-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI ASIA MARKETS ANALYSIS: Tsy Near Highs, Choppy Day For Stocks

US TSY SUMMARY: Extend Duration, Equities Falter

Monday was a choppy day all around -- rates and equities well bid on the open, the latter gapping lower ahead midday. No One Driver:

- Desks cited multiple headlines for rate bid that started well before NY open:

- German Navy sending ship to Japan (keep eye on activity in the South China Sea), pharmaceutical co Merck canceled their Covid vaccine efforts after poor results. Rates continued to extend duration while equities gapped lower, desks pointed to several headlines: Sen majority leader Schumer saying stimulus

- Rates continued to extend duration while equities gapped lower, desks pointed to several headlines: Sen majority leader Schumer saying stimulus effort to pass in next 4-6 weeks, Rep Sen Portman will not run for re-election (makes Trump imp conviction more likely ?), German Dax also hit as equities reversed gains, stops triggered.

- Heavy surge in volumes, TYH more than doubled in the first hour of trade. Large Blocks an hour later: 1021:04ET: 11,190 TUH 110-15.62 buy through 110-15.5 offer; 22,900 TYH 137-10.5 buy through 137-09 offer; 12,467 UXYH 154-13 buy through 154-11.5 offer. Bbg breakdown: 2s7s10s cash fly; DV01 $460k/$2M/$1.8M.

- Record $60B 2Y note auction stopped through: drew 0.125% (0.137% last month) vs. 0.127% WI, bid/cover 2.67 vs. 2.45 previous.

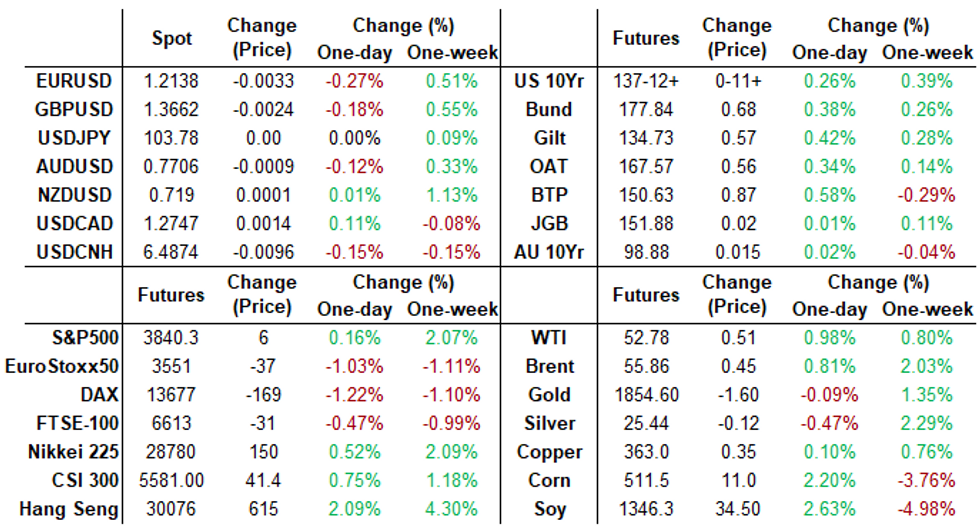

- The 2-Yr yield is down 0.2bps at 0.1189%, 5-Yr is down 2.4bps at 0.4071%, 10-Yr is down 4.9bps at 1.0363%, and 30-Yr is down 5bps at 1.7962%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00162 at 0.08463% (-0.00038 net last wk)

- 1 Month +0.00275 to 0.12750% (-0.00475 net last wk)

- 3 Month -0.00237 to 0.21288% (-0.00813 net last wk)

- 6 Month -0.00300 to 0.23300% (-0.01213 net last wk)

- 1 Year +0.00000 to 0.31225% (-0.01038 net last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $193B

- Secured Overnight Financing Rate (SOFR): 0.05%, $906B

- Broad General Collateral Rate (BGCR): 0.04%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $326B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $23.580B submission

- Next scheduled purchases:

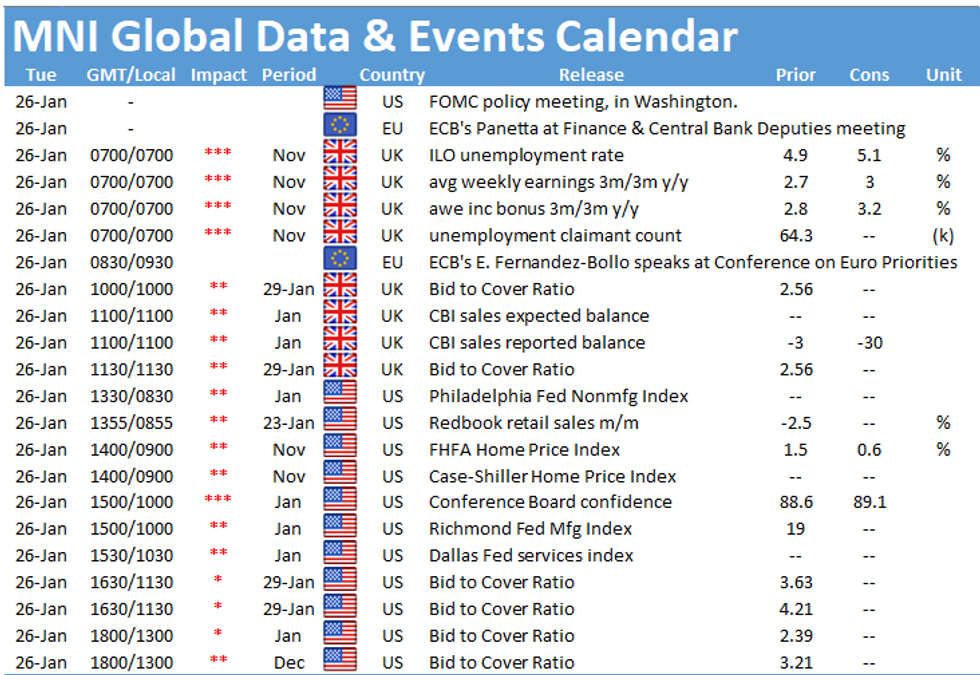

- Tue 1/26 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 1/28 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 01/29 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- 16,650 Blue May 90/91/92/95 call condors

- +10,000 Blue Dec 85 puts, 7.0

- +5,000 Blue Sep 87/90 put spds 5.0 over 96 calls

- -1,500 Blue Mar 90/92 put spds 0.5 over Green Mar 95/97 strangles

- +3,000 Green Dec 91/96 put over risk reversals, 1.5

- Overnight trade

- +4,000 May/short May 98 call spds, 0.0

- +4,000 TYJ 135 puts 13 over 8,000 TYH 135.5puts

- +5,000 TYH 137.25 straddles, 56

- 2,800 USH 176 calls, 7

- +3,500 TYH 136.5 puts, 11-12

- +2,500 TYH 141.5 calls, 1

- -1,200 TYH 137.25 calls, 28

- +2,300 USH 166/167 put spds, 12

- Overnight trade

- Block, +10,000 TYJ 133.5/138 put over risk reversals, 4 vs. 5,000 FVH 125-27

- 2,500 TYJ 132/134 put spds

- +5,000 TYH 135/136.5 put spds vs. 137.5 calls, even net

- TYH 135/136/136.5 and 135.5/136/136.5 put trees, strike volumes:

- >12,500 TYH 136.5 puts, 15 last

- >6,800 TYH 136 puts, 10 last

- >8,900 TYH 135 puts, 3 last

EGBs-GILTS CASH CLOSE: Awaiting Conte

Bonds gained all afternoon with weaker equities. Interest in Italian politics grew after the cash close, with reports that PM Conte would resign Tuesday morning in a bid to gain a mandate from President Mattarella to form a new government with broader backing. Italian spreads dropped in the cash session, while BTP futures regained lost ground following the Conte headlines in the post-cash session. Closing levels:

- Germany: The 2-Yr yield is down 2bps at -0.727%, 5-Yr is down 2.8bps at -0.744%, 10-Yr is down 3.8bps at -0.55%, and 30-Yr is down 3.9bps at -0.136%.

- UK: The 2-Yr yield is down 0.8bps at -0.133%, 5-Yr is down 2.7bps at -0.062%, 10-Yr is down 4.6bps at 0.262%, and 30-Yr is down 5.8bps at 0.834%.

- Italian BTP spread down 3.5bps at 122.8bps

- Spanish bond spread down 1.2bps at 62.3bps

- Portuguese PGB spread down 1.1bps at 57.2bps

- Greek bond spread up 1.8bps at 123.4bps

FOREX: Single Currency Lags - IFO, Italy To Blame

Risk appetite took a considerable hit shortly after the Wall Street opening bell, with US futures shedding around 60 points inside 15 minutes. The sell-off translated to some support for JPY in currency markets, with the USD also faring well. Growth proxy currencies, however, saw no material downside, with the NZD actually the best performer across G10.

- A softer-than-expected IFO release and continued wrangling in Italian politics led the single currency lower from the off. EUR/USD was sold to lows of 1.2116 before the pair bounced, trimming the day's losses to around 30 pips by the London close.

- Focus Tuesday turns to UK jobs data for December and US consumer confidence numbers for January. Speeches are due from ECB's Centeno and de Cos. US earnings season continues with Johnson & Johnson, Microsoft and Verizon Communications all due to report.

FX OPTIONS: Expiries for Jan 26 NY Cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E707mln), $1.2230-50(E625mln)

- USD/JPY: Y105.00($510mln)

- USD/CNY: Cny6.4600($500mln)

- Larger Option Pipeline

- EUR/USD: Jan27 $1.2190-00(E1.4bln), $1.2250(E1.45bln); Jan29 $1.2050-70(E1.7bln)

- USD/CHF: Jan29 Chf0.8800($1.46bln-USD puts)

- AUD/USD: Jan27 $0.7500(A$1.2bln)

- USD/CNY: Jan27 Cny6.42($1.0bln); Jan29 Cny6.50($1.5bln)

- USD/MXN: Jan29 Mxn20.00($1.1bln)

PIPELINE: $11B 7-Eleven Multi Tranche Tues

- Date $MM Issuer (Priced *, Launch #)

- 01/25 $600M #United Airlines 5Y 4.875%

- 01/25 $550M *Woori Bank 5Y +45

- 01/25 $Benchmark Armenia investor call

- Potential multi trance jumbo for Tuesday:

- 01/26 $11B est 7-Eleven

- 01/25 Oesterreichische Kontrollbank (OKB) 5Y +8

EQUITIES: Stocks Suffer Mid-Day Dip

After a relatively smooth start for US equity markets, prices soon turned south following the open. The E-mini S&P slipped from around 3,850 to 3,790 within around 15 minutes, with volume surging sharply.- No specific headline or news catalyst prompted the move, with a number of risk-negative stories piling up to weigh on stocks. Moderna finding evidence that their vaccine had a reduced impact on the South African variant of COVID-19 and Schumer delaying stimulus expectations by another 4-6 weeks all had their part to play, but the price action was more reminiscent of profit-taking and position squaring ahead of the FOMC and month-end later this week.

- Utilities and real estate were the top performers Monday, with energy and materials names on the back foot.

COMMODITIES: Early Commodity Gains Fade Into the Close

Having pulled lower into the close of last week, both WTI and Brent crude futures contracts traded positively Monday, although a large part of the day's gains were erased ahead of the close. Nonetheless, WTI has narrowed the gap with $53/bbl and last week's highs of $53.79.

- Precious metals markets traded flat, with early equity-inspired gains fading well ahead of the close. Spot gold remained inside the Friday range of $1837.5 - $1870.8.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.