-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: S&P Eminis to New Highs

US TSY SUMMARY: Rates Hold Weaker Range As Equities Make New All-Time Highs

Mildly weaker Tsy futures trading sideways since noon on light volume Friday, TYM1 just over 1M futures after the bell.- Largely two-way option related flow keeping the lights on, some moderate pin risk in May 10s, 132.5 strike with 65,527 options coming into the session (41,430 calls, 24,097 puts). Some selling ahead next week's front-ended Tsy auctions (2- and 5Y notes, 13- and 26W bills all on Monday; 2Y FRN and 7Y notes Tuesday) to make way for Wednesday's FOMC.

- Stocks marched higher with Jun'21 S&P emini futures making new all-time highs in late trade of 4184.75. Upward trajectory all session after decent beat in US PMIs (Markit Services PMI 63.1 (EXP. 61.5, MAR 60.4); FLASH Composite PMI 62.2; (MAR 59.7)) and New homes sales ( +20.7% TO 1.021M SAAR).

- Otherwise, relative sedate session as markets set sites on next Wednesday's FOMC policy annc.

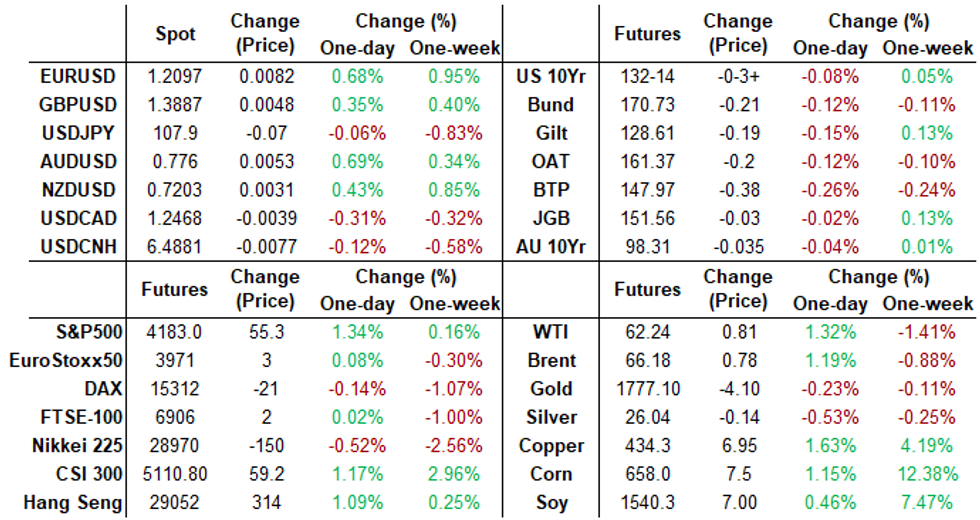

- The 2-Yr yield is up 1bps at 0.1575%, 5-Yr is up 2.8bps at 0.818%, 10-Yr is up 2.9bps at 1.5666%, and 30-Yr is up 3.1bps at 2.2491%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N +0.00000 at 0.07338% (+0.00063/wk)

- 1 Month +0.00487 to 0.11100% (-0.00488/wk)

- 3 Month +0.0563 to 0.18138% (-0.00687/wk) ** (New Record Low 0.17288% on 4/22/21)

- 6 Month -0.00650 to 0.20413% (-0.01950/wk)

- 1 Year +0.00013 to 0.28088% (-0.01150/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $263B

- Secured Overnight Financing Rate (SOFR): 0.01%, $870B

- Broad General Collateral Rate (BGCR): 0.01%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $356B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.401B accepted vs. $5.518B submission

- Next scheduled purchases:

- Mon 4/26 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 4/27-Wed 4/28 Pause for FOMC

- Thu 4/29 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/30 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

US TSYS/OVERNIGHT REPO: Steady-On

Holding steady, Bills unchanged. Current levels:

T-Bills: 1M -0.0025%, 3M 0.0152%, 6M 0.0304%; Tsy General O/N Coll. 0.01%

| Duration | Current | Old Issue |

| 2Y | -0.02% | -0.01% |

| 3Y | 0.01% | -0.08% |

| 5Y | -0.08% | -0.07% |

| 7Y | -0.02% | -0.05% |

| 10Y | -0.08% | -0.08% |

| 30Y | -0.04% | -0.03% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +3,000 Green Jun 99.31 straddles, 18.0

- +10,000 Blue Sep 80/90 put over risk reversals, 1.0 vs. 98.555/0.40% (appr +50,000 since Tuesday)

- +5,000 Blue Dec 75/91 put over risk reversals, 0.5

- 13,000 Green May 99.43/99.5/99.56 1x3x1 call flys (+Blue May 90/91/92 1x3x1 call flys, 0.0 Thursday)

- +10,000 Green Jun 88/91 2x1 put spds, 4.5

- +5,000 short Sep 96 puts, 5.0

- +2,250 Blue Sep 83/85/86/87 put condors earlier

- +15,000 short Dec 92/93/95 put flys, 1.0

- +2,000 Gold Sep 75/77 put spds 0.0 over 87 calls

- +7,500 Blue May 82/83/85 put flys, 1.0 (+10k at 1.25 Thu)

- +5,000 short Mar 90/92 put spds 1.0 over the 97 calls

- +2,000 Blue Sep 80/90 put over risk reversals, 0.5 (paid 1.0 Thu)

- -2,000 short Dec 96 calls 4.5 over 91/93 put spds

- +10,000 short Dec 97 calls, 2.0 vs. 99.59-585/0.10%

- Overnight trade

- 15,000 short Sep 96 puts, 4.5-5.0

- +4,400 Blue Sep 82/85 2x1 put spds, 3.5

- +2,500 short Dec 93/95/96 put flys, 1.5

- +2,000 short Jul 93/95/96 put flys, 1.0

- 3,500 short Jul 99.56 puts

- +10,000 TYU 123.5/124.5 puts, 2

- 5,000 TYM 130.5/131.5 3x2 put spds, 8

- +3,000 USM 152 puts, 9

- +1,500 TYM 132.5 straddles, 121

- +3,000 TYM 132/133 strangles, 56

- Overnight trade

- -10,600 TYM 133.5 calls, 16

- +17,000 wk5 TY 131/131.5 put spds

- -4,000 TYM 128/130.5 put spds vs. +TYN 127.5/129.5 put spds, 9 db

- 2,800 FVM 122.5/123.25 put spds vs. 125 calls

EGBs-GILTS CASH CLOSE: Opposing Forces Leave Yields Flat

A back-and-forth final session of the week in the Europe FI space, with price action in both directions leaving yields basically flat, with periphery EGB spreads wider.

- A strong start for Gilts / early Bund strength - in part due to a bigger than expected reduction in the gilt remit for FY21/22 - reversed on strong French flash PMIs. But then another rebound on a German PMI miss, and continued gains as equities fell to session lows.

- Data came to the fore again in the afternoon with EGBs / Gilts moving lower mirroring US Tsys, after a beat in US PMIs and new home sales data.

- Not to mention a sharp drop at midday on a BBG sources piece reporting a "difficult" decision at the June meeting on whether to slow PEPP purchases (echoing Tuesday's MNI Exclusive).

- After hours sees a few ratings reviews, including the UK, Italy and Greece.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.1bps at -0.691%, 5-Yr is down 0.6bps at -0.605%, 10-Yr is down 0.5bps at -0.257%, and 30-Yr is up 0.4bps at 0.29%.

- UK: The 2-Yr yield is down 0.7bps at 0.036%, 5-Yr is down 0.8bps at 0.308%, 10-Yr is up 0.4bps at 0.744%, and 30-Yr is up 0.2bps at 1.277%.

- Italian BTP spread up 3.1bps at 103.8bps / Spanish spread up 1bps at 65.5bp

OPTIONS/EUROPE SUMMARY: Sterling Put Selling

Friday's options flow included:

- DUM1 112.00/112.10cs 1x2, sold at 2.5 in 2k

- RXM1 171/170/169p fly, bought for 16 in 2.5k

- LM1 99.875 put sold at 0.5 in 8.5k

- 0LM1 99.87/99.75ps, sold at 8.25 in 8k (ref 99.775)

- 0LU1 99.62/99.50ps, bought for 2.25 in 4.5k total

- 2LN1 + 2LU1 99.37/99.12ps strip, sold at 9.75 in 4k

FX SUMMARY

USD took its cue from US yields price action this afternoon.

- The Greenback has been better offered for most of the session as US yields moved lower, after Equity pared some gains.

- But US data spoiled the momentum after a decent beat in US PMIs and New homes sales.

- U.S. Business output expanded the most on record

- Equity spiked on the releases, in turn pushing US yields higher, which helped fade some of the USD weakness.

- Nonetheless, the US Dollar is still trading mostly in the red, against all G10s and EMs, beside the TRY.

- Looking ahead, BoC Macklem speaks to Parliamentary Committee.

- After market, Rating review::

- Fitch on Finland (current rating: AA+, Outlook Stable) & the Netherlands (current rating: AAA; Outlook Stable)

- S&P on {EU} the European Financial Stability Facility (current rating: AA; Outlook Stable), Greece (current rating: Greece BB-; Outlook Stable), Italy (current rating: BBB; Outlook Stable) & the United Kingdom (current rating: AA; Outlook Stable)

- DBRS Morningstar on {FI} Finland (current rating: AA (high), Stable Trend)

FX OPTIONS: Expiries for Apr23 NY cut 1000ET (Source DTCC)

- EUR/USD: Apr27 $1.1935-50(E1.0bln); Apr28 $1.1900(E2.0bln), $1.1980-85(E1.7bln-EUR puts), $1.2000(E2.6bln, E2.35bln of EUR puts), $1.2030-41(E1.1bln), $1.2130-45(E1.0bln); Apr29 $1.1850(E1.5bln), $1.1875-85(E1.1bln), $1.1890-1.1905(E1.4bln-EUR puts)

- USD/JPY: Apr27 Y108.74-75($1.5bln-USD puts), Y109.00-10($1.3bln-USD puts), Y109.70-85($1.8bln); Apr28 Y108.10-15($982mln-USD puts); Apr29 Y106.25($1.3bln), Y106.60-70($1.5bln-USD puts), Y106.85-107.00($1.5bln), Y108.45-50($1.1bln-USD puts), Y109.00($1.0bln-USD puts)

- EUR/JPY: Apr29 Y129.85-95(E1.1bln-EUR puts)

- GBP/USD: May03 $1.3700(Gbp1.3bln)

- USD/CHF: Apr29 Chf0.9200($930mln-USD puts)

- AUD/USD: Apr27 $0.7710-25(A$1.4bln-AUD puts), $0.7830-35(A$1.1bln-AUD puts)

- AUD/JPY: Apr29 Y81.00(A$1.1bln-AUD calls)

- AUD/NZD: May04 N$1.0855-65(A$1.9bln-AUD puts)

- USD/CAD: Apr28 C$1.2600($1.1bln-USD puts)

- USD/MXN: Apr30 Mxn19.50($1.4bln)

- USD/ZAR: Apr29 Zar14.20($930mln-USD puts)

PIPELINE: $47.63B High-Grade Debt Issued Through Thursday

$7.75B Priced Thursday, $47.63B total for week. No new issuance on tap for Friday as yet- Date $MM Issuer (Priced *, Launch #)

- 04/22 $3B *Petronas $1.25B +10Y +92.5, $1.75B 40Y +115

- 04/22 $2B *Royal Bank of Canada 5Y +45, 5Y FRN SOFR+57

- 04/22 $1B *Santos 10Y +210

- 04/22 $750M *BOC Aviation 3Y +140

- 04/22 $500M *Penn Mutual Life 40Y +155

- 04/22 $500M *EIB 5Y TAP SOFR+17

EMINIS New All-Time Highs

June emini futures breaks through April 16 high of 4179.75 4180.0 last -- ample time to move higher in late trade. Other late index levels:

- S&P E-Mini Future up 59 points (1.27%) at 4186

- DJIA up 284.09 points (0.84%) at 34083.87

- Nasdaq up 224.9 points (1.6%) at 14042.32

COMMODITIES: Late Friday Retreat Erases Weekly Advance For Precious Metals

- Precious metals had accelerated towards multi-week highs in early trade on Friday, however, a flurry of selling brought prices to broadly unchanged for the week.

- Analysts attributed the late sell-off to profit taking heading into the weekend, exacerbated by a very strong U.S. existing home sales report, adding further pressure to the space after beating lofty expectations. Additionally, bullion gains appear to be stalling ahead of the 100-day MA that comes in just above $1,800.

- Spot Gold and Silver both lost ~0.4% on Friday to trade at 1777.50 and 26.04 respectively, as we approach the close.

- Oil prices succumbed to global growth demand anxieties this week, after failing to consolidate last week's breakout to the topside. *WTI futures - $61.90 (+0.78%) Brent futures - $65.80 (+0.61%)

- Despite session gains on Friday, crude benchmarks retreated around 2% on the week. Prices were dragged down by surging coronavirus cases across major energy importers India and Japan. With India being a large, high growth market for oil case spikes may pose a challenge for demand in the short term.

- OPEC+ are said to hold a full ministerial meeting on April 28, according to a draft agenda of the gathering seen by Bloomberg. Previously, OPEC+ had been discussing downgrading next week's full-scale ministerial meeting.

- Elsewhere there were Reuters reports that OPEC Secretary-General Barkindo told members of the cooperative they could be fined and have assets seized if the US. adopts legislation that authorizes antitrust enforcement against countries in the bloc.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.