-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - 25Th Amendment Resolution

US TSY SUMMARY:

Rates traded largely weaker by the closing bell, Treasury futures well off midmorning lows amid deceptively heavy over all volumes, TYH1 over 1.86M after the bell.

- Another low data-risk session, rates buffeted by ongoing political headline risk and global Covid case surge. House convening Tuesday evening at 1930ET to vote on the 25th amendment resolution to remove Trump from office after last Wed's violent siege in DC Capitol. CAD$ hit after headline "ONTARIO HEALTHCARE IS `ON THE BRINK OF COLLAPSE" while vaccine rollout remains slow.

- Not a lot of correlation between rates and stocks, Tsys ignored a late morning sell-off in equities, while both asset classes traded off lows into late trade. Position squaring, short covering noted in second half. Huge +30k TYH1 Block buy 136-11 helped spur move.

- Tsys rallied after strong 10Y Auction Re-Open: $38B 10Y note auction re-open (91282CAV3) drew 1.164% high yield (0.951% last month) vs. 1.172% WI; 2.47 bid/cover (2.33 previous).

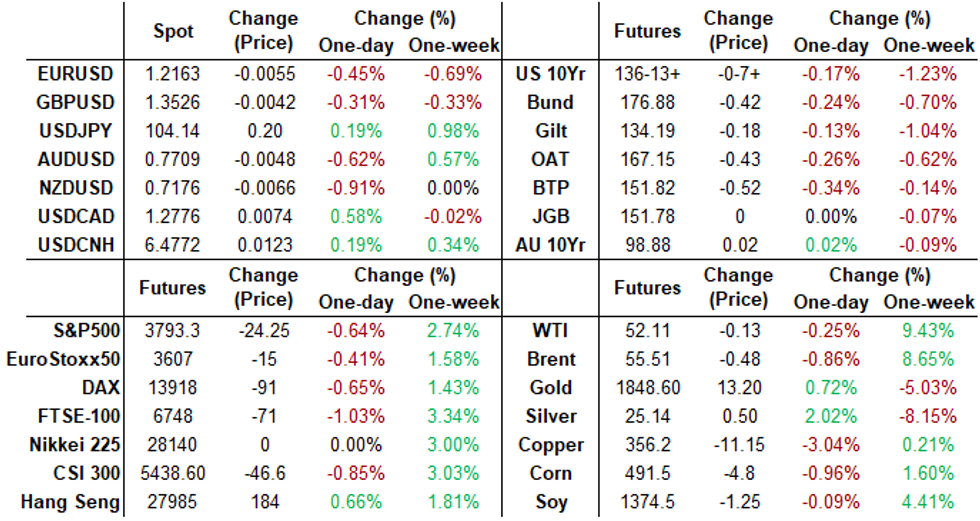

- The 2-Yr yield is unchanged at 0.1449%, 5-Yr is down 0.2bps at 0.5042%, 10-Yr is down 0.8bps at 1.1376%, and 30-Yr is up 0.2bps at 1.8854%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00100 at 0.08588% (-0.00087/wk)

- 1 Month +0.00125 to 0.12600% (+0.00087/wk)

- 3 Month +0.00925 to 0.23375% (+0.00937/wk)

- 6 Month -0.00262 to 0.24763% (+0.00113/wk)

- 1 Year -0.00125 to 0.32563% (-0.00400/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $55B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $146B

- Secured Overnight Financing Rate (SOFR): 0.09%, $964B

- Broad General Collateral Rate (BGCR): 0.07%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $332B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 4.5Y-7Y, $6.001B accepted vs. $19.996B submission

- Next scheduled purchases:

- Wed 1/13 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- Block 20,000 Green Sep 95 calls, 16-16.5

- 5,500 Blue Jun 83/86 2x1 put spds

- +3,000 Blue Jun 92 puts, 24

- -2,500 Green Sep 95 calls, 16

- +5,000 Green Sep 83/87 put spds, 3.5

- -5,000 Apr/May 99.75/99.812 put spd strip, 2.0

- +10,000 short Sep 95/96 put spds, 1.5

- +10,000 May/Jun 97 put spds, 0.5

- Block, 5,000 Blue Jun 98.75/99.125 3x2 put spds vs. 2x Blue Jun 99.37 calls,

- 7.5 net vs. 4,200 EDM4 at 99.11, 0824:13ET

- Overnight trade

- 5,000 Blue Mar 90/92/95 put trees

- 4,000 Blue Mar 90/91/92 put trees

- 2,700 Blue Feb 93/95 3x2 call spds

- 5,000 May 99.75/99.812 put spds

- 7,600 Green Jun 95 puts, 8.0

- -5,000 TYH 135/136 put spds, 21-19

- 5,500 TYG 136.5/137/137.5 call flys, 11

- +4,000 TYH 133.5/134/135/135.5 put condors 4 over TYH 138/138.5/139.5/140 call condors

- Block, +36,000 TYG 137 calls, 4/64 at 0949:32ET

- 6,100 TYG 135.5 puts 1 over TYG 136.5/137 call spds

- 8,500 TYH 134 puts, 10

- Overnight trade

- Block, 10,000 135.5/136/136.5 5x3x6 put ladder, 53 net on 140,000 option package

- Block, 20,000 TYH 136/136.5 put spds, 14

- 28,000 TYG 136 puts, mostly 16

- 8,000 TYG 135.75/136.75 put spds

- 5,000 TYH 137 puts, 103-109

- 5,000 TYH 136.5 puts, 49-51

EGBs-GILTS CASH CLOSE: BTP Spds Widen On Politics

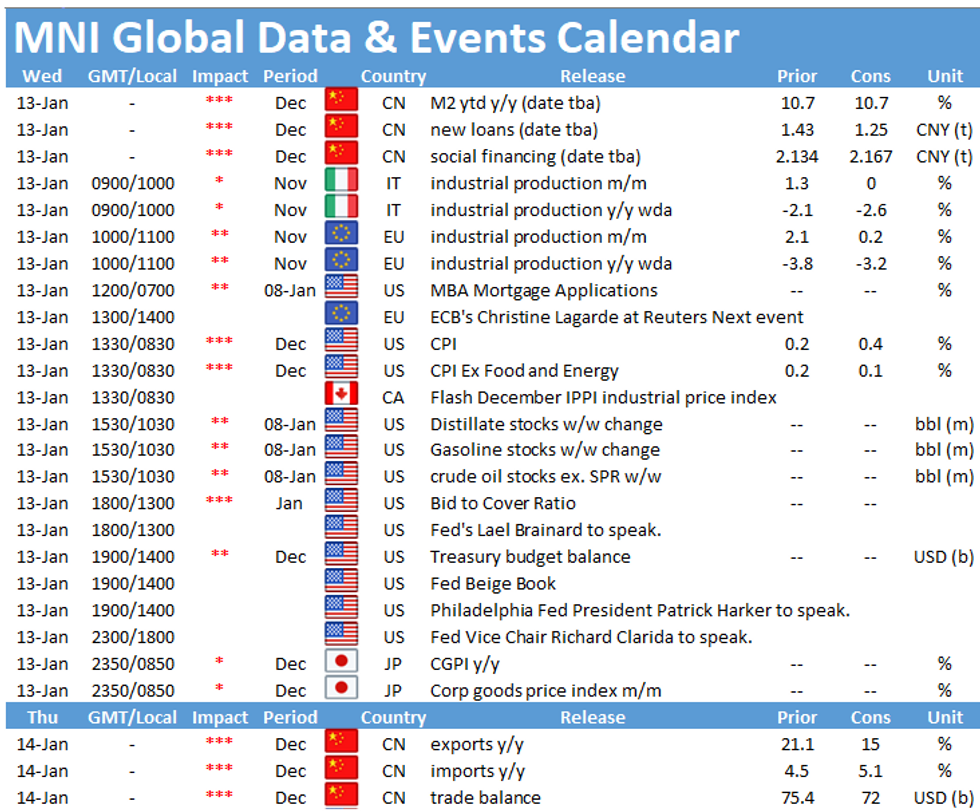

Big supply, political risk and pushback on UK negative rates saw weakness across the FI space Tuesday. Main theme was supply: UK, Netherlands, Austria, Belgium (syndication) all issued today.

- BoE's Bailey noted "lots of issues" w negative rates in the UK, which weakened the short-end.

- BTP spreads widened the most since in more than 2 months amid rumblings of a collapse in the ruling Italian coalition.

- Supply theme continues Wednesday w Spain set to syndicate new 10-Yr and Germany, Portugal and the UK all hold auctions. Also Weds, ECB's Villeroy and Lagarde speak, and we get IT and EZ industrial production data.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.8bps at -0.691%, 5-Yr is up 2.8bps at -0.688%, 10-Yr is up 2.8bps at -0.468%, and 30-Yr is up 2.5bps at -0.065%.

UK: The 2-Yr yield is up 4bps at -0.077%, 5-Yr is up 4.4bps at 0.012%, 10-Yr - UK: The 2-Yr yield is up 4bps at -0.077%, 5-Yr is up 4.4bps at 0.012%, 10-Yr is up 4.3bps at 0.352%, and 30-Yr is up 2.5bps at 0.928%.

- Italian BTP spread up 5.8bps at 111.8bps / Spanish up 2.4bps at 57.8bps

EUROPE OPTIONS: Summary

Mixed trade, Sterling in size- RXH1 176p, sold at 59 in 3k

- RXH1 175.00p was sold at 27 and 26.5 in 15k (ref 176.76)

- RXH1 176/175ps, bought for 27 in 6k vs RXH1 177p, sold at 99 in 3k

- RXG1/RXH1 177p calendar, bought the March for 37 in 2.75k

- RXG1 177/176.5/175p ladder sold at 20 in 2.6k

- DUG1 112.20p, bought for 1.5 in 10k

- DUG1 112.30/112.20ps, sold at 4 in 5k

- 0LG1 99.875p, sold at 0.75 in 6.5k

- LM1 100.00/100.12/100.25/100.37c condor, bought for 3 in 2.5k

- LM1 100.00/100.125/100.25c fly, bought for 2 in 5k

- LM1 100^, sold at 10.5 in 20k

- 0LJ1 100.25c/99.75p RR, bought the call for 0.25 in 5k

- LU1 100/100.12/100.25/100.37 call condor, bought for 3.25 in 2k

- LZ1 100.375 call bought for 2.5 in 100k

- 2LU1 99.75/99.50 put spread bought for 5.75 in 20k

- 2LZ1 99.25/99.00 put spread with 3LZ1 99.00/98.75 put spread, bought for 2.5 in 2.5k

- 2LH1 99.75p, bought for 1.75 in 8k

FOREX: Sterling Shines In Soggy Session

GBP traded well following a speech from BoE governor Bailey who highlighted the difficulties and uncertainties when it comes to negative interest rates. Bailey stated that while there "nothing to stop" the imposition of negative interest rates, there would be lots of issues including complicating the outlook for the banking sector. Markets read these comments as a firm indication that the MPC are still well away from seriously considering NIRP, resulting in markets pushing out rate cut expectations and boosting GBP in the process. GBP/USD showed above $1.36.

- Elsewhere, price action was less directional. The USD resumed recent weakness despite an uptick in US yields and a modest steepening in the curve. Meanwhile, haven currencies weakened, keeping JPY & CHF on the backfoot while AUD, and commodity-tied FX advanced.

- Focus Wednesday turns to Italian, Eurozone industrial production and the US CPI report for December. More central bank speak is due to cross, with ECB's Lagarde, Villeroy and Bullard, Brainard, Harker and Clarida of the Fed are all scheduled.

FX OPTIONS: Expiries for Jan 13 NY Cut 1000ET (Source DTCC)

- EUR/USD: Jan19 $1.2000(E1.1bln), $1.2190-1.2210(E4.5bln-EUR puts), $1.2250-55(E1.0bln), $1.2300(E1.4bln), $1.2350-55(E1.1bln-EUR puts); Jan22 $1.2275(E1.95bln)

- USD/JPY: Jan14 Y104.25-40($1.3bln); Jan15 Y104.80-00($1.4bln); Jan19 Y103.00($1.4bln)

- EUR/GBP: Jan15 0.8650(E1.5bln)

- AUD/USD: Jan19 $0.7450(A$1.2bln), $0.7700(A$1.1bln); Jan25 $0.7550(A$2.8bln), $0.7650(A$1.4bln)

PIPELINE: $19.69B High-Grade Debt To Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 01/12 $5B *KFW 5Y +3

- 01/12 $5B #CADES 10Y +23

- 01/12 $3B BPCE $1.75B 5Y +60, $1.25B 11NC10 +115

- 01/12 $2.09B #Rep of Colombia $790M 10Y tap 2.8%, $1.3B 40Y +210

- 01/12 $1.75B *Zurich Insurance Co 30.25NC10.25 3.0%

- 01/12 $1.5B *MuniFin 5Y +8

- 01/12 $750M #Aviation Capital 5Y +165

- 01/12 $600M #Pacific Life 7Y +62

- 01/12 $Benchmark Nippon Life investor call

- On tap for Wednesday:

- 01/13 $Benchmark Japan Bank Int Cooperation (JBIC) 10y +29A

- 01/13 $Benchmark Ontario 5Y +20a

EQUITIES: Tele-Comms Lead Losses

After a very modest positive open, US equities softened into the close, with the S&P500 opening a ~1% gap with the all-time highs posted late last week. Telecomms underperformed, dragging the communication services sector lower, but losses were also noted in large tech names including Netflix and Twitter. At the other end of the table, energy outperformed, with a persistent rise in oil prices helping contribute.

- Focus on the first wave of earnings reports due later in the week, from BlackRock, JPMorgan, Citigroup and Wells Fargo.

COMMODITIES: Oil Uptrend Firms, WTI/Crude New Cycle Highs

The uptrend in oil contracts continued Tuesday, resulting in WTI and Brent crude futures hitting new cycle highs and the best levels since early 2020. USD weakness helped contribute, although Bank of America analysts warned that Brent could face some stiff resistance headed into the $58-60/bbl levels. Wednesday's DoE inventories could prove crucial to the ongoing rally, with markets currently expecting a draw of near 2mln barrels in headlines stocks.

- Having sustained material losses since the beginning of the year, silver bounced Tuesday, adding just under 2% to show above the Monday high. Friday's highs are still well away, however, with 27.21 the initial upside target.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.