-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Risk Gets A Reprieve, For How Long?

US TSY SUMMARY

Rates finish broadly weaker after a stronger start, off late session lows after the bell. Story of tail wags dog. After a slight delay, Tsy futures pared gains in long end after weekly claims drops 67k to 847k, drew more selling on heels of Q4 GDP (+4.0 vs. +4.2% est), Advance Goods Trade Balance is a deficit ($82.5B vs. $84B est), Wholesale Inventories (+0.1% MoM vs. +0.5% est).

- But it wasn't until word that brokers Robinhood and Interactive Brokers would crack down on trading of high-flyer single lists that have seen massive surges in prices and volume this week that risk appetite surged, Tsys falling sharply as equity indexes rebounded from Wed's sharp rout (eminis +1.33% after falling more than 3% late Wed). "ROBINHOOD RESTRICTIONS APPLY TO GME, AMC, BB, BBBY, NOK, OTHERS" .. "ADDS AAL, CTRM, SNDL, OTHERS TO RESTRICTED TRADING," Bbg, Seante and House reps both to launch hearings.

- Futures continue to slide lower across the board, back near middle of range traded from Jan 14-22; 10YY +.0475 to 1.0636% day after breaching 1.0% (0.9992% low Wed; 30YY +.0565, 1.8305%. Yield curves back near early Jan/multi-year highs.

- Little react after decent 7Y Auction: Record US Tsy $62B 7Y Note auction (91282CBJ9) stopped through: draws high yield 0.754% (0.662% last month) vs. 0.757% WI; 2.30 bid/cover vs. 2.31 prior.

- The 2-Yr yield is unchanged at 0.1191%, 5-Yr is up 1.7bps at 0.4288%, 10-Yr is up 3.4bps at 1.05%, and 30-Yr is up 3.8bps at 1.8115%.

MONTH-END EXTENSIONS: FINAL Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS -0.16Y; Govt inflation-linked, 0.23.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.09 | 0.1 | 0.07 |

| Agencies | 0.16 | 0.05 | -0.03 |

| Credit | 0.09 | 0.12 | 0.09 |

| Govt/Credit | 0.09 | 0.1 | 0.07 |

| MBS | 0.06 | 0.08 | 0.07 |

| Aggregate | 0.08 | 0.09 | 0.08 |

| Long Gov/Cr | 0.09 | 0.09 | 0.05 |

| Iterm Credit | 0.1 | 0.1 | 0.09 |

| Interm Gov | 0.09 | 0.09 | 0.07 |

| Interm Gov/Cr | 0.09 | 0.09 | 0.08 |

| High Yield | 0.11 | 0.12 | 0.09 |

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00363 at 0.07925% (-0.00700/wk)

- 1 Month -0.00213 to 0.12288% (-0.00187/wk)

- 3 Month -0.00650 to 0.20500% (-0.01025/wk)

- 6 Month -0.00750 to 0.22013% (-0.01587/wk)

- 1 Year -0.00125 to 0.31075% (-0.00150/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $213B

- Secured Overnight Financing Rate (SOFR): 0.03%, $913B

- Broad General Collateral Rate (BGCR): 0.02%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.02%, $325B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.735B accepted vs. $5.779B submission

- Next scheduled purchase:

- Fri 1/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 01/29 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- +2,000 Apr 99.687/99.75/99.812 put flys, 0.5

- +1,300 Dec 99.062 puts, 0.5

- +10,000 Blue Dec 72/82 put spds, 3.5

- +12,000 Sep 99.75/99.812 put spds, 1.5 hear unwind of sale from earlier in week

- +10,000 Green Sep 90/91/92/93 put condors, 2.5

- +5,000 Green Jun 95/96 1x2 call spds, 0.0 to 0.25

- +2,500 Blue Jun 98.75/98.87/99.12 put trees, 0.5

- Overnight trade

- 6,400 Blue Apr 98.87/99.12 put spds

- +6,000 Jun 99.75/99.812 put spds, 1.0

- +5,000 Green Dec 91/95 2x1 put spds vs Green Dec 96 calls, 2.0

- +1,250 Blue Dec 87/91 3x2 put spds vs. x2 Blue Dec 93 calls

- +2,500 Blue Mar 91/Gold Mar 87 put spds, 2.0 Gold Mar over

Treasury Options:

- 11,000 TYJ 134 puts, 10

- Block 10,000 TYJ 135/136 2x1 put spds, 0.0 vs. 136-05.5/0.09%

- 10,000 TYH 136.5/138 2x1 risk reversals, 16/64 net

- >43,000 TYH 138 calls, 10

- -5,000 TYH TYH 135.75 puts

- >7,500 more TYJ 136/137 2x1 put spds on screen 3-4

- Block, +10,000 TYJ 136/137 2x1 put spds, 3 vs. TYM 136-16.5/0.18%

- 2,000 FVH 127.5 calls, 0.5

- Overnight trade

- 14,000 TYJ 134.5 puts, 12

- Block, +20,000 TYJ 136/137 2x1 put spds, 4 vs. TYM 136-16.5/0.18%

- +5,000 TYH 137 puts, 18, total >12k from 17 low

- 5,100 TYH 136.75 puts, 14

- +4,000 USH 174 calls, 22-27

EGBs-GILTS CASH CLOSE: Reversal Of Fortune

Another busy session Thursday, with risk appetite swinging from negative to positive from early afternoon onward. The German and UK curves went from bull flattening to bear steepening, while BTP spreads narrowed after initial widening.

- In data, Germany had an upside inflation shocker in January (on base effects/changing basket weighting); earlier, Eurozone confidence figures modestly beat expectations. Friday sees some key Eurozone Q4 prelim GDP figures.

- Some AstraZeneca vaccine headlines garnered attention (Germany potentially recommending shouldn't be given to over 65s).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.4bps at -0.745%, 5-Yr is down 0.1bps at -0.752%, 10-Yr is up 0.7bps at -0.539%, and 30-Yr is up 1.5bps at -0.101%.

- UK: The 2-Yr yield is up 1.8bps at -0.113%, 5-Yr is up 1.3bps at -0.042%, 10-Yr is up 1.8bps at 0.287%, and 30-Yr is up 1.8bps at 0.85%.

- Italian BTP spread down 2.6bps at 117.5bps

- Spanish bond spread down 0.8bps at 61.2bps

- Portuguese PGB spread down 1bps at 55.7bps

- Greek bond spread down 0.3bps at 122.1bps

EUROPE OPTIONS: Schatz Action

Thursday's options flow included:

- RXH1 176/175ps 1x2 bought for 19 in 1k

- RXH1 178.00/179.00cs 1x2, bought for 13 in 1k

- DUH1 112.30/112.40 RR, sold the call at half in 2.5k

- DUH1 112.30/20ps, bought for 2.25 in 8k

- DUH1 112.30/112.20ps 1x2, bought for 1.5 in 6k

- DUH1 112.30/112.40/112.50c fly sold at 3 in 2.5k

- DUJ1 112.40/60cs 1x2 sold at 0.5 in 3.25k

- LH1 99.87/100/100.12c fly sold at 8 in 16k

- LK1 100.25c, bought for 0.75 in 5k

- LM1 100/100.12/100.25cs vs LH1 100/100.12/100.25c fly, bought for1.25 in 2k

- 0LH1 100.00/99.875/99.75 put fly bought for 3.75 in 4k

- 3LM1 99.50/99.25ps vs 2LM1 99.62p, bought the Blue for 0.75 in 8k

- 3LU1 99.62/99.37ps 1x1.5 vs 2LU1 99.75/99.50ps 1x2, bought blue for 1.5 in 4k

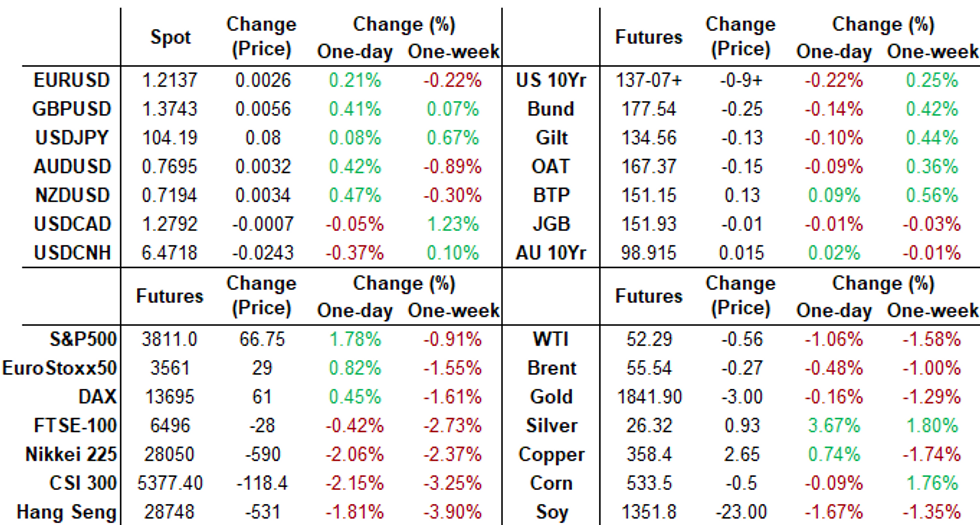

FOREX: USD Gives Up Early Gains, JPY Sinks To Lowest Since Early Dec

The greenback traded well for the first half of the Thursday session, before a short, sharp spell of risk-on worked against the USD, spurring the USD index to sink into negative territory ahead of the close. The USD sales spurred EUR/USD briefly back above 1.2140, despite further stressing from the ECB that a rate cut is not off the table if the circumstances change.

- JPY was comfortably the poorest performer Thursday, with USD/JPY cracking through major resistance at the bear channel top of 104.40 (drawn from the March 2020 high). This confirms a resumption of the uptrend that started at the beginning of January and opens levels not seen since November.

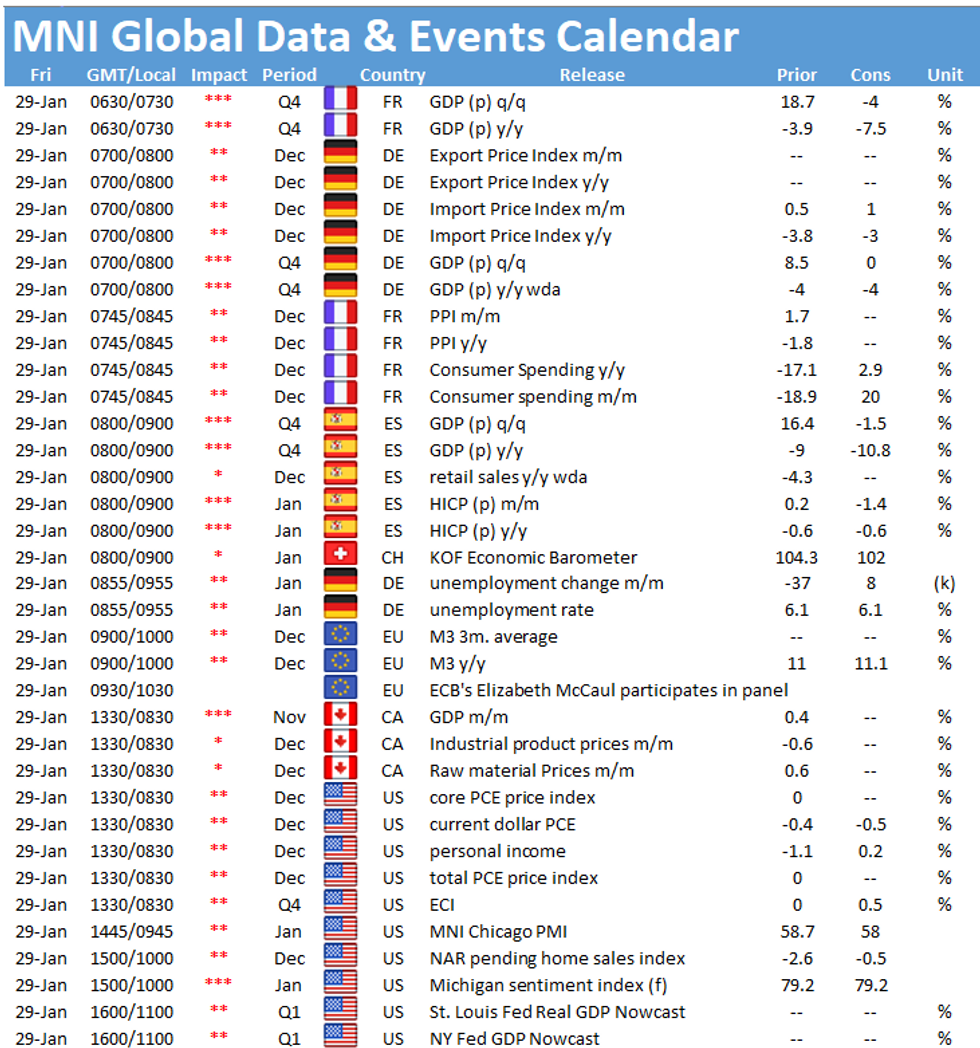

- Focus Friday turns to French, German and Canadian GDP releases and US personal income/spending figures for December. The first Fed speakers since Wednesday's FOMC decision are due, with Kaplan and Daly both on the docket.

OPTIONS: Expiries for Jan29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2070-75(E1.0bln), $1.2100(E697mln), $1.2200(E751mln), $1.2300(E953mln)

- USD/JPY: Y103.80-85($593mln), Y104.35-45($1.3bln)

- EUR/GBP: Gbp0.8800(E631mln), Gbp0.8845-60(E1.1bln)

- USD/CHF: Chf0.8800($1.46bln-USD puts)

- AUD/USD: $0.7610-30(A$778mln), $0.7650(A$781mln), $0.7725-35(A$1.0bln-AUD puts)

- USD/CAD: C$1.2750-60($685mln)

- USD/MXN: Mxn19.80($1.1bln), Mxn20.00($1.2bln)

- USD/CNY: Cny6.50($1.5bln)

PIPELINE: JP Morgan Launched

JP Morgan outpaces Cargill, Airport Authority HK combined.

- Date $MM Issuer (Priced *, Launch #)

- 01/28 $5B #JP Morgan $2B 6NC5 fix/FRN +62, $3B 11NC10 fix/FRN +90

- 01/28 $1.5B #Cargill $500M 3Y +25, $500M 5Y +40, $500M 10Y +65

- 01/28 $1.5B #Airport Authority HK $900M 10Y +65, $600M 30Y +80

- 01/?? $Benchmark IDB 5Y +5a

EQUITIES: Single Stock Turmoil Continues, Indices Breathes Sigh of Relief

After a negative start to the session, US equity futures rallied sharply at the open, helping boost indices nicely throughout the cash session. Drama and turmoil in single stocks continued, with GameStop opening with losses of 25% and falling further after a number of brokers, namely Interactive Brokers and Robinhood looked to limit or restrict options traded in some stocks to liquidation only and by upping margin requirements on new positions.- The e-mini S&P bounced well off support at the 50-dma (both Wednesday and Thursday), which crosses at 3709.82. Wednesday's highs of 3853 mark the first upside target for the index from here.

COMMODITIES: Gold Erases Early Spike Into the Close

A short, sharp spell of risk-on in US equities alongside the open helped buoy gold (the positive correlation between the two has firmed in recent weeks) to prompt a near $25 rally in prices to touch $1864.24. This effect soon faded, however, with prices returning into negative territory ahead of the close. Silver saw a similar rally, with gains of as much as 7% at some points of the session. USD weakness helped, as did speculation that silver could be subject to an imminent short squeeze.

- Both WTI and Brent crude futures slipped into the close despite seeing early risk-related support. Wednesday's lows held in both contracts, however.

- Further growth numbers from France, Germany and Canada cross Friday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.