-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA MARKETS ANALYSIS: Huge Range 10YY, Top 1.75%

US TYS SUMMARY: Off Overnight Lows Tied To BoJ Yld Band Widening Story

Can't read too much into it, but Tsys broke session range into the closing bell, still weaker and well off overnight levels, but trading at best levels of the NY session.

- Nascent buying around 1.75% in 10s (1.7082% after the bell, 1.7526%H/1.6268%L range on day) from prop, fast$ accts noted early in the session. Meanwhile, pick-up in geopolitical tensions between US and Russia, return of lockdowns in Europe (France, Italy, and Czechoslovakia) and accelerating weakness stocks spurred some positioning, and/or short covering in rates.

- Rates opened under pressure across the curve, long end underperforming after overnight spike in Tsys yields on back of Nikkei report ahead London open that the BoJ will widen 10Y JGB yield band +/- .25% vs +/- 0.2% around zero) at Fri's policy annc.

- Little to no react on weekly claims (+45K TO 770K; continuing claims 4.124M) but a huge jump in Philly Fed Mfg Index from 23.1 in Feb to 51.8 in march (highest lvl since 1973!) underscored the early risk-on tone.

- Yield curves bear steepened, 5s30s climbed to 166.240 high (just off Feb 25 high of 166.984 -- Aug 2014 lvl) but retraced late morning and traded flatter after the bell. Note multiple steepeners (5s vs. 10s and 30s) Blocked overnight..

- The 2-Yr yield is up 2bps at 0.1531%, 5-Yr is up 5.7bps at 0.8555%, 10-Yr is up 7.1bps at 1.7135%, and 30-Yr is up 4.3bps at 2.4612%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N +0.00075 at 0.07875% (+0.00062/wk)

- 1 Month +0.00063 to 0.11088% (+0.00475/wk)

- 3 Month -0.00300 to 0.18663% (-0.00287/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00088 to 0.20388% (+0.00988/wk)

- 1 Year -0.00500 to 0.27588% (-0.00225/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $222B

- Secured Overnight Financing Rate (SOFR): 0.01%, $883B

- Broad General Collateral Rate (BGCR): 0.01%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $331B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.743B accepted vs. $4,994B submission

- Next scheduled purchase

- Fri 3/19 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US TSYS/OVERNIGHT REPO

Overnight repo remains at special across the curve. Current levels:

T-Bills: 1M 0.0101%, 3M 0.0152%, 6M 0.0456%; Tsy General O/N Coll. 0.02%

| Duration | Current | Old Issue |

| 2Y | -0.01% | 0.00% |

| 3Y | 0.01% | -0.30% |

| 5Y | -0.23% | -0.08% |

| 7Y | -0.15% | 0.00% |

| 10Y | -0.16% | -0.12% |

| 30Y | -0.01% | -0.07% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -10,000 Green Jun 93/95 1x2 call spds, 1.5, another 2k on screen

- Block, 10,000 Jun 100 calls, cab

- Block, 15,000 Jun 98 calls, .75

- -10,000 Dec 99.87 calls, 1.0

- +4,000 Blue Jun 80/82/85 put flys, 3.75

- -4,000 Green Dec 88/91/93 put flys, 4.5

- Overnight trade

- 4,000 Blue Apr 80/82/85 put flys

- 5,000 Jul 99.81/99.87/99.93 2x3x1 put flys

- 8,900 short Sep 99.68/99.75 1x2 call spds

- over 15,000 short Sep 97 calls

- 6,000 Blue Apr 82/83/85 put flys

- 8,000 Green Apr 92/93 2x1 put spds

Treasury Options:

- +5,500 TYM 128.5 puts, 28, total 8,600 on day

- -5,700 TYK 130.5 puts, 40, total >17.5k total

- -2,500 TYJ 133 puts 61 over TYM 130 puts

- -2,000 TYM 129/130/131/132 iron condors, 49

- 7,500 TYJ 132/132.5 1x2 call spds, 3

- 2,500 TYK 133/134/134.5 call trees, 6

- 3,900 TYM 131/131.5 3x2 put spds, 47 net 3-leg over vs. 131-06/ 0.33%

- 3,000 TYK 133/134.5/135 1x5x2 call flys, 0-1

- -6,000 USM 157 calls, 109-105

- 6,000 FVK 122.75 puts, 11

- Overnight trade

- Block, 40,000 FVJ 124.25 calls, 2 w/another 14,500 on screen from 1.5-3

- 17,900 TYJ 130.5 puts, mostly 10-13, 12 last

- 6,500 TYK 132.5 calls, 23

- 1,600 TYK 128/130 2x1 put spds, 15

EGBs-GILTS CASH CLOSE: Afternoon Relief

European bond yields rose sharply at the open as part of a global move Thursday, but the sell-off paused for breath in the afternoon and yields closed below session highs.

- Gilts knee-jerked lower following the BoE decision (unchanged as expected) announcement at 1200GMT, and then rebounded as the BoE didn't slow down the pace of QE (as some had expected it might).

- Periphery spreads compressed for most of the session.

- The European Medicines Agency gave its backing to the AstraZeneca/Oxford vaccine.

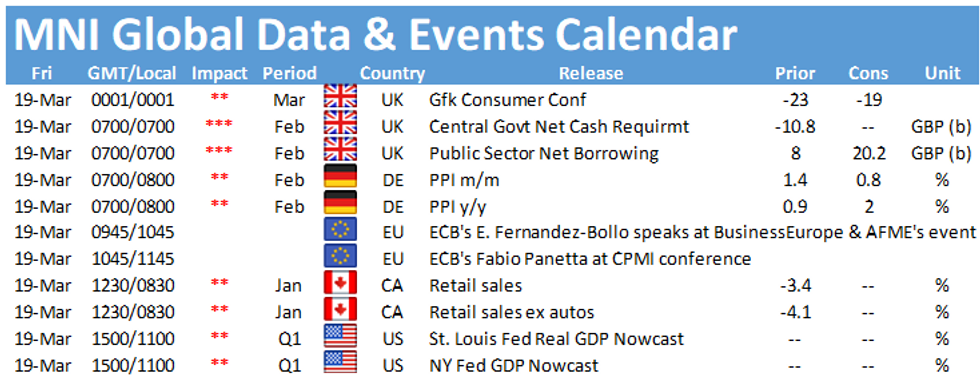

- A pretty light Friday calendar lies ahead, with a few speakers (ECB's Panetta and Vasle, and BOE's Cunliffe), but little data.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is unchanged at -0.685%, 5-Yr is up 0.6bps at -0.618%, 10-Yr is up 2.7bps at -0.264%, and 30-Yr is up 4.6bps at 0.301%.

- UK: The 2-Yr yield is down 0.1bps at 0.11%, 5-Yr is up 2.2bps at 0.419%, 10-Yr is up 4.5bps at 0.875%, and 30-Yr is up 4.7bps at 1.405%.

- Italian BTP spread down 3.5bps at 95.3bps / Spanish spread down 2.9bps at 63.9bps

OPTIONS/EUROPE SUMMARY: Bund Risk Reversals, Mixed Sterling

Thursday's options flow included:

- RXK1 173c bought for 21, 22, 22.5 in ~24k. Said to be part of a condor leg short cover.

- RXK1 167.5/173.5 RR, bought the put for 4.5 in 2.5k

- RXK1 170/171.5 RR, bought the put for 4 in 1.5k

- DUK1 112.10^ sold at 10 in 1.25k (6k total between yesterday and today)

- ERM1 100.37/100.62 combo, bought the put for 0.25 in 5k (ref 100.535)

- 0RU1 100.37p, sold at 2 in 3.5k total

- 0RZ1 10062/100.50ps 1x2, bought for 0.25 in 3k and 6k

- 0LU1 99.37/99.00ps, bought for 2.5 in 10k (ref 99.685)

- 0LU1 99.50/99.25ps, bought for 3.75 in 10k (same ref)

- 0LZ1 99.75 call bought for 9 in 40k (v 99.615)

- 0LZ1 99.50/99.62/99.75c ladder, sold the 2 at 1 in 50k

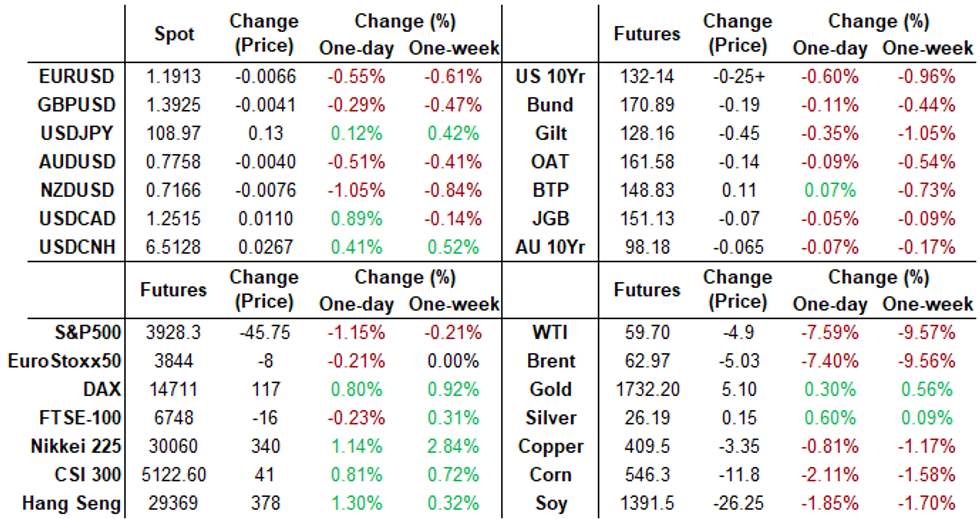

FOREX: Greenback on Front Foot as Markets Rethink Fed

- Despite a spell of USD weakness following the Federal Reserve rate decision late on Wednesday, the greenback turned around Thursday, running higher against all others in G10. USD strength helped support a ~0.6% rally from the post-Fed lows, with the USD Index erasing the bulk of the Thursday losses.

- AUD/NZD traded well, with the cross topping the late February highs at 1.0828 to clear the way for a test on the 2021 highs posted at 1.0843.

- Initial NOK strength on the back of a steeper rate path projection from the Norges Bank faded into the close as the oil price reversed. Nonetheless, USD/NOK remains well within range of the 2021 lows at 8.3151.

- Focus Friday turns to German PPI and Canadian retail sales as well as the Japanese and Russian central bank rate decisions. Speeches are scheduled from ECB's Panetta & Vasle and BoE's Cunliffe.

FX OPTIONS: Expiries for Mar19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1825-40(E533mln), $1.1865-80(E1.2bln), $1.1935-55(E1.9bln-EUR puts), $1.2000(E1.2bln)

- USD/JPY: Y107.50($800mln), Y108.45-50($887mln), Y109.00($840mln), Y109.95-00($690mln)

- GBP/USD: $1.3900(Gbp430mln)

- AUD/USD: $0.7750(A$693mln)

- NZD/USD: $0.7225-40(N$510mln)

- USD/CAD: C$1.2550($630mln)

- USD/CNY: Cny6.35($879mln)

PIPELINE: Toyota, Sumitomo Launched Late

$7.7B To price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 03/18 $2.75B #Toyota $1.25B 3Y +35, $1B 5Y +48, $500M 10Y +65 (adds to $3B debt issued on Jan 6: $1B 3Y +25, $750M 3Y FRN SOFR+33, $700M 5Y +40, $550M 10Y +62.5)

- 03/18 $2.25B #Sumitomo Mitsui Trust $1.75B 3Y +55, $500M 5Y +70

- 03/18 $2.2B #Diamondback Energy $650m 2Y +75, $900m 10Y +145, $650m 30Y +195

EQUITIES: Stocks Mixed as Oil Rout, Yield Rally Undermines Sentiment

- US equity futures started the Thursday session well, with prices holding toward the upper-end of the week's range thanks to a more dovish-than-expected Fed decision late Wednesday.

- This support soon evaporated into the close, however, as a sharp pullback in oil prices and a resumption of the rally in Treasury yields undermined equity sentiment.

- This kept the key psychological level of 4,000 intact for the e-mini S&P as prices retreated back toward Thursday's pre-Fed low of 3935.25.

- Given the rout in oil prices, no surprise to see energy names among the session's poorest performers, with tech and consumer discretionary also suffering. Financials traded well, with banks benefiting from the steeper Treasury curve.

COMMODITIES: Oil Tumbles 7% Amid Demand Concerns, US Dollar Rebound

- Oil has had its biggest intraday drop since October in New York amid short-term demand concerns (amid fresh European lockdowns) and a rising dollar, sliding as much as 7%. WTI futures testing/breaking the March 4 low at $60.52 per barrel. The extension of the decline may also be attributed to some unwinding of long positions from CTAs as daily price gains or losses of more than 3% can often trigger this account group to quickly unload. Watch for this unwind to continue if price action maintains this pace in the days ahead.

- Beyond that, money managers could be unwinding longs. This group's crude holdings are the longest in more than two years, according to the most recent CFTC data. Let's not forget Iran is swamping China with oil. Also, quarter-end window dressing can also get in the way of an otherwise nice trend.

- Precious metals consolidated near their highs during Asia trade, following the fed announcement. A reversal during Europe saw an aggressive move lower and a test of Wednesday's lows. A small bounce leaves spot gold and silver with losses around 0.7% for the day, however, prices are broadly unchanged for the week, with the focus of price volatility in other assets.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.