-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS Tsys Finish Strong After Early ECB Vol

US TSY SUMMARY: Risk-Off Back To The Fore

Choppy early trade generated better volumes into the NY open and again into the NY session close as Bonds surged to new session highs.

- Tsys had extended late overnight highs but reversed the move after ECB ramped up asset purchases by E500B. Risk-off remained underlying theme w/futures climbing back to pre-ECB highs ahead weekly claims -- and pared gains yet again after higher than exp weekly (716K) and continuing (5.757M) jobless claims.

- Rates settled into a range from midmorning on -- but extended highs into the close as chances of a bipartisan Covid relief bill waned.

- Session flow included two-way in 5s from various accts, real$ +10s, bank portfolio buying across the curve, pre-auction short sets in 30s.

- Strong 30Y Auction, after last tailing in Oct: Tsys bounce after strong US Tsy $24B 30Y bond auction (912810SS8) yields 1.665% (1.680% last month) vs. 1.677% WI; w/ 2.48 bid/cover (2.29 prior). Indirects drew 65.87% vs. 61.90% prior, 16.77% directs vs. 16.54%, and 17.36% for dealers vs. 21.56% prior.

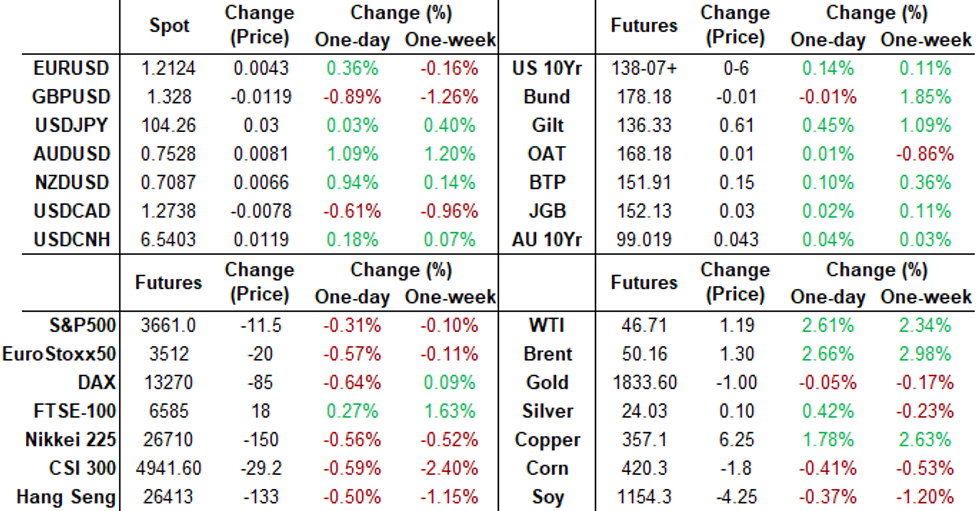

- The 2-Yr yield is down 1.2bps at 0.1369%, 5-Yr is down 1.9bps at 0.3845%, 10-Yr is down 2.7bps at 0.9096%, and 30-Yr is down 4.5bps at 1.6396%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00025 at 0.08288% (-0.00038/wk)

- 1 Month +0.00600 to 0.15388% (+0.00183/wk)

- 3 Month -0.00113 to 0.21950% (-0.00658/wk)

- 6 Month -0.00600 to 0.24475% (-0.01100/wk)

- 1 Year -0.00138 to 0.33450% (-0.00225/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $172B

- Secured Overnight Financing Rate (SOFR): 0.08%, $935B

- Broad General Collateral Rate (BGCR): 0.06%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $340B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $8.890B submission

- Next scheduled purchase:

- Fri 12/11 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Fri 12/11 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- +15,000 Jun 95/97 put spds, 0.5 vs. 99.85/0.05%

- +1,000 Red pack (EDZ1-EDU2) 100 call strip, 8.5-9.0

- +3,000 Jun/Sep 97/98 strangle strips, 5.0

- +20,000 May 99.87/99.937 1x2 call spds, 0.0

- +5,000 Green Jun 87/91/95 put flys, 3.0

- Overnight trade

- 5,000 Jun 98/100 call spds

- 4,000 Sep 97/98/100 call flys

- 1,000 Mar 96/97/98 put flys

- 4,000 Green Jun 91 puts

- 2,500 Green Mar 95 puts

- +3,000 USF 169.5/171.5 put spds, 20

- +3,000 TYG 138 straddles, 115

- over 5,000 USF 175 calls, 16

- over 4,000 USG 169/172 put spds vs. 177 calls, wide range

- -5,000 TYG 136/139 strangles, 21, small lots/paper reloads

- -3,000 FVG 125.5/126.5 strangles, 9.5

- Overnight trade

- 3,000 TYG 136/137 put spds

EGBs-GILTS CASH CLOSE: Gilts Easily Outperform In A Very Busy Session

A very busy session, with Gilt yields ultimately settling lower and Bund yields higher.

- We opened on a bullish note with Wednesday's Brexit talks having gone poorly and bringing a 'no deal' outcome clearly into focus. Gilts rallied at the open, and outperformed all day.

- But the mood turned more hawkish as the ECB decision and press conference were seen to disappoint dovish expectations. Bunds sold off in a bear flattening move with Schatz underperforming, BTP spreads initially widened but came back in.

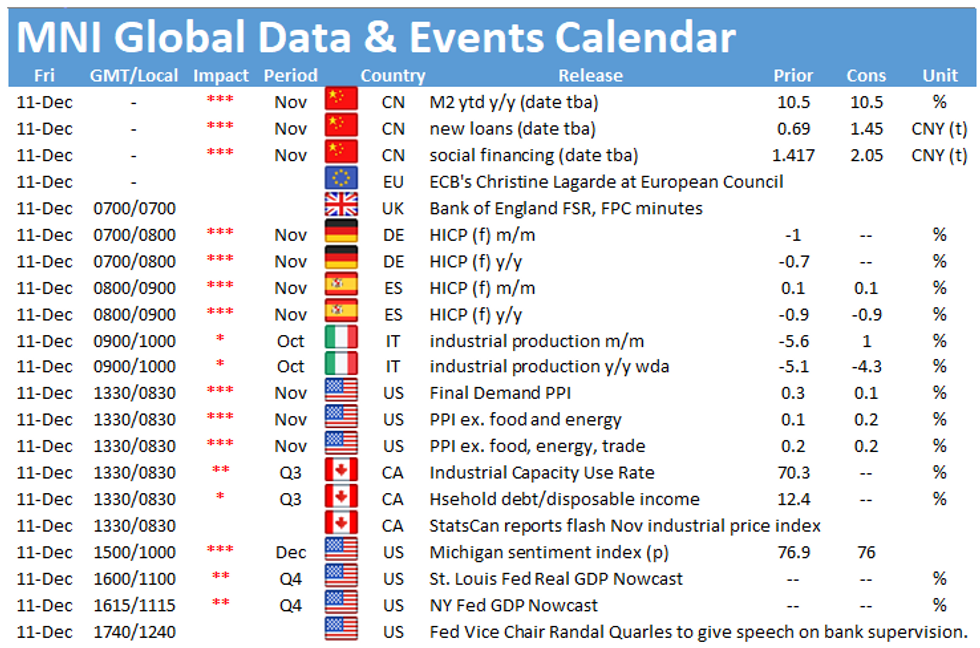

- Friday sees 2-day European summit continue, with BOE financial stability report published at 0700GMT. Speakers include ECB's Holzmann and de Cos. Light data schedule though (mostly final Eurozone CPIs).

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.8bps at -0.766%, 5-Yr is up 0.6bps at -0.787%, 10-Yr is up 0.2bps at -0.603%, and 30-Yr is down 0.7bps at -0.186%.

- UK: The 2-Yr yield is down 3.5bps at -0.115%, 5-Yr is down 4.3bps at -0.083%, 10-Yr is down 6bps at 0.201%, and 30-Yr is down 6.4bps at 0.744%.

- Italian BTP spread down 2.2bps at 116.5bps

- Spanish bond spread down 0.1bps at 62.5bps/ Portuguese spread down 0.5bps at 58.3bps

EUROPE OPTION SUMMARY: Heavy Session

Thursday's options flow included (selected from among 25+ trades we recorded):

- DUG1 112.30p, bought for 2 in 4.5k

- DUG1 112.30/112.20ps, bought for 1.5 in 16k all day

- DUG1 112.30/20/10pp ladder, bought for 1.25 in 5k

- DUG1 112.20/112.00ps, bought for 0.75 in 4k

- LH1 100.12c, bought for 1.75 in circa 30k (ref 100.99 * 100.995, 17del)

- LH1 100.00/100.125/100.25c fly, bought for 1.75 in 6k

- LM1 100.00/12/25/37c condor, sold at 3 in 2k

- LU1 100.00/99.87/99.75p fly bought for 2.5 in 7.5k

- LU1 100.25/100.50cs, bought for 2.25 in 3.5k

- LU1 100.12/100.00/99.875p fly 1x3x2 sold at -0.5 in 2k

- ERM1 100.625 call sold at 2.25 in 3k

- ERH1 + ERM1 100.75/100.875 1x2 call spread, pays 0.25 for the 2 in both in 4k

- 3RH1 100.37/100.25ps 1x2, bought for 0.5 in 10k

FOREX: Markets Brush Off Lagarde's FX Warning

Traders brushed off Lagarde's warning that the ECB would "carefully monitor" the exchange rate by bidding up the EUR in response to the ECB's recalibration of policy. The ECB expanded the size of the PEPP envelope by €500bln (largely alongside expectations) and extended the duration of their bond-buying program by another nine months - although various sourced reports suggest there was much consternation among the board on this. EUR/USD rallied to touch 1.2159 before fading.- Sterling remains a laggard, falling against all others Thursday as Brexit ire extends into another session. The currency took a late dip just after the London close as the UK PM Johnson warned the public and UK business to prepare for no EU trade deal after the end of the transition period. GBP/USD traded a low of 1.3246, but stayed clear of Monday's worst levels.

- Focus Friday turns to Italian industrial production numbers, US PPI for November and prelim December Uni. of Michigan confidence data.

FX OPTIONS: Expiries for Dec11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1720-30(E675mln), $1.1875-95(E552mln), $1.2100-10(E1.3bln)

- USD/JPY: Y102.00($865mln), Y102.90-00($512mln), Y104.50($601mln), Y105.95-00($514mln)

- GBP/USD: $1.3600(Gbp767mln)AUD/USD: $0.7420-25(A$609mln)

- USD/CAD: C$1.3060-65($582mln), C$1.3190($542mln)

EQUITIES: US Markets Mixed, Stimulus Chatter Remains a Driver

Taking their cue from an unimpressive European performance, US equities languished into the close Thursday, with the S&P 500 opening a small gap with all time highs printed earlier in the week.- Energy firms surged, topping the table comfortably as the oil price rallied to fresh multi-month highs. This failed to prop up the index however, with considerable weakness in industrials, materials and utilities countering. Notable individual stocks included Twitter (+5%) and Starbucks, who hit a fresh alltime high. General Motors and Ford were among the largest fallers Thursday, shedding as much as 3% apiece. Airbnb's IPO saw the firm valued at over $100bln in its stock debut.

- Stimulus talks on Capitol Hill remain a driver, with Mnuchin and Pelosi both sounding optimistic on the prospects of a deal, but ultimately failing to reach any breakthrough.

PIPELINE: Issuance Pace Slowing Into Holidays

- Date $MM Issuer (Priced *, Launch #)

- 12/10 $1.5B #HSBC Holdings PerpNC10 4.6%

- -

- $725M Priced Tuesday; $22.841B total/wk

- 12/09 $725M *Realty Income $325M 5Y +50, $400M 12Y +100

- 12/09 $Benchmark Lao People's Democratic Rep 5Y investor calls

COMMODITIES: Swift Oil Rally Puts WTI at Best Level Since March

Both WTI and Brent crude futures saw a stiff rally Thursday, adding over 3% apiece to hit the best levels since March to open levels not seen since the beginning of 2020 and before the COVID crisis. The rally began in earnest in European hours, but extended throughout the NYMEX session as traders took confidence in evidence of firm oil demand from Chinese refiners and Indian importers. Brent crude futures traded above $50/bbl for the first time since March.- Precious metals traded pretty much flat, with spot gold and silver trading either side of unchanged as equity markets tread water - taking little cue from macro drivers to retain the directional parameters.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.