-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Yellen Talks China Risk, 50Y Bonds

US TSY SUMMARY

Futures holding firmer levels across the curve, narrow range after futures surged to new session highs in late morning trade.

- Driver debatable as former Fed Chair/Tsy Sec nominee Yellen testified at confirmation hearing: targeting China as main competitor, talked abusive practices and `GENOCIDE' ON UIGHURS. Yellen positively eyes 50Y Bond to extend duration/raise $, Yld curves spiked but finishing off highs.

- Futures extended session highs as Yellen said US not "seeking weaker $", equities pared gains (ESH1 +14.0). Prop and real$ acct selling int strength as levels receded slightly; yield curves mildly steeper for most part.

- But futures reverse support after Yellen discusses extending duration to 50Y Bond, would "be pleased to look at issue". Yld curves moving steeper as long end support evaporated briefly. Countdown to Pres-elect Biden inauguration at 1200ET Wed.

- Additional flow tied to multiple bill auctions, while supra-sovereign US$ debt issuers resumed

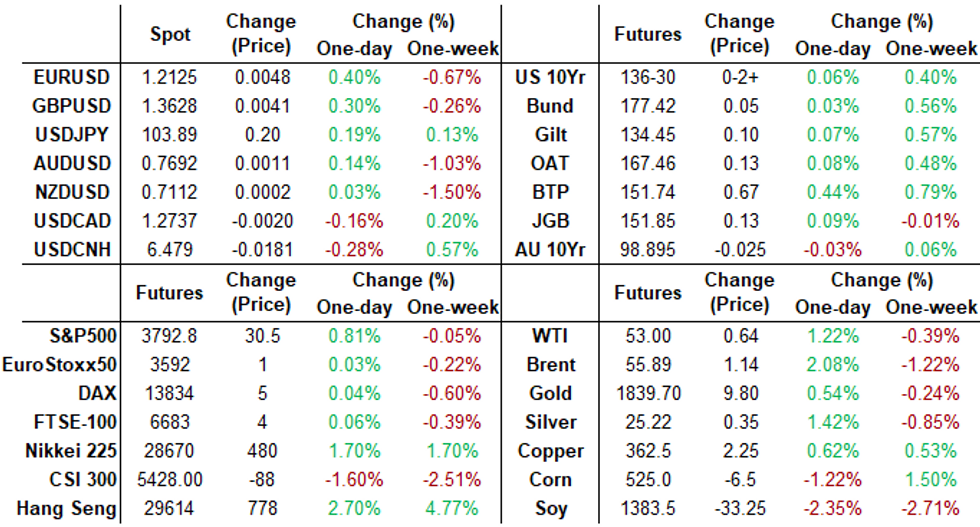

- The 2-Yr yield is down 0.4bps at 0.129%, 5-Yr is down 0.3bps at 0.447%, 10-Yr is up 0.7bps at 1.0903%, and 30-Yr is up 0.6bps at 1.8388%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00150 at 0.08513% (-0.00150/wk)

- 1 Month -0.00138 to 0.12950% (+0.00000/wk)

- 3 Month -0.00037 to 0.22363% (+0.00025/wk)

- 6 Month +0.00013 to 0.23588% (-0.01225/wk)

- 1 Year +0.00062 to 0.31300% (-0.00963/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $150B

- Secured Overnight Financing Rate (SOFR): 0.08%, $887B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $321B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $4.966B submission

- Next scheduled purchases:

- Wed 1/20 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 1/21 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 1/22 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- +5,500 Red Mar 96/97 put spds, 2.5

- +5,000 Green Jun 92/95/96 put flys, 1.0

- -3,000 Red Dec'22 96 puts, 7.5, -7.5k total

- Overnight trade

- 6,200 Dec 100 calls, 1.0

- 3,800 Jun 98/100.12 call spds

- 7,450 Blue Feb 92/93 2x1 put spds

- 6,300 Blue Mar 90/92 2x1 put spds

- 4,100 Blue Mar 93 puts

- 5,000 TYM 131 puts, 10

- 4,000 TYH 135.5/TYJ 135 put spds, 27

- -10,000 TYH 136/137.5 strangles, 31

- Update, 4,000 TYH 135.75/136/136.25/136.5 put condors, 3

- 5,000 TYG 136.5 puts vs. TYH 135 puts, 1

- 11,100 TYJ 133 puts, 13

- 10,000 TYH 136.5/137 strangles, 55-54

- -1,100 TYG 137.5 straddles 41 over TYH 135 puts

- Overnight trade:

- 5,000 TYG 136/136.25 put spds

- 2,000 TYH 134/135/136 put trees

- 2,000 TYH 135.5/137.5 strangles

- 10,400 FVG 125.5 puts

EGBs-GILTS CASH CLOSE: BTPs Outperform As Conte Seen Safe

BTPs outperformed Tuesday, while Bunds and Gilts rallied late in the afternoon, following US Tsys. Supply today saw strong demand.

- BBG citing sources that PM Conte may receive an outright majority in the Senate confidence vote later today (with some abstentions helping the arithmetic) pushed 10-Yr BTP spreads vs Bunds to lowest close since Jan 13. Vote expected well after hours.

- Otherwise the story of the day was supply: Finland (E1bn), UK (GBP6.5bn 2046 syndication), France (E7bn 50-Yr). Additionally, local press reported Greece raised E2bn in 30-Yr private placement.

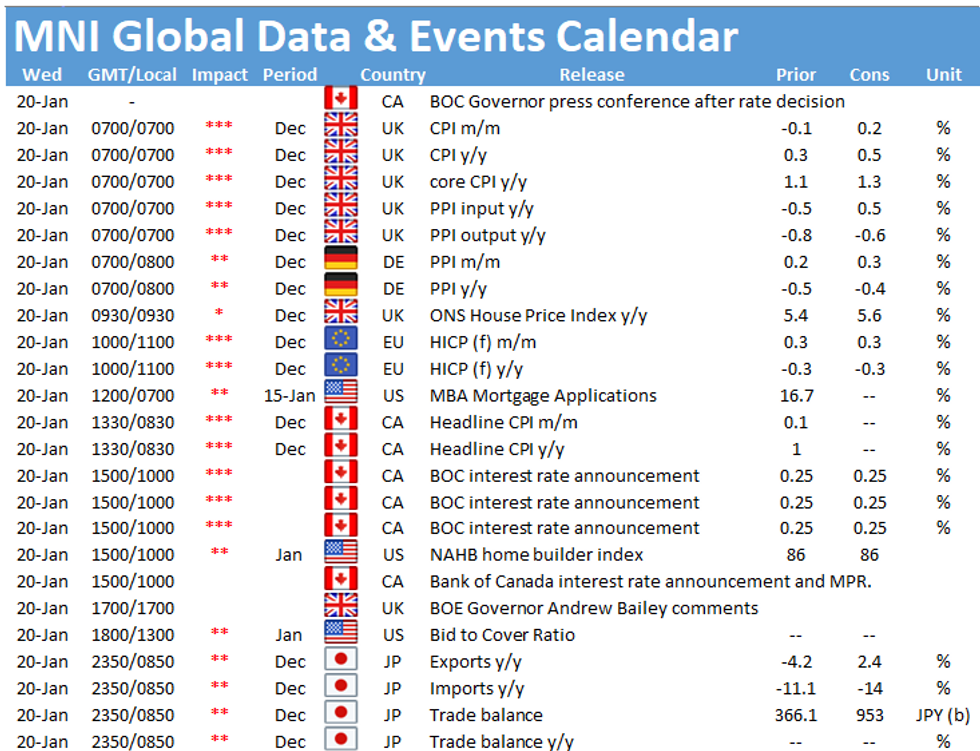

- UK inflation data the early focus Wednesday; ECB coming Thursday. Closing Cash Levels/10-Yr Bond Spreads vs Bunds:

- Germany: The 2-Yr yield is up 0.8bps at -0.707%, 5-Yr is up 0.1bps at -0.716%, 10-Yr is up 0.1bps at -0.526%, and 30-Yr is up 0.1bps at -0.114%.

UK: The 2-Yr yield is up 1bps at -0.127%, 5-Yr is up 0.8bps at -0.041%, 10-Yr - UK: The 2-Yr yield is up 1bps at -0.127%, 5-Yr is up 0.8bps at -0.041%, 10-Yr is up 0.2bps at 0.289%, and 30-Yr is down 0.3bps at 0.859%.

- Italian BTP spread down 4.4bps at 111.4bps / Spanish down 1bps at 59.5bps

EUROPE OPTIONS

Stg 1x2 Call Spreads Of Note; Tuesday's options flow included:

- DUG1 112.40/112.20/112.00/p fly sold at 12.5 in 5k

- RXG1 176.50/176.00ps 1x2, bought for 3 in 4k (4 days to expiry)

- RXH1 179.00c, sold at 16 in 4k

- RXH1 177.5/178.5/179.5c fly, bought for 18.5 in 3k

- 3RM1 100.37/100.25ps 1x2 vs 100.62c, bought the ps for -0.5 (receive) in 3.6k

- LG1 100.125c, bought for 0.5 in 7k

- LH1 100.00/100.12cs 1x2, bought for 1.5 in 27k

- LK1 100/100.12cs 1x2, bought for 1.5 in 50k

- 0LU1 99.87/99.75ps, bought for 3.5 in 10k

- 0LU1 100.00/99.875 1x2 put spread bought for 0.25 in 3.5k

FOREX: Yellen Supports Risk-On, USD, Yen Weaker

As was expected, incoming Treasury Secretary Janet Yellen supported the risk-on sentiment evident in markets from the off. Yellen talked up the requirement to "act big" on COVID-19 stimulus, and also allayed fears of any imminent requirement to raise taxes as the economy recovers. This prompted EUR/USD to bounce back above the 50-dma at 1.2093, hitting the week's best levels in the process at 1.2145.

- Scandi currencies are among the best performers, with NOK, SEK outstripping gains seen elsewhere. The single currency also traded well, helping EUR/JPY clock the first positive session in 8.

- Focus Wednesday turns to UK, Eurozone and Canadian inflation numbers for December and the Bank of Canada rate decision. The BoC are seen keeping rates unchanged at 0.25%. BoE's Bailey is also scheduled to speak.

FX OPTIONS

Larger Option Pipeline

- EUR/USD: Jan21 $1.2000(E1.7bln); Jan22 $1.2275(E1.95bln)

- USD/JPY: Jan21 Y103.65-75($1.4bln)

- USD/CHF: Jan29 Chf0.8800($1.3bln)

- AUD/USD: Jan25 $0.7550(A$2.8bln), $0.7650(A$1.4bln)

- USD/CAD: Jan21 C$1.2715($1.85bln-USD puts)

- USD/CNY: Jan25 Cny6.57($1.0bln)

- USD/MXN: Jan21 Mxn19.50($1.2bln)

PIPELINE

Supra-Sovs US$ Issuance Continues To Outpace Domestic Names Sidelined Into Earnings; $132.69B/month.

- Date $MM Issuer (Priced *, Launch #)

- 01/19 $3.51B #Wells Fargo PerpNC5 3.9%

- 01/19 $2.25B #Chile $750M 2032 tap +87, $1.5B 40Y +127

- 01/19 $1.5B #Credit Agricole 6NC5 fix/FRN

- 01/19 $1.25B #BNP Paribas 20Y +118

- 01/19 $1B #Bank of Montreal 6NC5 +50

- 01/19 $750M #Air Lease Corp 3Y +72

- 01/19 $1.5B Hilton Domestic 11NC5.5

- 01/19 $1.3B Howard Hughes Corp 8NC3, 10NC5

- 01/19 $Benchmark SK Innovations 3Y +150a, 5Y +175a

- 01/19 $Benchmark Rep of Turkey 5Y 5.25%a, +10Y 6.25%a

- Up next:

- 01/20 $Benchmark Asia Infrastructure Inv Bank (AIIB) 5Y +8a

- 01/?? $Benchmark EBRD 5Y

- 01/?? $Benchmark Gazprom 8Y

EQUITIES: Mixed Day For Stocks, US Mkts Play Catch-Up

Having missed out on a positive session for global equities on Monday, US markets looked to close higher Tuesday as earnings season resumed. The S&P500 narrowed in on 3,800, which would mark the best level for the index since late last week, and narrow the gap with all-time highs at 3,826.69.

- In the US, energy and communication services names were the best performers, while real estate, consumer staples and utilities lagged.

- General Motors traded particularly well on a vehicle tie-up with Microsoft, while banks lagged slightly as markets pondered a mixed set of earnings releases from the likes of Bank of America, Goldman Sachs and State Street.

COMMODITIES: Oil Well Bid, Brent-WTI Spread Widens

Both WTI and Brent crude oil futures resumed their uptrend Tuesday, with both contracts notching up gains of 1% or more. A gap opened in the Brent-WTI spread, correcting some of the tightening evident since the beginning of 2021.

- Oil resuming the recent rally came on the back of broad USD weakness and a general risk-on theme across asset classes, as markets welcomed the incoming US Treasury Secretary's pledge to 'act big' on COVID-19 stimulus.

- The oil gains came despite the IEA's outlook report cutting their estimates for Q1 oil demand - although these headlines were countered by a more positive outlook for the market later in 2021.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.