-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: No Extension for SLR Exemption

US TYS SUMMARY: So Long SLR Exemption

Some decent movement and heavier volumes in rates on a zero data session. Two main factors at play:

- Tsys bounced overnight on apparent reversal of what spurred sell-off on prior overnight session: Nikkei report that the BoJ will widen 10Y JGB yield band +/- .25% vs +/- 0.2% around zero) at Fri's policy annc. During Fri Asia hours Bbg headline spurred short cover bid: KURODA: BOJ CLARIFIED ITS VIEW ON YIELD TARGET RANGE. Apparently, Kuroda had previously expressed his belief that there was no need to widen the band.

- Treasuries sold off midmorning when the Fed confirmed they would let the Supplementary Leverage Ratio (SLR) exemption expire as planned on Mar 31. Rates recovered following the initial gap sale: after much speculation over the past few weeks over what would happen if the exemption wasn't extended, fear of forced unwinds by financial institutions was unwarranted. FED CONFIDENT ALLOWING RULE TO EXPIRE WILL NOT IMPAIR TREASURY MARKET LIQUIDITY OR CAUSE MARKET DISRUPTION- FED OFFICIALS," Rtrs.

Markets calmed in second half, geo-pol angst simmered after some misc Pres Biden headlines, will speak to Russia's Putin "at some point"; also "U.S. SEEKS `PREDICTABLE AND STABLE' TIES WITH RUSSIA" Bbg State Dept Reeker on Blinken's trip to Brussels. Nothing really market moving from a geopolitical standpoint, but Tsys are bouncing off low end of range with equities bouncing as well: ESM1 near steady.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N -0.00187 at 0.07688% (-0.00125/wk)

- 1 Month -0.00250 to 0.10838% (+0.00225/wk)

- 3 Month +0.01025 to 0.19688% (+0.00738/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00150 to 0.20238% (+0.00838/wk)

- 1 Year +0.00037 to 0.27625% (-0.00188/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $75B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $239B

- Secured Overnight Financing Rate (SOFR): 0.01%, $868B

- Broad General Collateral Rate (BGCR): 0.01%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $339B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.401B accepted vs. $6.266B submission

- Next scheduled purchases

- Mon 3/22 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 3/23 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 3/24 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Thu 3/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/26 No buy operation

US TSYS/OVERNIGHT REPO

Overnight repo remains at special across the curve. Still off last March lows, Bills grinding lower, current levels:

T-Bills: 1M -0.0025%, 3M 0.0025%, 6M 0.0254%; Tsy General O/N Coll. -0.01%

| Duration | Current | Old Issue |

| 2Y | -0.04% | -0.02% |

| 3Y | -0.01% | -0.12% |

| 5Y | -0.24% | -0.06% |

| 7Y | -0.20% | -0.03% |

| 10Y | -0.20% | -0.10% |

| 30Y | -0.09% | -0.06% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -1,200 Blue Apr 83/87 strangles, 10.5-10.0

- Update, >15,000 short Dec 98 calls, 1.0 pit/screen

- +4,000 Blue Apr 86/87/88 call trees, 3.5

- Overnight trade

- 10,000 Green Apr 91 puts, 2.0

- 7,000 short Dec 98 calls

- 4,000 Gold Apr 76/77/78 put flys, opener (EDM5 trading 98.085)

- 5,000 TYJ 130 puts, 3

- 3,000 TYK 129.5/130 put spds, 7

- 9,200 FVM 122/123 put spds, total volume>11K

- +1,500 TYK 132.5/133.5 3x4 call spds, 36

- TYK 132.5/133.5 2x3 vs. TYK 134/134.5 1x2 call spds

- 5,800 TYK 132.5/133 2x3 call spds vs. 134/134.5 call spds, 1 net pakage

- 2,.000 TYK 130.5/133.5 strangles, 32

- 2,200 TYM 129 puts, 27

- Block, 20,000 TYJ 131 puts, 23-20

- -10,000 TYK 129/130 put spds, 13-14

- Overnight trade

- -4,250 FVK 123 puts, 12-11

- 1,800 TYK 128.5/129/130 broken put flys

- 2,000 TYJ 130/130.5 put spds

- 3,600 TYJ 132.5 calls, 4

EGBs-GILTS CASH CLOSE: Holding On To Early Gains

Friday saw a relatively quiet end to a very active week, with yields drifting a little higher over the course of the day following an initial drop.

- Overall, the UK and German curves bull flattened, with periphery spreads nudging wider.

- The biggest event of the day came out of the US, where the Fed surprisingly decided against extending SLR bank regulatory relief, sending Treasury yields higher and Bunds/Gilts higher on the follow.

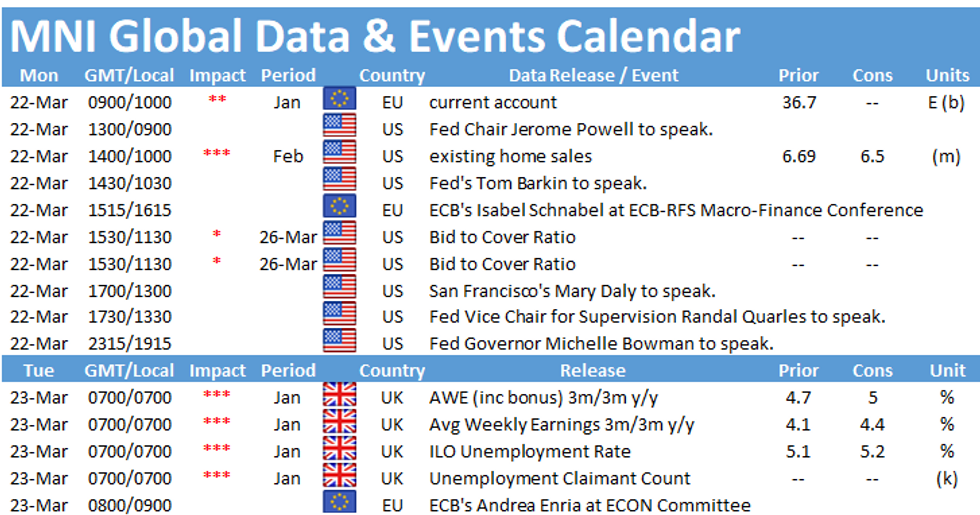

- After hours we get ratings decisions on Spain, Portugal, and Greece among others. The highlights next week include UK labour market and CPI data, and March flash PMIs across Europe.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 1bps at -0.695%, 5-Yr is down 2.7bps at -0.645%, 10-Yr is down 3bps at -0.294%, and 30-Yr is down 1.9bps at 0.282%.

- UK: The 2-Yr yield is down 1.7bps at 0.093%, 5-Yr is down 3.2bps at 0.387%, 10-Yr is down 3.7bps at 0.838%, and 30-Yr is down 3.9bps at 1.366%.

- Italian BTP spread up 0.5bps at 95.8bps / Spanish spread up 0.2bps at 64.1bps

OPTIONS/EUROPE SUMMARY: Schatz In Size

Friday's options flow included:

- RXJ1 170.50/170.00ps, bought for 8.5 in 2.3k. (said to be a short cover)

- DUK1 112/112.10/112.20c fly bought for 3.5 in 20k

- DUK1 112.20/112.10/111.90p fly, bought for 2.5 in 10k

- DUK1 112.20 c, bought for 2.5 in 10k

- ERZ1 100.50/100.62^^, sold at 5.25 in 5k

- 3RZ1 99.87/99.50ps, bought for 3.25 on 3k

- 0LZ1 99.62/99.75/99.87c ladder, bought for 1 in 40k

- 0LZ1 99.62/78/87c ladder, bought for 1.25 in 2.5k (ref 99.60, -5 del)

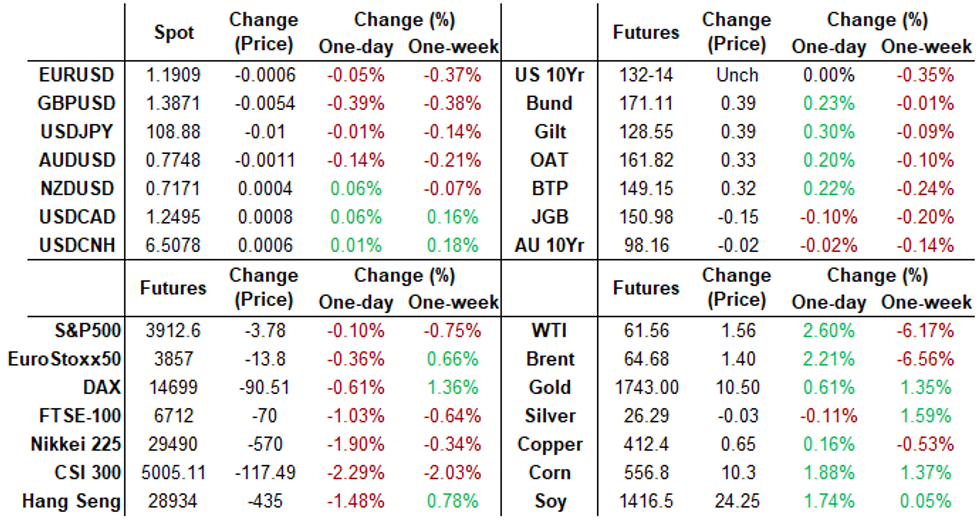

FOREX: Fed Turn Down Opportunity to Extend SLR, Boosting USD

- In a surprise for many in markets, the Fed confirmed Friday that the pandemic era SLR policy would not be extended beyond the March 31st deadline, leading to an abrupt (albeit short-lived) slide in US Treasury prices. This, in turn, drove yields and the US dollar higher - which kept the USD among the session's strongest performers in G10.

- GBP was among the session's poorest performers, with EUR/GBP bouncing off multi-month lows, but holding below the week's best levels. GBP weakness pressured GBP/USD briefly below 1.3850 before the pair recovered into the US close.

- The JPY was non-directional despite the Bank of Japan decision to extend some flexibility to their into their yield band target.

- NZD outperformed, but largely reversed modest weakness posted earlier in the week, doing little to rejig the technical outlook for now.

- Focus for the coming week turns to UK jobs, retail sales and inflation data and prelim global March PMIs. Central bank decisions are due from Mexico, South Africa, Hungary and Thailand.

FX OPTIONS: Expiries for Mar22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1840-50(E1.0bln), $1.1875-85(E599mln), $1.1990-1.2010(E1.1bln)

- USD/JPY: Y107.95-108.02($1.1bln), Y108.56-65($567mln), Y108.75($1.1bln)

- EUR/GBP: Gbp0.8525(E650mln)

- NZD/USD: $0.7080(N$1.2bln), $0.7400(N$1.0bln)

- USD/CAD: C$1.2600($889mln)

PIPELINE: $6.75B ATT 4Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/19 $6.75B #ATT 4pt offering to fund Spectrum; $2.25B 3NC1 +60, $750M 3YFRN SOFR+64, $3B 5NC2 +85, $750M 5YFRN/SOFR+64

- 03/19 $550M #Athene Global Funding 7Y +118

EQUITIES: Mixed Finish to the Week

- US indices were mixed Friday, with tech stocks bouncing and driving the NASDAQ higher from the open. The Dow Jones lagged, slipping around half a percent as Visa and Nike made considerable point deductions to the index. Nike's earnings update proved disappointing, while Visa slipped on a DoJ investigation into debit card practices.

- In the S&P 500, small gains were underpinned by communication services and energy, while financials and industrials weighed on the index.

- European equity markets were lower into the close, with weakness led by Spain's IBEX-35 (-1.5%) and France's CAC-40 (-1.1%). Focus remains on the beleaguered vaccine rollout across the continent, with AstraZeneca doses resuming after a mid-week pause on safety concerns.

COMMODITIES: Oil Stabilises Friday, Set For 7% Weekly Drop

- Oil prices stabilised on Friday, after Thursday's rout. The price action on Thursday was likely linked to positioning factors. Money managers' crude holdings are the longest in more than two years, according to the most recent CFTC data, which could have exacerbated the volatility as longs were unwound.

- Both WTI and Brent crude futures gained just over 2% during the session but are set for a weekly fall in the region of 7%. Despite the overall technical picture remaining bullish and the most recent moves considered a correction, short-term trendline supports have been broken. An extension lower for WTI would open $57.31, the Feb 12 low and Brent targets round number support at $60/bbl.

- Once again, price action in precious metals remained lacklustre and played second fiddle to the moves in oil. Both spot gold and silver rose around 0.5% on Friday, posting weekly gains of a similar magnitude. For gold, a bullish technical outlook remains intact and scope is seen for a climb towards the 50-day EMA at $1786.7. Firm short-term support has been defined at $1699.3, Mar 12 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.