-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Stocks and Tsys Regain Footing

US TSY SUMMARY: Stocks and Rates Near Session Highs Late

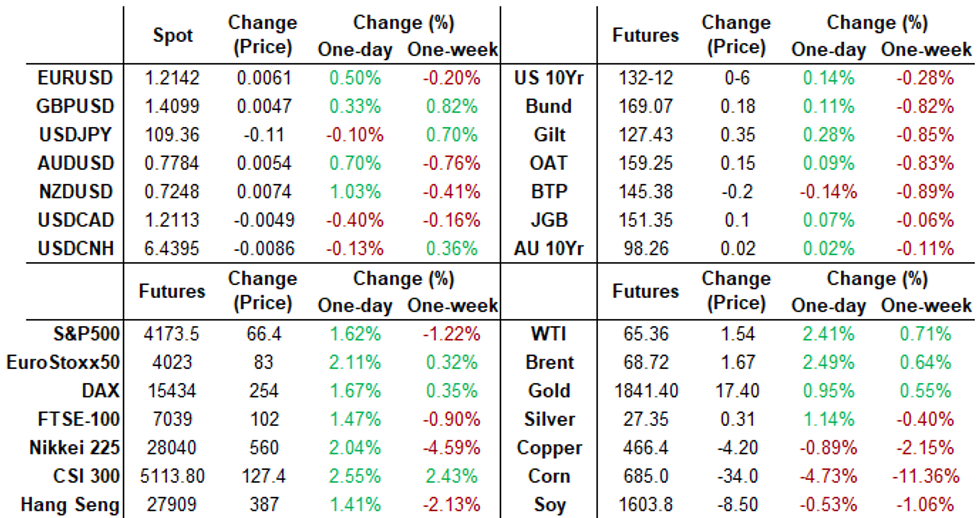

Early post-data chop resolved quickly, rates finishing near session highs while equities remained strong in late trade (ESM1 +65.0 at 4172.0). Bounce in equities said to weigh on US$.- Tsys traded lower on mixed data: retail sales weaker than expected, import prices little higher) but quickly rebounded back to opening levels/top end of range soon after.

- Moderate volumes in Tsy futures by the close (TYM1 1.45M), flow largely two-way positioning from fast$, prop and option acct hedging, no deal tied flow but some light steepener resets after curves bull flattened earlier. Yld curves finished session near lows w/5s30s appr 3.4bp flatter at 153.32.

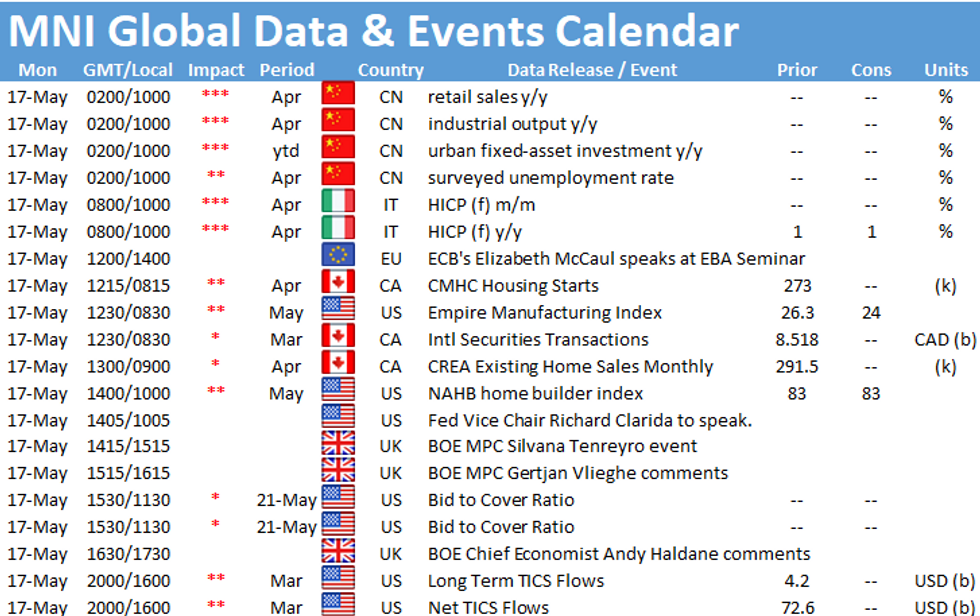

- After slow start for data next week, focus on Apr FOMC minutes on Wednesday.

- The 2-Yr yield is down 0.4bps at 0.149%, 5-Yr is down 0.8bps at 0.8193%, 10-Yr is down 1.9bps at 1.6386%, and 30-Yr is down 4.2bps at 2.3538%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00025 at 0.06200% (-0.00212/wk)

- 1 Month -0.00338 to 0.09750% (-0.00388/wk)

- 3 Month -0.00075 to 0.15513% (-0.00475/wk) ** (vs. Record Low 0.15413% on 5/12)

- 6 Month -0.00500 to 0.18763% (-0.00512/wk)

- 1 Year +0.00125 to 0.26588% (-0.00512/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $63B

- Daily Overnight Bank Funding Rate: 0.05% volume: $253B

- Secured Overnight Financing Rate (SOFR): 0.01%, $860B

- Broad General Collateral Rate (BGCR): 0.01%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $349B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.401B accepted vs. $42.745B submission

- Next week's purchases:

- Mon 5/17 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 5/18 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 5/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 5/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/21 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options

- -4,000 Blue Jun 87 straddles, 20.0

- +15,000 Green Jul 90 puts, 6.0 (appr +100k/day from 5.5-6.0)

- Block, +49,900 Green Jul 90 puts, 5.5

- +30,000 Green Jul 90 puts, 5.5

- -5,000 Dec 99.75/99.81 1x3 call spds, 0.5 3-leg over

- +10,000 short Sep 90 puts, 0.5

- +15,000 Red Jun 93/96 put spds, 2.5

- Overnight trade

- 11,000 Dec 100 calls, 0.5

- Block, 7,200 Blue May 87/88 1x2 call spds, 1.0

- 3,900 Jun 97/98 1x2 call spds

- 2,000 short Sep 93/96 2x1 put spds

- 1,200 Blue Sep 77/80/82 put flys

- 1,500 Blue Dec 78/82 put spds vs. 88 calls

- 1,000 Blue Jul 86/87/88/90 call condors

- 5,100 TYN 130.5/131.5 put spds, 23

- -5,600 TYN 131.5/132.5 strangles, 1-03

- -8,300 TYQ 129.5/133 strangles, 40

- -20,000 TYM 131.5 puts, 3 (total volume on strike near 90k)

- +1,500 TYU 127/128/129 2x3x1 put flys, 14

- 30,000 TYM 131/131.5 put spds, 2.0

- 3,000 USQ 165/175 call spd

- over 2,000 TYN 130/131 2x1 put spds,

- +2,000 FVM 123.75/124/124.25 2x3x1 put flys, 1

- -8,000 TYM 131.5 puts, 3

- -2,500 USN 156 calls, 119-118

- +10,000 TYQ 131 puts, 51

- over 2,000 TYN/TYU 131 put calendar spds, 33

- Overnight trade

- 12,800 TYM 131 puts, 2-3

- 2,000 USM 154/155 put spds

EGBs-GILTS CASH CLOSE: Gilts Outperform In Broad Relief Rally

Gilts strongly outperformed Bunds Friday amid a broader reprieve for core global FI, following Wednesday's US inflation data. Periphery spreads widened, led by Italy.

- With no bond supply, or key data or speakers, the broader risk tone (less fearful of an inflation surge) set the stage for a retracement lower in yields vs the past couple of sessions.

- Equities rose sharply and the euro and pound strengthened.

- MNI published an Exclusive talking to ECB sources on an upcoming Strategy Review meeting.

- After hours Friday sees ratings reviews: Fitch on Portugal, S&P on Netherlands.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.2bps at -0.656%, 5-Yr is down 0.8bps at -0.52%, 10-Yr is down 0.9bps at -0.129%, and 30-Yr is down 0.3bps at 0.434%.

- UK: The 2-Yr yield is down 2.3bps at 0.08%, 5-Yr is down 2.9bps at 0.38%, 10-Yr is down 4.1bps at 0.857%, and 30-Yr is down 4.1bps at 1.397%.

- Italian BTP spread up 2.3bps at 120bps /Spanish spread up 0.8bps at 71.4bps

OPTIONS/EUROPE SUMMARY: Euribor Puts Look For 2024 ECB Rate Hikes

Friday's options flow included:

- DUM1 112.30/20/10/00p condor, sold at 3.5 in 5k

- RXM1 170/168/167p fly sold at 112 in 3k (profit taking)

- RXM1 168/167ps 1x2, bought for 6.5 in 3k

- RXM1 168p, bought for 7.5 in 2k (ref 169.06)

- RXM1 169/168.5/167.5p ladder, bought for 15 in 4.5k

- RXM1 167p, bought for 1 in 20k

- RXM1 169/168.5ps 1x2, bought for 3 in 1.7k

- 3RU1 100/99.62ps 1x2, bough for 2.5 in 10k

- 3RU1 100/99.87/99.62 broken put ladder, bought for flat in 4k (circa 20k done this week)

- 3RQ1 100.125/100/99.875p ladder, bought for 0.25 in 2k

- 3RZ1 100/99.87ps vs 100.50/100.62cs, sold the ps at 3 in 5k

- 0LU1 99.62c, sold at 9.25 in 2.5k

- 3LU1 99.00/98.87ps 1x2, bought the 1 for -5 (receive) in 1.75k

FOREX: Strong Recovery In Risk Weighs On US Dollar

- A strong bounce in US equity indices and oil prices prompted the dollar to lose ground on Friday. Broad dollar indices retreated around 0.4% to levels closely matching the prior week's close.

- The clear outperformer was NZD, squeezing just shy of 1% back to 0.7250. The improved global sentiment also boosted the Aussie (+0.65%) to 0.7777.

- Unchanged on the session and lagging the move against the greenback was the Japanese Yen as cross/JPY was a beneficiary, consistently supported throughout the day.

- EUR, GBP and CAD all roughly 0.4% higher in a very gradual, orderly manner, with little notable price action to report throughout the session.

- GBPUSD outlook remains bullish despite the post-CPI weight in the pair. Cable looks almost certain to post the highest weekly close since mid-February. The rate has cleared a number of resistance levels, reinforcing a positive theme with sights set on the key resistance at 1.4237, Feb 24 high.

- Data highlights next week include, Australian Employment, Eurozone Flash PMIs as well as Inflation data from the UK and Canada. The week kicks off with multiple Fed Speakers on Monday, as they participate in an online conference hosted by the Federal Reserve Bank of Atlanta.

FX OPTIONS: Expiries for May17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1980-95(E816mln), $1.2120(E635mln), $1.2150-53(E2.1bln)

- AUD/USD: $0.7750-60(A$1.6bln)

- USD/CNY: Cny6.45($906mln)

PIPELINE: Nearly $60B Priced on Week

05/14 No new issuance Friday after $55.95B priced first 4 days of week, Monday's $18.5B Amazon 8pt jumbo the lion's share. $5.55B Priced Thursday:- Date $MM Issuer (Priced *, Launch #)

- 05/13 $1.85B *JP Morgan PerpNC5 $25par pfd, 4.625%

- 05/13 $1.5B *Arthur J Gallagher $650M 10Y +90, $850M 30Y +115

- 05/13 $1.45B *Goodyear $850M 8Y 5%, $600M 10Y 5.25%

- 05/13 $750M *Vornado Realty 00M $5Y +135, $350M 10Y +180

EQUITIES: Stocks Cement Bounce into Friday Close

- Stocks continue to inch higher, with the e-mini S&P touching new session highs and showing above Wednesday's best levels of 4150.50. This extends the recovery above the 50-dma support at 4060.59, which remains a key level going forward.

- Tech outperformed as the high beta sectors continued to bounce, prompting the NASDAQ to outperform core S&P and Dow Jones markets. Tech traded well alongside the energy sector, which benefited from a stabilisation in oil prices Friday.

- European indices outperformed their US counterparts, with Spanish stocks rallying to close higher by 2%. The UK's FTSE-100 was a relative underperformer, closing higher by 1.2% as sluggish materials stocks dragged on the index.

COMMODITIES: Oil Regains Poise, Gold Looks For Strong Weekly Close

- Having slipped sharply on Thursday, WTI and Brent crude futures regathered some poise ahead of the Friday close, finishing with gains of over 2% apiece.

- Markets suffered Thursday on the reopening of the gas-carrying Colonial Pipeline, which eased the supply scramble that'd unnerved many Southern States mid-week. Luckily for bulls, markets re-coupled with equities into the Friday close, bouncing well ahead of key support at the $62.61 50-dma.

- Meanwhile, Gold staged a USD-inspired recovery, with the softer greenback putting the yellow metal on course for a strong weekly close. Bulls now need to take out resistance layered between the week's high at $1845.5 and the 200-dma at 1846.9. A break through here opens levels not seen since February.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.