1bln)

- GBP/USD: $1.3100(Gbp531mln)

- EUR/GBP: Gbp0.8840(E570mln-EUR puts)

- AUD/NZD: N$1.1000(A$1.6bln-AUD calls)

- USD/CAD: C$1.2900($760mln-USD puts), C$1.3000($838mln-USD puts),

- C$1.3100-20($1.6bln)

- USD/CNY: Cny6.60($1.37bln-$1.32bln of USD puts), Cny6.90($2.0bln)

PIPELINE: Allstate Launched Late

- Date $MM Issuer (Priced *, Launch #)

- 11/19 $3B #Charter Comm's $1B +11Y +147, $650M tap 30Y +207, $1.35B +40Y +227

- 11/19 $1.8B #AES Corp $800M 5Y +100, $1B 10Y +160

- 11/19 $1.2B #Allstate 5Y +40a, 10Y +70a

- 11/19 $555M #Uzbekistan 10Y 3.7%

- 11/19 $500M *Goldman Sachs +5Y +255

- 11/19 $500M *Massachusetts Electric 10Y +88

- 11/?? $Benchmark Rep of Serbia

EQUITIES: Breaking Higher

Equities surged to new session highs late, apparently on the back of fiscal relief hopes after Senate Majority Leader Mitch McConnell "agreed to resume negotiations with Democrats over a potential new Covid-19 bill as cases continue to surge around the country, Senate Minority Leader Chuck Schumer said" CNBC.

- * DJIA up 35.35 points (0.12%) at 29315.57

- * S&P E-Mini Future up 10.75 points (0.3%) at 3558.25

- * Nasdaq up 94.3 points (0.8%) at 11852.43

COMMODITIES: Gold Extends Losses

- WTI Crude Oil (front-month) up $0.14 (0.33%) at $41.82

- Gold is down $7.07 (-0.38%) at $1865.31

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.