-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Commodity Weekly: Oil Markets Assess Trump Impact

MNI Gas Weekly: Winter Weather Takes the Driver's Seat

MNI ASIA MARKETS ANALYSIS: BLS Oils Wheels Ahead CPI Tuesday

US TSY SUMMARY: Condensed Treasury Supply Well Absorbed

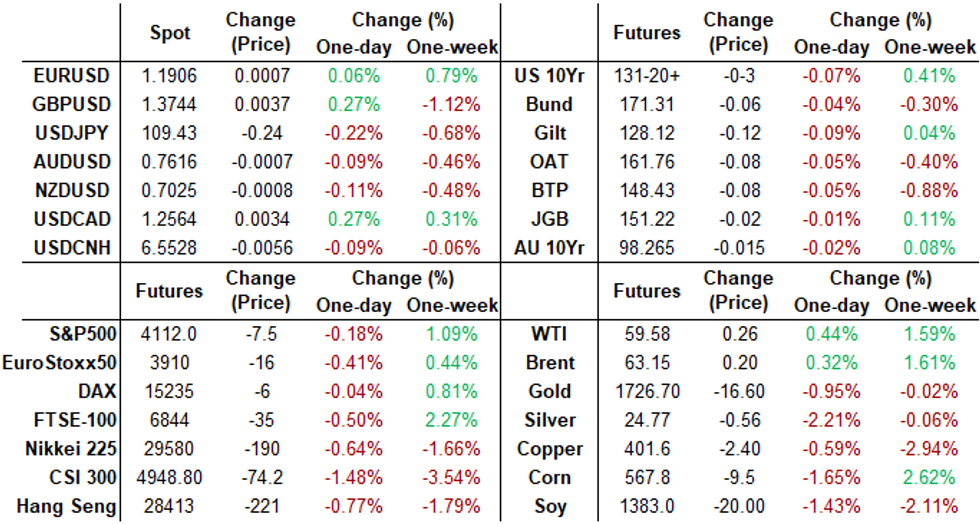

Subdued start to the week, Tsys mildly weaker, holding narrow range near session lows since midmorning, while equities trade mildly weaker to near middle session range. Modest volumes, TYM leads with just over 1M futures, yield curves mixed, 5s30s flatter.

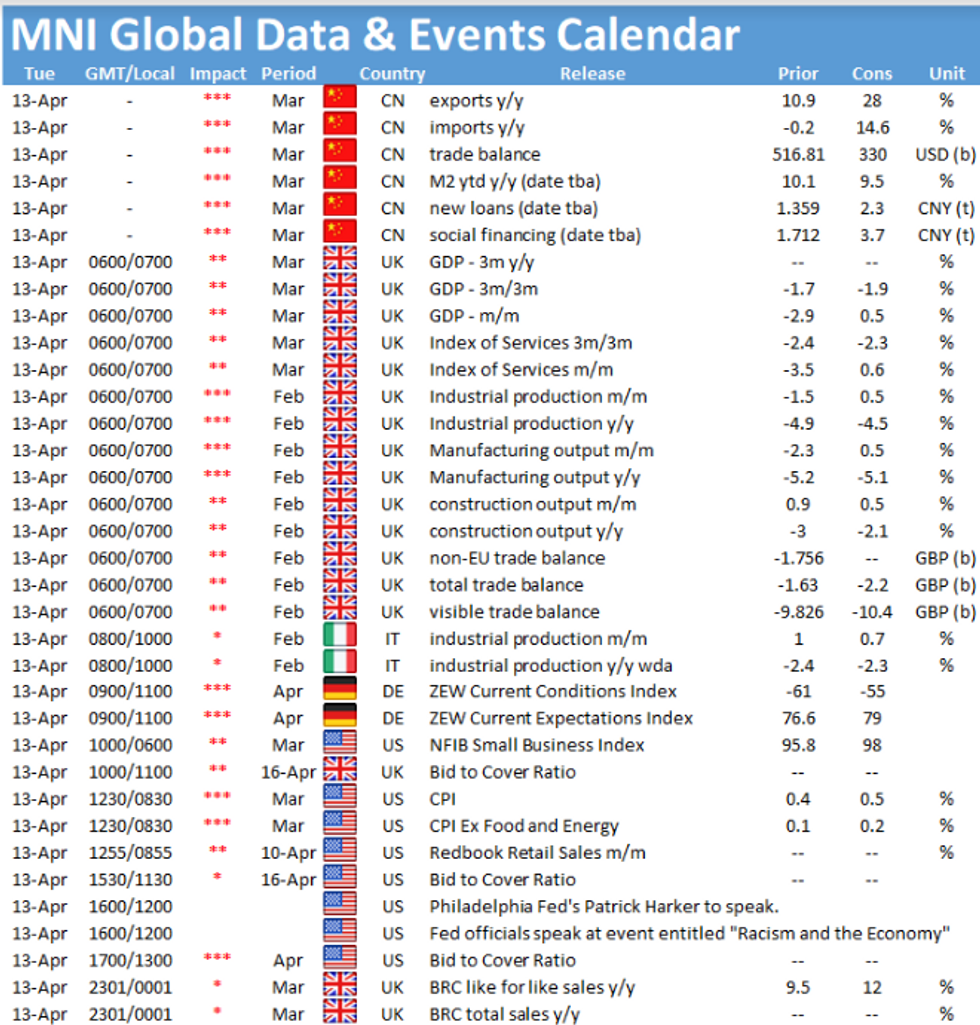

- No relevant data Monday, focus on Tuesday CPI (MoM 0.4% est, 0.5% prior; Ex food & Energy MoM 0.1% est, 0.2% prior). Otherwise, hectic wk for Fed speakers ahead, Fed media blackout starts late Friday evening. Fed Chair Powell scheduled for moderated Q&A at Economic Club of Washington Wed, noon.

- Condensed Treasury coupon auctions: market absorbed $58B 3Y notes and $38B 10Y note reopen, 3s on the screws while 10s tailed slightly (.3bp). Tsy likes to keeps at least one day between the auction date and settlement (April 15 for the 3Y, 10Y and 30Y Bond), while keeping the smallest WI period. Meanwhile, 2s and 5s will also both be auctioned on Mon, April 26, followed by the 2Y FRN and 7Y note auctions on April 27, ahead of the April 30 settlement date due to the FOMC policy announcement falling on April 28.

- Just over $8B swappable corporate supply priced on session, generating soem two-way flow in intermediates.

- By the bell the 2-Yr yield is up 1.4bps at 0.1688%, 5-Yr is up 2.6bps at 0.8886%, 10-Yr is up 1.4bps at 1.6728%, and 30-Yr is up 1.4bps at 2.3434%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N -0.00125 at 0.07350% (+0.00000 total last wk)

- 1 Month +0.00100 to 0.11225% (+0.00087 total last wk)

- 3 Month -0.00175 to 0.18575% (-0.01225 total last wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00325 to 0.21463% (+0.01013 total last wk)

- 1 Year -0.00137 to 0.28438% (+0.00525 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $69B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $244B

- Secured Overnight Financing Rate (SOFR): 0.01%, $867B

- Broad General Collateral Rate (BGCR): 0.01%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $346B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, appr $1.735B accepted vs. $4.710B submission

- Updated purchase schedule release

- Tue 4/13 1500ET: NYFRB: the Desk plans to purchase appr $80B over the monthly period from 3/12/21 to 4/13/21.

US TSYS/OVERNIGHT REPO: 10s, 30s Heat Up Slightly

Largely steady while 10s and 30s heat up slightly. 1M Bills off negative level, matches 3M. Current levels:

T-Bills: 1M 0.0076%, 3M 0.0076%, 6M 0.0254%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | -0.01% | -0.01% |

| 3Y | -0.13% | -0.20% |

| 5Y | -0.12% | -0.13% |

| 7Y | 0.00% | -0.08% |

| 10Y | -0.31% | -0.11% |

| 30Y | -0.20% | -0.07% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -3,000 Green Sep 92 calls vs. Gold Sep 81/83 call spd, cab

- -3,000 short Dec 93 straddles, 30.25/legs

- -4,000 Green Dec 88/91 put spds vs. short Dec 93/96 put spds, 4.75 net cr on bear curve flattener

- -5,000 short Mar 90/95 put spds, 12.0 vs. 99.465/0.30%

Treasury Options:

- over 21,000 TYM 133 calls, 17-19 outright and vs. TYM 130/131.5 put spds, 13 net

- 2,000 TYK/TYM 131.5 straddle spds, 46

- +2,000 FVM 122 puts, 4

- -2,000 TYM 130/132 strangles, 59

- -2,500 TYM 134/TYK132.5 call spds, 0.0

- 2,500 USM 153/USK 154 put spds, 29-30 net, Jun over

- 1,811 FVK 123.25/123.75 2x1 put spds vs. FVM 122.5/123.25/124 2x3x1 put flys

- FVK 123.25 puts outright at 6 pushes volume over 7,700

- Overnight trade

- 3,000 TYK 131/131.25/131.75 put trees

- 3,900 TYK 130.25 puts, 5

- 2,500 wk3 TY 131/131.5 2x1 put spds

- 2,500 USK 154/155 put spds

EGBs-GILTS CASH CLOSE: Prepping For Big Issuance Tuesday

A fairly quiet session to start the week, with early yield dips (on overnight weakness in equities) reversing over the course of the session.

- More than anything, supply eyed later in the week, with large syndication announcements pushing EGB yields higher. Data showed ECB net asset purchases rebounded sharply last week; in Germany, there was some attention on interrnal party wrangling over who will be the Union parties' candidate for Chancellor in the September elections.

- While today saw "just" E4bn of EFSF syndication, tomorrow sees: syndications from Austria (dual-tranche) and Spain which were announced today, and auctions from the Netherlands, Italy, Germany, and the UK.

- Apart from that, UK Feb GDP and German ZEW figures highlight Tuesday's docket.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.1bps at -0.701%, 5-Yr is up 0.2bps at -0.631%, 10-Yr is up 1bps at -0.293%, and 30-Yr is up 2bps at 0.262%.

- UK: The 2-Yr yield is up 0.8bps at 0.054%, 5-Yr is up 0.8bps at 0.361%, 10-Yr is up 1.5bps at 0.789%, and 30-Yr is up 0.5bps at 1.31%.

- Italian BTP spread down 0.2bps at 102.8bps / Spanish up 0.2bps at 68.2bps

OPTIONS/EUROPE SUMMARY: Sizeable Bund May/Jun Put Trades

Monday's options flow included:

- DUK1 112.10 put bought for 1.5 in 5k

- RXM1 170.00/RXK1 170.50 put diagonal bought for 22 in 2.5k (earlier)

- RXM1/RXK1 170.50/169.50/168.50/167.50 put condor calendar bought for 8 in 30k (bought June)

- RXM1 172/173/174.5/175.5 broken call condor bought for 33 in 25k vs RXK1 172.00 call sold at 35/34/33 in 25k

- RXM1 171.00/169.00/168.00 put fly bought for 41.5 in 2.75k

- 2RZ1 100.125/100.00 put spread bought for 1.25 in 3k

- 3RM1 100.25/100.375/100.50 call ladder sold at 6.25 in 3k

- 0LM1 99.625/99.75/100.125/100.25 broken call condor sold at 9.5 in 4k

- 0LM1 99.875/99.75 put spread sold at 8.5 in 4k

- 0LZ1 + 0LH2 99.875 call strip bought for 9.25 in 5k

- 3LZ1 99.00/98.75/98.50 put fly bought for 3 in 8k

FOREX: Inside Session as Markets Look Ahead to Busy Week

- Markets generally took profits on the price action seen at the tail-end of last week throughout Monday trade as GBP gained, the greenback softened and recent ranges were generally respected.

- Data releases were few and far between Monday, with more focus paid to the CPI, retail sales prints later in the week as well the beginning of US earnings season. Big name US banks including Goldman Sachs, JP Morgan, Bank of America and others are due to report from Tuesday onwards.

- Early gains in WTI and Brent crude futures faded, leaving the likes of NOK and CAD at the bottom of the G10 pile.

- JPY traded well alongside GBP and CHF, with the upside momentum in equity markets globally petering out as US indices traded in a holding pattern for most of the session.

- Focus Tuesday turns to UK industrial production and trade data for February, Germany's ZEW survey and the US CPI report. China trade balance numbers may also be released. Fedspeak picks up, with Harker, Daly, Barkin, Mester, Rosengren and Bostic all due to speak.

FX OPTIONS: Expiries for Apr13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E594mln)

- USD/JPY: Y106.35($1bln)

- AUD/USD: $0.7600(A$593mln)

- USD/CNY: Cny6.60($730mln)

PIPELINE: Near $8B To Price Monday

- Date $MM Issuer (Priced *, Launch #)

- 04/12 $2.25B #BNP Paribas 11NC10 +120

- 04/12 $2B #CK Hutchison Hlds $500M 5Y +65, $850M 10Y +95, $650M 20Y +100

- 04/12 $1.25B #Sodexo $500M 5Y +75, $750M 10Y +105

- 04/12 $1B #Genting Malaysia 10Y +220

- 04/12 $750M Transdigm 8NC3 +4.75$a

- 04/12 $700M *Kia Corp 3Y +110a, 5.5Y +125a

- Expected this week:

- 04/13 $Benchmark JFM 5Y +20a

- 04/12 $Benchmark Ontario Teachers Finance Trust 10Y +41a

- 04/15 $5.5B United Airlines $2.75B 5Y, $2.75B 8Y

- 04/?? $Benchmark/Euro Altice France 8NC3

- 04/?? $Benchmark IADB 5Y expected this week

- 04/?? $Benchmark World Bank 2Y, 7Y

- 04/09 No new Issuance Friday; $43.37B total last wk

EQUITIES: Stocks in a Holding Pattern, But All Time Highs in Sight

- An unimpressive session for stock markets Monday, with the three major US indices in a holding pattern and just below all time highs printed last week.

- The e-mini S&P trades just a few points below last week's 4,121.50 high, but Monday trade lacked sufficient momentum to press the index to new highs.

- In cash markets, consumer discretionary and materials outperformed, while communication services and tech (last week's outperformers) were the laggards Monday.

- Similarly in Europe, indices were mainly lower with UK's FTSE-100 and Spain's IBEX-35 at the bottom of the pile. Italy's FTSE-MIB fared better, closing with gains of 0.1%.

COMMODITIES: Oil Gains Trimmed, Precious Metals Retreat

- Reports of tension between Iran and Israel over the weekend buoyed prices by around 2% during the European session on Monday. Both WTI and Brent crude futures continue to trade in minor positive territory but have reversed the majority of gains. Key resistance levels have capped the price action for both benchmarks.

- This price action continued the largely rangebound trade that has seen WTI crude close each of the past twelve sessions less than $2 above or below $60 as investors continue to assess the multitude of counteracting factors in play.

- Precious metals are ending towards the lower end of recent ranges as US yields ticked higher on Monday. Spot gold has also seen the 50-day EMA act as key resistance at $1759.8. This moving average would need to be cleared to suggest scope for a stronger bounce.

- CRU copper conference was held today. CRU estimates copper project delays of 3-6 months and assumes copper disruption rate 5.5% 2021 vs. 4.7% normally. The headlines had little effect in a subdued session where Copper retreated 0.4%.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.