-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Stocks New Highs, Strong Housing Data

US TSY SUMMARY: Risk-On Even Before Strong Housing Data

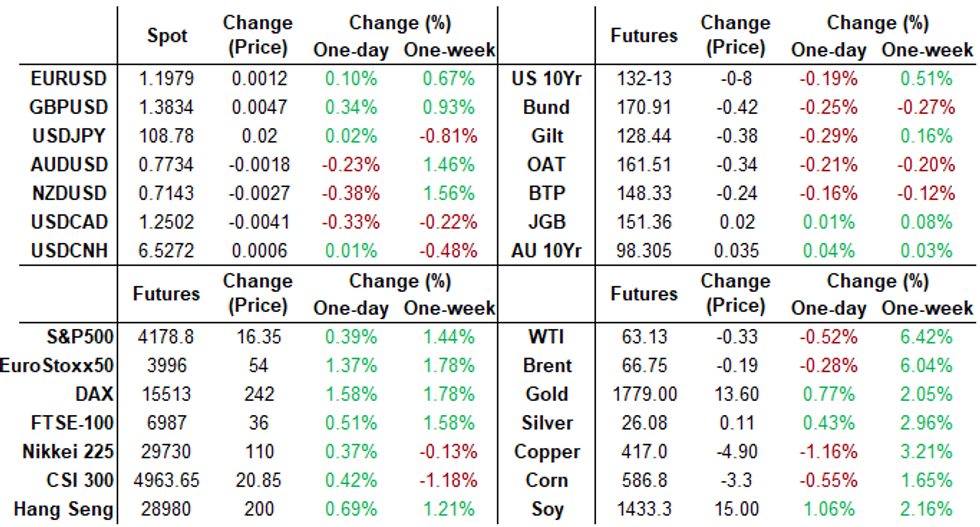

Weaker across the curve all session, Tsy futures holding near middle session range, yield curves see-sawed to flatter levels after the close, equities new highs (ESM1 4180.)- Risk-on after strong data: housing starts (1.457M) and permissions (1.720M) both beat expectations, with Tsy futures making new lows, 10YY tapped 1.5957% high vs. 1.5728% currently. Sources noted real$ and fast$ sold 5s and 10s early on, bank selling 30s, prop 2-way in 5s.

- Moderate two-way positioning ensued as accts looked to square up ahead weekend and lack of data until Thursday next week, Fed enters media blackout at midnight through April 29.

- Large $15B Bank of America 6pt jumbo debt issuance launched late, rounding out heavy week of issuance from GSIBs ($13B JPM, $6B GS, $8B World Bank, $4.25B IADB, $2.25B BNP Paribas).

- No react to to Fed Gov Waller comments "FED'S DOT PLOT OF FORECASTS ON RATES ISN'T HELPING US" Bbg mirrored Fed Chair on Wed: mkt places too much importance on dot-plot, stresses outcomes / goals need to be met: labor market recovery, inflation stable at 2% (not temporary), moving above 2%.

- The 2-Yr yield is up 0.2bps at 0.1612%, 5-Yr is up 0bps at 0.8178%, 10-Yr is down 0.7bps at 1.5693%, and 30-Yr is down 1bps at 2.2595%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N -0.00050 at 0.07275% (-0.00200/wk)

- 1 Month +0.00088 to 0.11588% (+0.00463/wk)

- 3 Month -0.00150 to 0.18825% (+0.00075/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00600 to 0.22363% (+0.01325/wk)

- 1 Year +0.00463 to 0.29238% (+0.00663/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $66B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $242B

- Secured Overnight Financing Rate (SOFR): 0.01%, $928B

- Broad General Collateral Rate (BGCR): 0.01%, $384B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $359B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, appr $1.199B accepted vs. $1.770B submission

- Next scheduled purchases:

- Mon 4/19 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 4/20 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 4/21 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US TSYS/OVERNIGHT REPO: Steady-On Specials

Largely steady, slight cooling in 10s and 30s; Bills unchanged. Current levels:

T-Bills: 1M 0.0025%, 3M 0.0101%, 6M 0.0355%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | 0.00% | 0.00% |

| 3Y | 0.00% | -0.09% |

| 5Y | -0.11% | -0.07% |

| 7Y | 0.00% | -0.07% |

| 10Y | -0.07% | -0.10% |

| 30Y | -0.02% | -0.04% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- 6,000 Dec 98 calls, 0.5

- +5,000 Blue Jun 81/83/85 put flys, 0.0

- 3,000 Blue Jun 83/85/86/87 put condors

- +1,000 Green Jun 99.18/99.25/99.37 broken put trees, 0.5

- +3,000 wk1 TY 135 calls, 3

- +11,500 FVK 124 calls, 9-7

- +5,500 FVM 122.5 puts, 4

- +20,000 USM 161 calls, 33-36 vs. 157-16/0.20%

- -5,000 TYM 134.5 calls, 7

- -5,000 TYM 131 puts, 22

- 2,500 TYM 130/131/132/135.5 put condors

- +19,000 FVM 123.75/124.25 call spds, 16.5

- Overnight trade

- +17,000 FVM 125/125.5 call spds, 1.5

- +10,600 FVM 125/125.5 call spds, 2

- Block, +5,000 FVM 123.75/124.25 3x4 call spds, 40

- 3,000 USK 154.5 puts, 3

- 7,000 wk1 TY 131/131.25/132 put flys

EGB/Gilt Summary: Ending The Week On A Soft Note

European government bonds have broadly traded sideways through the day and have failed to claw back the losses posted earlier in the session.

- The gilt curve has bear steepened with the 2s30s spread 3bp wider.

- Bund yields are now 1-2bp higher with the curve 1bp steeper.

- OATs similarly remain a touch weaker on the day. Last yields: 2-year -0.6636%, 5-year -0.5609%, 10-year -0.0199%, 30-year 0.8313%.

- BTPs trade in line with core EGBs, with the longer end of the curve slightly underperforming.

- The UK and EU today pledged to work together in calming tensions in Northern Ireland following the recent spate of rioting.

- Focus next week will be the ECB Governing Council meeting on Thursday and any additional clarity on the roll out of the Johnson & Johnson Covid vaccine.

FOREX: AUD, NZD Reverse Winning Streak

- Antipodean currencies snapped an extended winning streak Friday, prompting NZD and AUD to underperform all others into the Friday close. NZD/USD returned below the 50- and 100-dmas, but still managed to hold decent weekly gains.

- Markets largely shrugged off the release of the US Treasury's FX report, despite the US noting that Switzerland, Taiwan and Vietnam all met the criteria to be tagged as an FX manipulator. The SNB responded by reaffirming their commitment to CHF intervention to ensure domestic price stability. The CHF was among the session's best performers, alongside CAD.

- The USD index continues to oscillate either side of the 50-dma, with the trajectory of US yields still a key driver. The Treasury curve flattened modestly Friday, helping keep a lid on the greenback.

- Focus in the coming week turns to the ECB rate decision, a slew of UK data including inflation and jobs numbers as well as the prelim April global PMIs. Rates decisions from the Canadian, Indonesian and Russian central banks also cross.

FX OPTIONS: Expiries for Apr19 NY cut 1000ET (Source DTCC)

- USD/JPY: Y108.60-64($1.2bln-USD puts), Y110.00($1.2bln)

- AUD/USD: $0.7620-40(A$705mln), $0.7720-30(A$796mln)

- USD/CAD: C$1.2715-25($1.1bln)

PIPELINE: $15B Bank of America Launched, Back to 6Pts

- Date $MM Issuer (Priced *, Launch #)

- 04/16 $15B Bank of America $2.25B 4NC3 +65, $600M 4NC3 FRN SOFR+69, $3.75B 6.25NC5.25 +90, $400M 6.25NC5.25 FRN SOFR+97, $4.5B 11NC10 +110, $3.5B 21NC20 +115

- 04/15 $13B *JP Morgan $3.5B 6NCn +77, $500M 6NC5 FRN SOFR, $3.5B 11NC10 +102, $2B 21NC20 +100, $3.5B 31NC30 +107

- 04/15 $6B *Goldman Sachs $3.75B 11NC10 +105, $2.25B 21NC20 +105

- 04/13 $8B *World Bank (IBRD) $3B 2Y -5, $5B 7Y +7

- 04/13 $4.25B *IADB 5Y +0.0

- 04/12 $2.25B *BNP Paribas 11NC10 +120

EQUITIES: Seventh Consecutive Session of Record Highs

- US stock futures inched to a new record Friday, meaning the e-mini S&P has hit new all time highs for seven consecutive sessions. Gains were uniform across the three major cash indices, with the surge fuelled by outperformance in materials and utilities, with energy firms the only major laggards.

- A solid session for European equities, with the DAX outperforming and closing higher by over 1.3% as all sectors finished higher. Gains were fuelled by a solid rally in Siemens shares, which resulted in the company hitting new all time highs.

- Earnings remain a focus in the coming week, with 14% of the S&P 500 by market cap due to report. Highlights include IBM, Intel, Johnson & Johnson and Netflix among others.

Gold Extends Gains, Oil Consolidates Capping Off Stellar Week

- Spot Gold rallied a further 1% to $1,780/ounce on Friday, advancing on Thursday's breakout, taking weekly gains to around 2.2%.

- In similar fashion, the softer US dollar provided a solid backdrop for Silver to rally, regaining the majority of lost ground in late March to trade back above $26 an ounce.

- Recent price action in Gold suggests the yellow metal has been building a base since Mar 8. If correct, this signals a potential technical reversal and key nearby resistance levels appear exposed which may pave the way for strength towards $1800.0. Note that further out, this could also suggest the possible start of a stronger recovery towards the bear channel top at $1882.3 over the medium-term.

- Oil benchmarks did make new highs on Friday but settled broadly unchanged for the session, consolidating the week's 6.5% gains. A stronger demand outlook and signs of economic recovery in China and the United States offset concerns about rising COVID-19 infections in other major economies, kept prices well supported.

- Brent futures touched $67.38 and WTI futures made highs at $63.88 before giving up 50 cents into the close. The weekly closes should offer positive technical developments after spending the past three weeks in tight ranges.

- Copper prices lost ground on Friday but are set for their best weekly performance in two months after several investment banks predicted higher prices for the metal, citing the global green-energy transition propelling demand for the metal used in power grids, wind turbines and electric vehicles.

- Bitcoin ripped to fresh record highs of $64,870 on Wednesday before a near $5,000 retracement. Fresh optimism was provided for the cryptocurrency after Brevan Howard Asset Management announced they will invest up to 1.5% of its $5.6 billion fund into digital assets. However, volatility surrounding the Coinbase IPO and an announcement that Turkey's central bank decided to ban the use of cryptocurrencies for payments from the end of the month, prompted the minor reversal. XBTUSD currently trades $61,750.

OUTLOOK: Look Ahead, Doesn't Get Interesting Until Next Thursday

- US Data/Speaker Calendar (prior, estimate)

- Apr-16 Fed enters media blackout regarding monetary policy through Apr-29

- Apr-19-20 No significant data Mon-Tue. Bill auctions and NY Fed Buy-backs on tap

- Apr-19 1130 US Tsy 13W, 26W Bill auctions, $57B, $54B respectively

- Apr-20 1130 US Tsy $34B 52W bill auction

- Apr-21 0700 MBA Mortgage Applications (-3.7%, --)

- Apr-21 1300 US Tsy $24B 20Y Bond R/O auction

- Apr-22 0830 Initial Jobless Claims (576k, 650k)

- Apr-22 0830 Continuing Claims (3.731M, --)

- Apr-22 0830 Chicago Fed Nat Activity Index (-1.09, --)

- Apr-22 0945 Langer Consumer Comfort (53.9, --)

- Apr-22 1000 Leading Index ((0.2%, 0.9%)

- Apr-22 1000 Existing Home Sales (6.22M, 6.17M); MoM (-6.6%, -0.8%)

- Apr-22 1100 Kansas City Fed Manf. Activity (26, --)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.