-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Ylds Up Pre Fed Powell Testimony Wed

US TSY SUMMARY: Higher Ylds, Steeper Curves, 5s30s Breach 2015 Triple Top

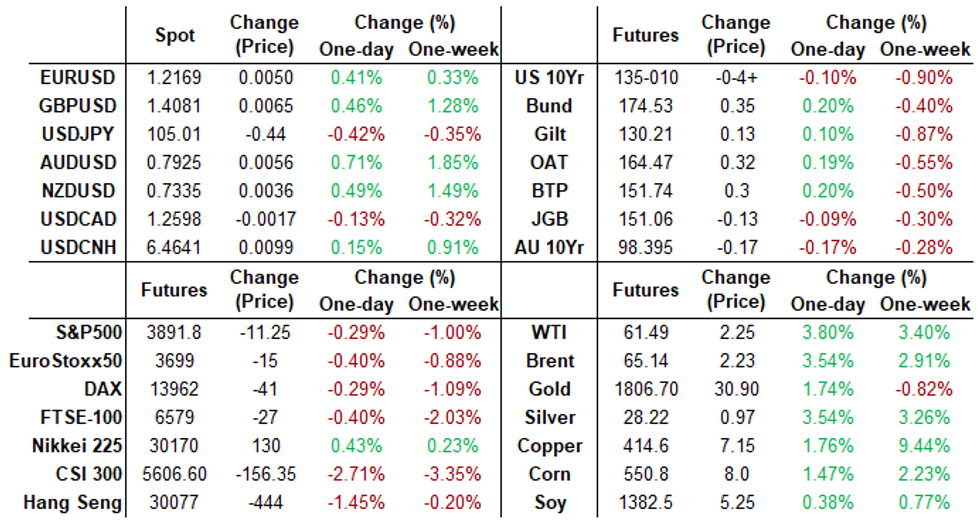

Futures have quietly drifted back to pre-NY open levels, weaker across the board to around middle of overnight range. Heavy overall volumes (3.35M TYH1) closer to average when taking surge in March/June rolls into account (835k TYH/TYM).

- Active participants have migrated to sidelines ahead Fed Chair Powell's semi-annual mon-pol testimony to Senate Banking Comm at 1000ET Wed. Note, officials have pre-released testimony around 0830ET in past - have not advised intention to do so. Unless Senate chooses to disclose the release time and advisory comes from the Fed then details are technically off the record and for planning only.

- Carry-over reflation theme from last week weighed on Treasury futures overnight, pushed yields to new 1Y highs (10YY 1.3925%; 30YY 2.1919%) yield curves climbed to new 5+ year highs (5s30s 159.336 vs. triple top from 2015 of 157.445, ).

- Early short covering, while LaGarde comment ECB is "CLOSELY MONITORING LONGER-TERM NOMINAL BOND YIELDS" Bbg and large TYH block buy (15,435 at 135-13) added impetus to gap bids in first half. Sporadic selling from fast$ and prop accts weighed followed by decent option-tied hedging vs. large 10Y puts trade, pick-up in deal-tied hedging and swap-tied selling in the short-end (2s-5s).

- The 2-Yr yield is up 0.8bps at 0.1129%, 5-Yr is up 2.3bps at 0.5986%, 10-Yr is up 3.9bps at 1.3755%, and 30-Yr is up 5.8bps at 2.1919%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00312 at 0.08125% (-0.00150 net last wk)

- 1 Month -0.00062 to 0.11488% (+0.00812 net last wk)

- 3 Month +0.00025 to 0.17550% (-0.01850 net last wk) ** (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00900 to 0.20400% (-0.00575 net last wk)

- 1 Year -0.00100 to 0.28550% (-0.01325 net last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $204B

- Secured Overnight Financing Rate (SOFR): 0.02%, $873B

- Broad General Collateral Rate (BGCR): 0.01%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $331B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $5.580B submission

- Next scheduled purchases:

- Tue 2/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 2/24 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 2/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 2/26 1010-1030ET: Tsy 0Y-2.25Y, appr 12.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- +20,000 Green Sep 88/90/92 put trees, 3.0

- +5,000 short Sep 88/09/92 broken put trees, 2.75

- +7,500 short Sep 97 puts 5-5.5 over 2,500 Blue Sep 86 puts

- +40,000 Green May 99.43/99.50/99.56/99.68 broken call condor, 0.0 net/wings over

- -10,000 Green Sep 99.12/99.25 put spds w/ 99.37 calls, 15.0 total

- Block -50,000 Green Jun 88/91/93 put flys, 2.0

- 9,000 Green Jun 92/95 put spds

- +25,000 Sep 99.812/Dec 99.75 put spds, 1.0 Dec over

- -5,000 Red Sep 98 calls 2.5 over 95/96 put spds

- -4,000 long Green Mar 96 calls, 16 vs. 99.61

- 4,000 Blue Apr 88 straddles, 26.0

- +4,000 Red Dec 97 puts, 16.0

- -2,500 Green Jun 95 straddles, 20.5-20.75

- Overnight trade

- 2,000 Jun 98/100/100.12/100.25 call condors

- 2,000 Green Apr 99.187/99.312/99.437 put flys vs. 99.812 calls

- 1,000 Blue Jun 83/85/86 2x3x1 put flys

- -10,000 TYJ 131/133 put spds, 15

- 3,500 TYJ 133 puts, 19

- -5,000 TYM 132.5 puts

- Overnight trade

- 23,000 TYJ 133 puts, 22-27, 25 last

- 20,000 TYJ 134 puts from 43-50 (adds to spd and Block volume)

- 10,000 TYJ 134/134.5 put spds, 15

- 5,000 TYJ 132.5/133 put spds, 9

- Block, +20,000 TYJ 133.5/134 put spds, 11-12

- Block, +8,000 TYJ 133.5/134.5 2x1 put spds, 10

- Block, +30,000 FVJ 123.75/124.5 put spds 4.5 over TYYJ 125.5 calls

BONDS/EGBs-GILTS CASH CLOSE: Big Rally On Lagarde's "Close Monitoring"

Gilts and Bunds rallied after a weak open to the session, on comments by ECB Pres Lagarde that "the ECB is closely monitoring the evolution of longer-term nominal bond yields".- This was seen as an unambiguously dovish development given that her comments come amid a rise in yields, and were in reference to banks passing through higher rates to clients.

- This overshadowed UK PM Johnson's announcement re the schedule to end lockdown over the coming months, the details of which had been largely anticipated.

- Periphery spreads came off early wides on Lagarde's comments as well.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.5bps at -0.686%, 5-Yr is down 2.1bps at -0.629%, 10-Yr is down 3.4bps at -0.339%, and 30-Yr is down 4.6bps at 0.167%.

- UK: 10-Yr is down 1.9bps at 0.679%, and 30-Yr is down 1.3bps at 1.255%.

- Italian BTP spread up 0.7bps at 93.6bps / Spanish spread up 0.6bps at 66.6bps

OPTIONS/EUROPE SUMMARY: Lagarde Dovishness = Bund Upside

Monday's options flow included:

- RXJ1 171/169.5ps, bought for 53 in 4k

- RXJ1 172/173.50/175c fly, bought for 30 in 25k

- RXM1 169.50/167.50ps 1x1.5, bought for 25.5 in 3.5k

- RXM1 169/167ps 1x1.5, bought for 22.5 in 2.5k

- OEJ1 135/135.25/135.50c ladder, bought for 2 in 7k

- DUM1 114.30c, trades for half in ~3k (underlying is 112.105)

- 3RM1 100.37/100.50/100.62c fly, bought for 1.75 in 10k

- 0RZ1 100.62/100.50ps 1x2, bought the 1 for 0.75 in ~4k

- LU1 100.25c, bought for 0.75 in 4k

- 0LU1 100/99.87ps 1x2, bought the 2 for 3.75 in 3k

- 0LU1 99.75/99.62/99.50 p fly, bought for 1.75 in 9k

- 2LH1 99.50/99.25/99.00p fly, bought for 0.5 in 1.5k

- 2LZ199.62/99.75/99.87c ladder, bought for -0.5 (receive) in 2.5k

- 3LZ1 99.75/100cs 1x2, bought for half in 3.5k

- 3LM1 99.50p, sold at 22.75 in 2.5k

- 3LU1 99.50/99.25ps, sold at 13 in 6.4k (ref 99.29, -24 del)

FOREX: Range Breaks Keep Trends in Tact

Weaker equity markets across the continent and in US futures space contrasted with the moves in the likes of AUD, NZD and GBP Monday, which all hit new multi-year highs against the USD as underlying positivity in risk sentiment (evident in roaring commodities) kept the ball rolling.

- GBP/USD has now traded higher for 11 of the past 13 sessions, with the outlining of the UK's plans to emerge from Coronavirus restrictions being received positively by the market. The UK PM Johnson laid out June 21st as the date to watch for all legal limits on social restrictions to be removed.

- AUD was buoyed by persistent and continued strength in commodities, with WTI and Brent bouncing as much as 3%, while copper hit new decade highs. The Bloomberg Commodities Index reflected the sentiment, touching the best levels since late 2018.

- Implied vol reflected the break to new highs in many developed markets, with front-end vol contracts in USD/JPY and USD/CHF posting the most notable gains.

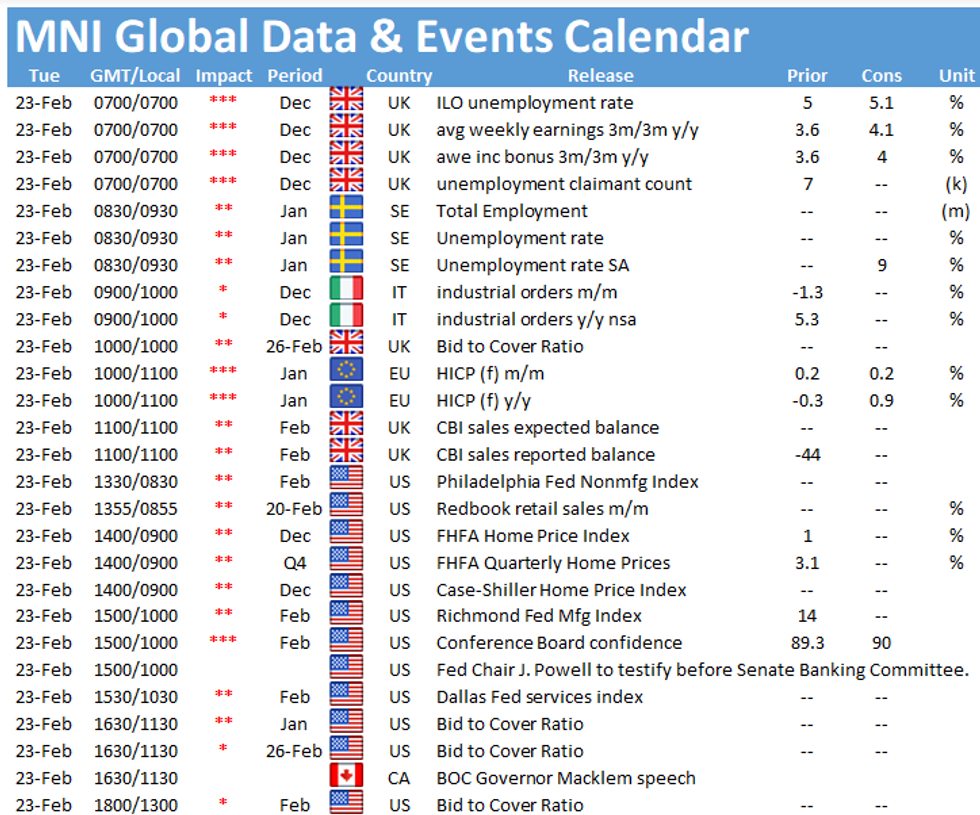

- Focus Tuesday turns to the UK jobs numbers for January, final Eurozone CPI readings and the February US consumer confidence release.

FX Options: Expiries for Feb23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2135-55(E2.3bln-EUR puts), $1.2195-00(E927mln), $1.2300(E788mln)

- USD/JPY: Y103.50-55($752mln), Y105.75($735mln), Y105.95-00($769mln)

- EUR/GBP: Gbp0.8750(E551mln)

- AUD/USD: $0.7900(A$551mln)

- USD/CNY: Cny6.42($505mln)

PIPELINE: $6.65B To Price Monday

- Date $MM Issuer (Priced *, Launch #)

- 02/22 $1.75B *Caterpillar $1B 2Y +18, $750M 5Y +35

- 02/22 $1B #Societe Generale 20Y tier 2 +160

- 02/22 $1B *Federal Farm Credit Bank 3Y +4

- 02/22 $800M #Spirit Realty $450M 7Y +120, $350M 11Y +140

- 02/22 $750M #Public Service of Colorado 10Y +58

- 02/22 $750M #Georgia Power 30Y +107

- 02/22 $600M #National Rural Utilities 5Y, +45

EQUITIES: Mixed Session - Dow Higher While Tech Stocks Slide

Equity markets were mixed Monday, with the Dow Jones Industrial Average holding in the green thanks to decent turnouts from Disney and Caterpillar shares, while the NASDAQ and the tech sector more broadly traded poorly.

- The e-mini S&P traded lower, with the index in the red for the fifth consecutive session, opening a gap of around 70 points with the all time highs printed early last week. For the index, directional parameters remain unchanged, with support at 3843.60 to the downside, while the first upside target remains the all time highs of 3959.25.

- In the S&P 500, utilities and tech names lead the decline, while the energy sector has seen decent support from the bounce in crude oil prices. Across Europe, the session was less inspiring, with shallow losses of 0.1-0.4% posted across the continent.

COMMODITIES: WTI Crude Futures +3% As Risk Stabilises

- WTI crude futures bounced back to within a dollar of their most recent highs, as early risk-off sentiment dissipated. Brent crude futures just behind the pace, but still +2.8%. Goldman Sachs raised guidance for Brent to reach $70 a barrel in Q2 and $75 a barrel in the following three months. The new guidance constituted a $10 revision.

- In the metals space, precious metals were steadily bid throughout the session as markets brushed off an early surge in the dollar and the most recent trend of dollar selling reasserted itself. Spot gold rose 1.4% and silver broke through last week's highs, briefly trading back above $28, currently +2.35% on the day.

- Copper's climb does not seem over with copper futures (HG1) extending above the 400 mark and continuing to reach best levels seen since 2011. Multiple analysts revised their cash forecasts for the bellwether metal last week to above 10,000 including Goldman Sachs and Citi.

- Bitcoin had a near 15% sell-off that sparked some concerns amid regulatory comments from the EU and comments related to it's inefficiency and links to illicit finance from Treasury Secretary Yellen. Price action has since stabilised back above 51,000 but remains down 6.75%.

- The Bloomberg Commodity Index (BCOM) climbed 1.25% amid the stabilised sentiment.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.