-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Shrugging Off Vaccine, Geopol Risk

US TSY SUMMARY: Vaccine, Russia/Ukraine Tension Take CPIs Spotlight

Busy session Tue as early vaccine headlines and geopolitical tensions overshadowed much higher than expected CPI (CPI 0.6%, CORE 0.3%; CPI Y/Y 2.6%, CORE Y/Y 1.6%).- Sharp risk-off move ahead of the NY open: Tsys gap bid, equities reversed course traded lower on J&J headlines that US calling for pause in J&J vaccine due to blood clotting issues. Vaccine headlines dominated the first half while Russia/US geopol angst plays close second amid following:

- Russia warns U.S. warships to steer clear of Crimea 'for their own good', Rtrs

- NATO demands Russia end Ukraine build-up, West examines options, Rtrs

- RUSSIA'S TAKING MEASURES IN RESPONSE TO NATO'S THREATS, Bbg

- Rates and equities gradually recovered by midmorning into the second half when Bonds surged after a strong 30Y auction Re-Open: Yield curves whipped around as short end reversed earlier steeper levels to flatter post auction, 5s and 10s vs. 30s holding steeper. 30Y R/O drew high yld of of 2.320%. Stop through of 1.5bp well above five auction avg of only 0.1bp, topping last Dec's 1.2bp stop. Bid-to-cover 2.47x well above 2.34x five auction avg.

- Equities shrugged off the exogenous risk factors in the second half, S&P eminis making new all-time high of 4139.75.

- The 2-Yr yield is down 0.8bps at 0.1589%, 5-Yr is down 4.2bps at 0.8386%, 10-Yr is down 4.2bps at 1.6233%, and 30-Yr is down 2.6bps at 2.3077%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N +0.00125 at 0.07475% (+0.00000/wk)

- 1 Month +0.00238 to 0.11463% (+0.00338/wk)

- 3 Month -0.00200 to 0.18375% (-0.00375/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00487 to 0.21950% (+0.00912/wk)

- 1 Year +0.00337 to 0.28775% (+0.00200/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $68B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $252B

- Secured Overnight Financing Rate (SOFR): 0.01%, $863B

- Broad General Collateral Rate (BGCR): 0.01%, $377B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $350B

- (rate, volume levels reflect prior session)

- Wed 4/14 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Thu 4/15 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/16 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Mon 4/19 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 4/20 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 4/21 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US TSYS/OVERNIGHT REPO: Steady-On Specials

Largely steady in special territory; 3M Bill gains. Current levels:

T-Bills: 1M 0.0051%, 3M 0.0152%, 6M 0.0355%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | 0.00% | 0.00% |

| 3Y | -0.26% | -0.19% |

| 5Y | -0.12% | -0.13% |

| 7Y | 0.00% | -0.07% |

| 10Y | -0.23% | -0.10% |

| 30Y | -0.20% | -0.06% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +30,000 Green Jun 90/91/92 put flys, 1.75 legged

- Block, 14,000 Blue Jun 98.37/98.62 put spds, 9.0 at 1403:04ET

- 15,000 short Dec 91/93/96 put flys

- +40,000 Green Dec 92/93/95/96 call condors, 2.25

- -5,000 short Dec 93/96 put spds, 7.5 and still offered

- +10,000 short Dec 95/96/97 call trees 3.0 over the 99.12 puts vs. 99.54/0.20%

- Overnight trade

- 2,500 short Jun 99.75/99.81 1x2 call spds

- 2,000 Green Jun 97 calls, cab

- 1,600 Green May 99.312/99.37/99.50 call trees

- +3,500 TYM 132.5/133.5 1x2 call spds, 6

- Block, +10,000 TYM 130.5/133 put over risk reversals, 3

- over -10,500 FVM 122/123 put spds from 8- tyo 11.5

- Additional post-data trade includes

- -2,000 TYM 131.5 straddles 140-139

- -1,000 TYN 123.5/137.5 strangles, 5

- -3,000 FVM 122.5 puts, 6.5

- -1,300 FVM 123.5/124 strangles, 27

- 2,000 USM 153 puts 16 over USK 155 puts

- Overnight trade

- Block, +10,000 FVM 123/124 put over risk reversals, 2.5

- +2,750 wk3 TY 131/131.5 2x1 put spds, 5

- +3,000 wk3 TY 130.75/131.25 put spds, 8-9 vs. 131-14.5 to -17/0.22%

EGBs-GILTS CASH CLOSE: Heavy Supply Ends Up Well-Absorbed

The theme of Tuesday was issuance, unsurprising given the heavy auction/syndication schedule going into the day. This weighed on the space in the morning, though news that J&J's COVID vaccine rollout would be paused in the US and Europe boosted Gilts and Bunds midday London time.

- In the end, Bunds and Gilts were little changed, with periphery spreads mixed.

- Supply this morning came from the UK (Gilt , GBP1bn), Germany (Linker, E0.387bn allotted), Italy (BTPs, E7.75bn) Syndications today include: Spain 15-year bond (E6bn) Austria (dual tranche 4-/50-year issues for combined E5.75bn, and the Netherlands (0% Jan-38 DSL, E5.9bn).

- German ZEW and UK Feb GDP disappointed, but little reaction. ECB's Villeroy said that he didn't favor the bank adopting yield curve control.

- Note Slovakia today announced a 15-Yr syndication mandate. Auctions Weds include 30-Yr Gilt linker and Germany Aug-48 Bund.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.1bps at -0.702%, 5-Yr is unchanged at -0.631%, 10-Yr is up 0.1bps at -0.292%, and 30-Yr is up 0.2bps at 0.264%.

- UK: The 2-Yr yield is down 0.5bps at 0.049%, 5-Yr is down 0.5bps at 0.356%, 10-Yr is down 1bps at 0.779%, and 30-Yr is down 0.3bps at 1.307%.

- Italian BTP spread up 1.3bps at 104.1bps / Spanish spread down 0.3bps at 67.9bps

OPTIONS/EUROPE SUMMARY: Mixed Trades

Tuesday's options flow included:

- RXM1 174.00 call bought for 11 in 5k. Hearing closing

- 0RM1 100.50/100.625/100.75 call fly with 100.50/100.625 call spread v 2x 100.50/100.375 put spread. Sells the fly and call spread at 7.5 in 5k

- 3RZ1 100.25/100.375 call spread sold at 5.25 in 4k

- 0LM1 99.625/99.75/100.125/100.25 broken call condor sold at 9.25 in 5k (v 99.75)

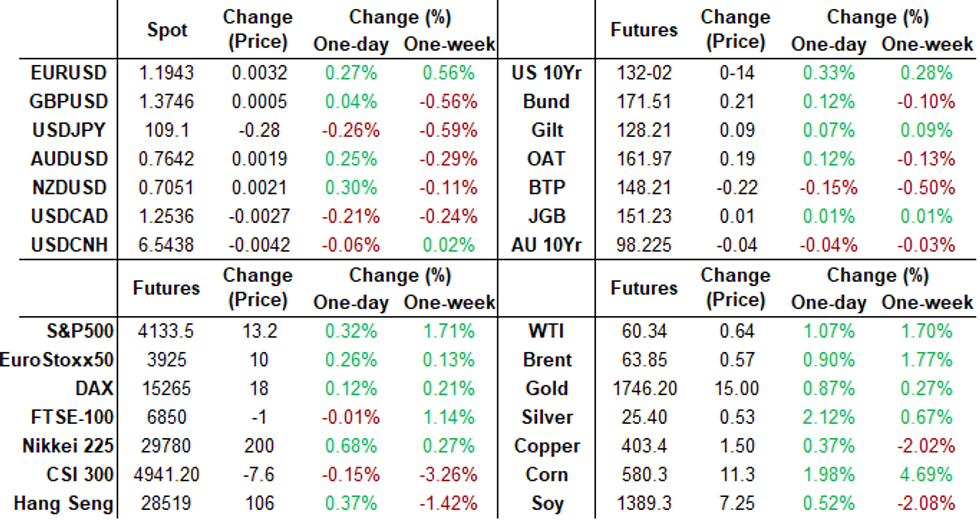

FOREX: CPI Headfake Sees Greenback Slip to April Lows

- The USD initially found some support after a higher-than-expected CPI print for March, but price action swiftly reversed and the USD slipped against most others in G10 ahead of the close.

- Much attention was paid to the decision that the US would pause the rollout of the J&J vaccine on blood-clotting concerns, prompting some equity selling and JPY strength in early US hours. JPY remained strong into the US close, narrowing the gap with the April lows at Y109.00.

- GBP found another headwind following news that Bank of England Chief Economist and MPC member Haldane is due to step down from his role after the June MPC meeting.

- Haldane had been one of the more hawkish members of the BoE rate-setting committee, raising the risk that the Bank could adopt a more active approach later this year. EUR/GBP broke to new April highs in response, with the 50-dma undercutting as firm support going forward.

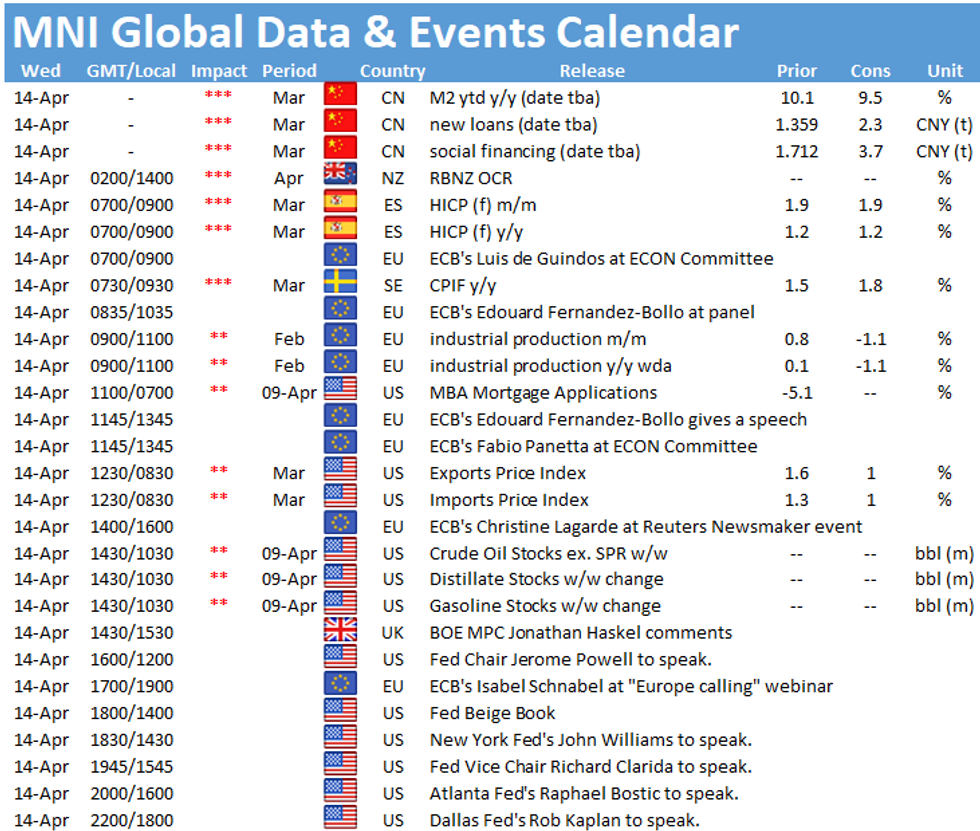

- Focus Wednesday turns to US import/export price indices and Australia's Westpac consumer confidence data. Central bank speak picks up further, with ECB's de Guindos, Panetta and Lagarde due to speak as well as Fed's Powell & Clarida and BoE's Haskel.

FX OPTIONS: Expiries for Apr14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-00(E855mln), $1.1900(E1.1bln - EUR puts), $1.1925(E1.3bln-EUR puts), $1.1945-55(E813mln)

- USD/JPY: Y108.00-16($1.1bln), Y108.50($525mln), Y108.95-00($738mln)

- GBP/USD: $1.3840-50(Gbp792mln-GBP puts), $1.4050(Gbp762mln)

- EUR/GBP: Gbp0.8600-15(E1.1bln)

- AUD/USD: $0.7700(A$700mln)

- USD/CAD: C$1.2465-60($750mln), C$1.2500($1.1bln-USD puts)

PIPELINE: $8B World Bank Dual-Tranche Lion's Share $15B Total Debt Issuance

- Date $MM Issuer (Priced *, Launch #)

- $15B to price Tuesday

- 04/13 $8B #World Bank (IBRD) $3B 2Y -5, $5B 7Y +7

- 04/13 $4.25B *IADB 5Y +0.0

- 04/13 $1.5B *Ontario Teachers Finance Trust 10Y +40

- 04/13 $1.25B *JFM 5Y +18

- 04/13 $Benchmark Tencent investor calls

- Expected this week:

- 04/14 $500M Kommunalbanken WNG 3.5Y +2a

- 04/14 $Benchmark Quebec 10Y +29a

- 04/15 $5.5B United Airlines $2.75B 5Y, $2.75B 8Y

- 04/?? $Benchmark/Euro Altice France 8NC3

EQUITIES: J&J Drags on Dow, DJIA Underperforms

- Markets read concern into Johnson & Johnson's decision to delay and stall the rollout of their COVID-19 vaccine across Europe, with the US CDC also deciding to pause the jab's use domestically over blood-clotting concerns.

- In response, the three main US indices slipped sharply alongside J&J shares, which fell as much as 3% and dragged on the Dow Jones Industrial Average, which traded lower against minor gains for the S&P 500 and NASDAQ. Utilities, consumer discretionary and tech outperformed, while financials and industrials lagged.

- The e-mini S&P wholly erased the initial vaccine-induced dip, which was preceded by a new all time high, keeping the recent run of strength very much in tact. The index trades with month-to-date gains of close to 4%.

- Earnings season kicks off materially Wednesday, with JPMorgan, Goldman Sachs and Wells Fargo all reporting.

COMMODITIES: Soft Dollar Benefits Precious Metals, Oil Maintains Tight Range

- Despite a brief spike on the release of US CPI, the US dollar index remained under pressure which helped bolster precious metals on Tuesday.

- Spot gold (+0.8%) and silver (+2.35%) recovered well off session lows and extended their rallies as lower treasury yields garnered further USD weakness.

- Gold has been holding onto the bulk of recent gains. Key resistance at $1755.5, Mar 18 high was probed on April 8. The yellow metal also needs to clear $1759.2, the 50-day EMA to suggest scope for a stronger bounce.

- Oil prices gained just shy of 1% on Tuesday but both Brent and WTI crude had subdued daily ranges of around $1. The daily gains have been largely attributed to strong Chinese import data, but the rally was capped by fresh vaccine anxieties stemming from likely delays on the rollout of J&J shots over clotting concerns.

- The counteracting factors dominating the newswires continue to keep WTI crude pinned to the $60 mark. The largely rangebound trade has seen the WTI active contract close each of the past thirteen sessions less than $2 above or below $60.

- Bitcoin surged to record highs above $63,000 amid the weak dollar, amounting daily gains of around 5.5%.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.