-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Tsys Track EGBs Lower Post-ECB Annc

US TSY SUMMARY: Tsys Track EGBs Lower Post ECB Policy annc

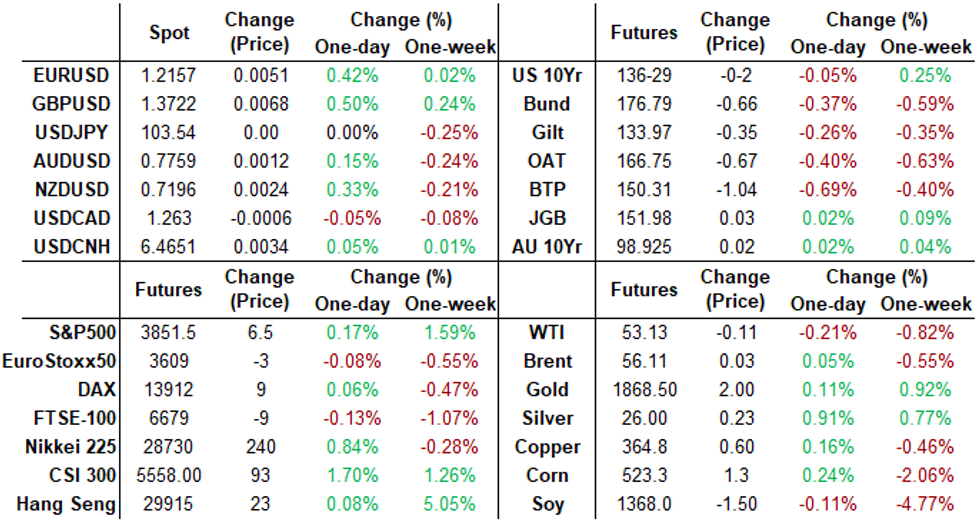

Rates traded mixed into Thursday's close, yield curves steepening to new multi-year levels (5s30s 142.71, level not seen since Nov 2016).

- First full day for Pres Biden, rolling out more executive actions (BIDEN POISED TO FREEZE OIL AND COAL LEASING ON FEDERAL LAND, Bbg) with main focus on grappling with Covid-19 response, says things still likely to get worse before they get better, est's death toll >500k by end of Feb.

- Early kick-start, Tsys followed EGBs lower: focus on "upward inflation pressure as economy recovers" ECB PM Lagarde headlines in post ECB steady rate annc. Volumes surged, yield curves bear steepened.

- Strong auction/aggressive bid: US Tsy $15B 10Y-TIPS auction (91282CBF7), high yield -0.987% (compared to -0.867% prior) vs. -0.972%% WI; 2.68 bid/cover vs. 2.71 prior. Note, record size Tsy auctions next wk: $60B 2Y, $61B 5Y and $62B 7Y.

- Aside from deal-tied positioning, Heavy Eurodollar futures Blocks: 12.5k 2Y bundles +0.0075 after 7.5k Whites -- may be related to talk ICE will annc end of LIBOR date early next week.

- The 2-Yr yield is down 0.4bps at 0.123%, 5-Yr is up 0.5bps at 0.4454%, 10-Yr is up 2.6bps at 1.1058%, and 30-Yr is up 4.1bps at 1.8706%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00037 at 0.08700% (+0.00037/wk)

- 1 Month +0.00150 to 0.13000% (+0.00050/wk)

- 3 Month -0.00463 to 0.21775% (-0.00563/wk)

- 6 Month -0.00338 to 0.23450% (-0.01363/wk)

- 1 Year -0.00187 to 0.31538% (-0.00725/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $72B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $188B

- Secured Overnight Financing Rate (SOFR): 0.06%, $883B

- Broad General Collateral Rate (BGCR): 0.04%, $355B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $323B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $9.440B submission

- Next scheduled purchase:

- Fri 1/22 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- 5,000 long Green Jun 97/98 call spds vs. 90/92 put spds

- +4,000 Blue Mar 88/91 2x1 put spds, 1.0

- +20,000 Blue Jun 88 puts, 4.5

- +5,000 Blue Jun 93/96 call spds, 4.5

- +5,000 Jul/Sep 97 put spds, 1.5

- +2,300 Green Dec 93/95 put strip 4.5

- -3,000 Blue Feb 93 calls, 1.5

- Block +20,000 Blue Sep 98.625 puts, 5.0 from 0839:34 to :45ET

- Overnight trade

- 4,000 Jul 99.75/99.812 put spds

- 1,200 Blue Dec 87/91 3x2 put spds vs. Blue Dec 93 calls

- +6,000 TYH 137.5/138 call spds, 7

- 12,500 wk5 TY 137.25/137.75 call spds

- 3,000 TYH 135 puts, 4, 8k total from 3-5

- 5,000 TYG 136.5/136.75 2x1 put spds, 4

- Overnight trade

- Block 6,925 TYG 137 puts, 5, total volume >11.6k

- 9,700 TYG 136.5 puts, 1

- 3,500 TYG 137 puts, 7

- 2,000 TYH 135.5/138 strangles

- 3,500 FVH 125.5/126 strangles

- 3,000 USH 171 calls, 38

EGBs-GILTS CASH CLOSE: Weakness Exacerbated On ECB Language

Weakness across the space accelerated in the afternoon after the ECB policy press release included a paragraph stating that the PEPP envelope may not be used in full if conditions warranted.

- Bund/Gilt curves bear steepened and periphery spreads widened.

- Earlier, heavy supply in the morning (France, Spain, UK) seen weighing on bonds, along with higher equities (which have since reversed lower).

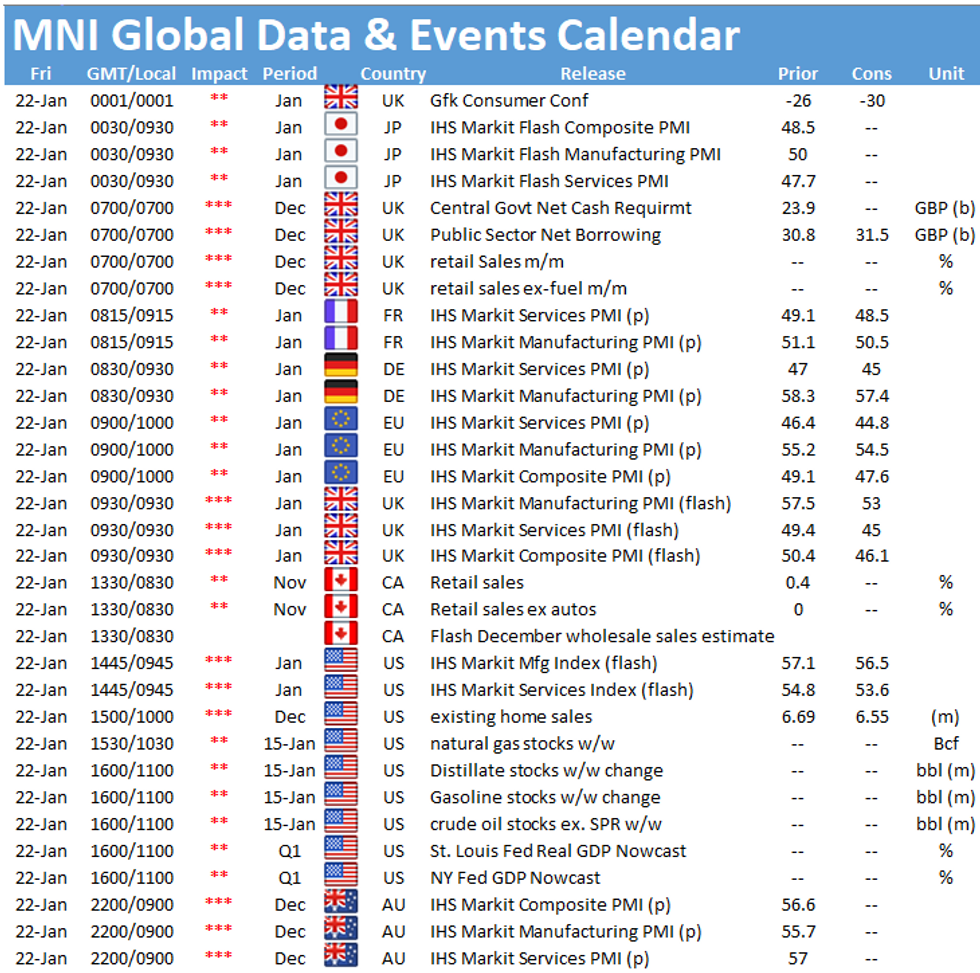

- A heavy data slate awaits Friday, with UK retail sales and European flash Jan PMIs.

- Closing Levels / 10-Yr Periphery Spreads to Bunds:

- Germany: The 2-Yr yield is up 1bps at -0.7%, 5-Yr is up 2.3bps at -0.699%, 10-Yr is up 3.3bps at -0.496%, and 30-Yr is up 4bps at -0.078%.

- UK: The 2-Yr yield is up 1bps at -0.107%, 5-Yr is up 1.6bps at -0.017%, 10-Yr is up 2.9bps at 0.33%, and 30-Yr is up 3.1bps at 0.912%.

- Italian BTP spread up 3.4bps at 118.2bps / Spanish up 1.7bps at 62.1bps

EUROPE OPTIONS: Large Bund Upside, Decent Sterling Action

Thursday's options flow included:

- DUH1 112.20/112.10ps, bought for 1 in 3k

- DUH1 112.30/112.40cs 1x2, bought for 1 in 2k

- DUH1 112.40/112.30/112.20p fly bought vs selling 112.30/112.20/112.10p fly, for 1 in 10k

- RXG1 176p, trades 1 in 2k

- RXH1 179.50 calls bought for 7 in 10k

- IKG1 151p, sold at 22 in 800

- ERM2 100.50^, sold at 18 in 2k

- 3RZ1 100.25/100.12/100.00p ladder, bough the 1 for -0.25 (receives) in 5k

- LH1 100.00/100.12cs 1x2, bought for 1.25 in 22k (ref 99.99)

- LK1 100.00/100.125 1x2 call spread bought for 1.75 in 18k (v 100.020)

- LU1/0LH1 100^ spread, bought the Sep for 5 in 2k

- 0LH1 100/100.12/100.25c fly, trades at 1.75 in 2k

- 0LZ1 100.00/99.875/99.75p ladder, sold at 2 in 5k

- 0LZ1 99.87/100.00^^, bought for 19 in 5k

- 2LZ1 99.75/99.62/99.50p ladder, bought for 0.25 in 1.5k

- 3LH1 99.625 put bought for 2.75 in 4k

- 3LU1 99.50/99.25ps, bought for 5 in 6.4k

FOREX: ECB Fails To Move Needle

The ECB rate decision came and went with little material market impact. EUR/USD was bid up to touch 1.2173, a new weekly high, but an uneventful press conference with ECB President Lagarde saw profit-taking take the rate to the mid-1.21s. This kept the technical picture broadly unchanged, with focus on the 50-dma support at 1.2107 and the near-term upside target of 1.2223. Source-based reports from Bloomberg failed to move the needle, after news suggested the ECB were seeking new gauges to measure financial conditions.

- CAD hit new cycle highs against the USD after comments from BoC's Macklem. The BoC governor stated that Canada will not need as much QE over time under their base case scenario - leading to a new multi-year low of 1.2590.

- The USD, JPY were the weakest currencies in G10, while NOK, SEK were he best performers Thursday.

- Focus Friday turns to UK and Canadian retail sales as well as the prelim January PMI numbers from across the Eurozone, UK and US. There are no central bank speakers of note, although the ECB release their latest survey of professional forecasters.

FX OPTIONS

- Larger Option Pipeline

- EUR/USD: Jan25 $1.22430-50(E2.0bln); Jan27 $1.2250(E1.45bln)

- USD/CHF: Jan29 Chf0.8800($1.3bln)

- AUD/USD: Jan25 $0.7550(A$2.8bln), $0.7650(A$1.4bln); Jan27 $0.7500(A$1.2bln); Jan29 Cny6.50($1.4bln)

- USD/CNY: Jan25 Cny6.57($1.0bln); Jan27 Cny6.42($1.0bln)

PIPELINE: $9.5B To Price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 01/21 $2.5B #Citigroup 6NC5 fix-FRN +68

- 01/21 $2B #European Bank for R&D (EBRD) 5Y +3

- 01/21 $1B *Kommunekredit WNG 5Y +6

- 01/21 $1.2B #Bank of NY Mellon $700M 5Y +35, $500M 10Y +55

- 01/21 $1B *Development Bank of Japan WNG 10Y +22

- 01/21 $1B *Canada Pension Plan Inv Brd (CPPIB) 10Y +24

- 01/21 $750M #Aircastle 7Y +230

- Rolled to Friday:

- 01/22 $Benchmark Prov British Columbia 10Y +22a

EQUITIES: Stocks Flat, Earnings Digested

On the second day of Biden's Presidency, more executive orders were pressed through, with the President using the Production Act to bolster production of vaccines, test kits and PPE for frontline workers. The S&P500 briefly touched a new intraday record, before turning flat ahead of the close. Gains in tech, consumer discretionary and communication services sectors were countered by a pullback in energy and materials.

- Earnings from Intel and IBM after the bell take focus. Larger earnings Friday include Schlumberger and Teradyne.

COMMODITIES: Mixed Performance, Oil Flat, Precious Metals Soft

The recent rally in WTI and Brent oil futures slowed Thursday, leaving both metrics broadly flat into the close. Friday's delayed weekly DoE data take focus going forward, with markets expecting a draw of close to 2mln bbls this week.

- Both Gold and Silver traded mildly lower, but recent ranges were respected. Gold found some support ahead of the 50-dma at $1860.35, as markets took profit after Wednesday's rally.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.