-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Mkts Pricing Strong May Jobs Data

US TSY SUMMARY: USD Gains, Rates & Equities Weaker Ahead May NFP

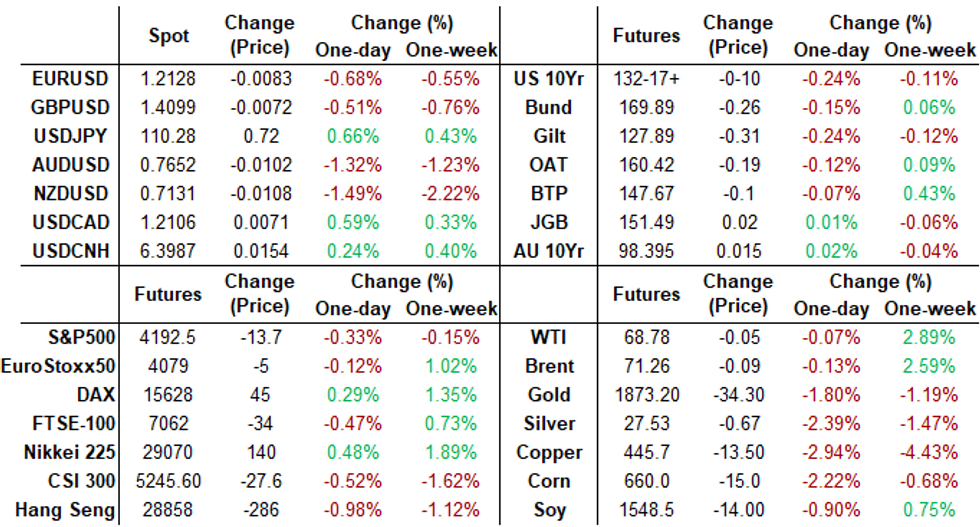

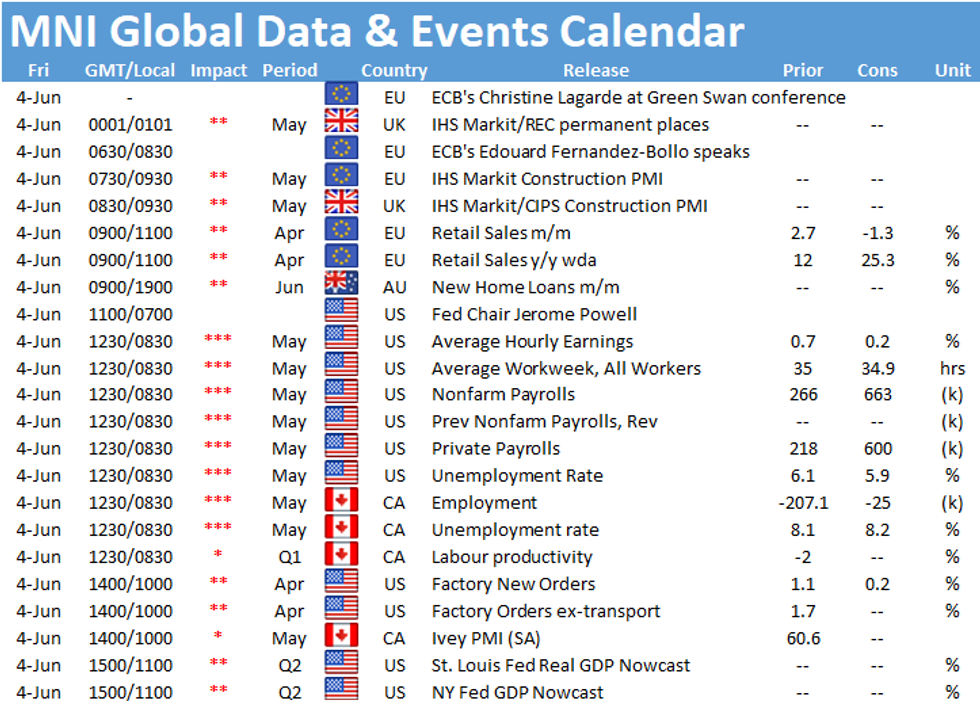

Rates and equities traded weaker while USD enjoyed strong gains (DXY topped 90.55) in the aftermath of stronger than expected ADP private employ data (+978K vs. +650 exp) Thu. Quiet sideways trade for rates and equities since before noon -- relative quiet ahead Fri's headline May employ data: mean estimate has been gaining: NFP +674k vs. +266k last month.- Signal For Nonfarms Remains Unclear: -88K revision to April's figure did little to take the sheen off a strong beat in May's ADP payrolls reading (+978k jobs vs +650k survey, and above the highest estimate of +900k).

- That said, the large discrepancy between ADP and the BLS nonfarms figure for April last month should be kept in mind, for another potential overestimation by the ADP's model for May. But perhaps we'll see some modest adjustments higher in the surveys for tomorrow's NFP (currently +655k, with BBG whisper.

- Eurodollar option trade consistently bearish on the day, hedging rate hikes via puts in 2- and 3Y midcurves.

- The 2-Yr yield is up 1.4bps at 0.1585%, 5-Yr is up 4.8bps at 0.8413%, 10-Yr is up 3.6bps at 1.6233%, and 30-Yr is up 2.3bps at 2.2946%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00037 at 0.05463% (-0.00650/wk)

- 1 Month -0.00550 to 0.08000% (-0.00588/wk)

- 3 Month -0.00325 to 0.13075% (-0.00062/wk) ** (Record Low 0.12850% on 06/01/21)

- 6 Month -0.00263 to 0.16475% (-0.00625/wk)

- 1 Year +0.00075 to 0.24563% (-0.00250/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $70B

- Daily Overnight Bank Funding Rate: 0.05% volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.01%, $953B

- Broad General Collateral Rate (BGCR): 0.01%, $408B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $371B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $5.650B submission

- Next scheduled purchase:

- Fri 6/04 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Update, +55,000 Green Dec 88/90 put spds 0.0-1.5 over 92/93 call spds

- -4,200 Green Oct 92 calls 0.5 over 88/90 put spds vs. 98.985/0.12%

- +4,000 Gold Sep 97.87/98.00 put spds 1.5 over 98.37/98.50 call spds

- 5,000 Jun 98/Dec 100 call spd, 0.0 Dec over

- +10,000 short Mar 87/92/97 put flys, 12.75

- +10,000 Sep 99.93/100/100.06 call flys, 0.25

- Overnight trade

- +22,000 Green Dec 88/90 put spds 0.0-0.5 over 92/93 call spds

- +5,000 Green Dec 85/87 put spds 3.0 over Green Dec 93 calls

- +9,000 USN 161 calls, 8

- +3,400 TYU 135 calls, 9

- -10,000 TYU 129.5/133.5 strangles, 47

- -2,000 TYN 131.25/132.25 strangles, 41

- Overnight trade

- +5,000 wk1 TY 133 puts, 2

EGBs-GILTS CASH CLOSE: Service Sector Recovery Helps Set Bearish Tone

EGBs and Gilts weakened Thursday amid strong European and US service sector data, and ahead of US nonfarm payrolls Friday.

- We saw fairly strong bear steepening in the Gilt curve, not helped by yet another weak BOE APF operation; 10-Yr BTP yields rose for the first session in five, though spreads remain relatively contained due to Bund weakness.

- Italy and Spain Services PMIs beat expectations to the upside, while the Eurozone and moreso the UK saw upward revisions in final readings vs flash.

- With no key European data (with the possible exception of Eurozone Apr retail sales), speakers or supply Friday, attention is almost entirely on the US employment report.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is down 0.5bps at -0.668%, 5-Yr is unchanged at -0.579%, 10-Yr is up 1.5bps at -0.183%, and 30-Yr is up 1.6bps at 0.379%.

- UK: The 2-Yr yield is up 2.7bps at 0.087%, 5-Yr is up 3.4bps at 0.371%, 10-Yr is up 4.2bps at 0.841%, and 30-Yr is up 4.3bps at 1.371%.

- Italian BTP spread up 0.5bps at 108.1bps / Spanish spread up 0.1bps at 65.3bps

OPTIONS/EUROPE SUMMARY: Bund Puts And Large Euribor Call Spread Sale

Thursday's options flow included:

- RXN1 168.5/167ps, sold at 3 in 2k

- RXN1 169.50/168.50/167.50 put fly bought for 6 in 1k

- RXU1 171.50/168.00/166.50 put ladder sold at 86.5 in 1.75k

- RXQ1 172.50/171.50ps 1x1.5, bought for 7 in 2k

- RXQ1 173/174.5cs 1x3, sold at 1 in 1k (1kx3k)

- OEU1 133.50/133ps, bought for 11 in 1k

- ERZ1 100.62/100.87cs, sold at 0.25 in 20k

- 3RM1 100.25p, sold at 3 in 5k (ref 100.235, -63 del)

- 0LU1 99.62c vs 3LU1 99.25c, sold the 1yr at 0.25 in 2k

- 3LU1 99.00/98.75ps vs 99.50c, sold the ps at 2.75 in 2k

FOREX: Strong Dollar Squeeze As Markets Await Friday's NFP Report

- The Dollar Index Reached its best levels since May 14th as the greenback consistently extended gains throughout the US session, following a firm ADP Employment Reading.

- Risk tied currencies were the hardest hit as equity markets started the US session poorly. Despite a late bounce on the Biden tax headlines, the more realistic prospect of legislation passing in the US continued to buoy the dollar.

- AUD and NZD lost around 1.5% compared to the 0.7% gains in broad dollar indices. Further relative underperformers were seen in the EM space with MXN, TRY and ZAR all retreating over 1%.

- Most other G10 currencies fell a proportional amount, with EUR, JPY, GBP, CAD and CHF all lower by between 0.5-0.7%.

- Recent fresh multi month/year highs made in both GBP and CAD represent interesting potential technical turning points. GBPUSD lies right at initial firm support of 1.4092, May 27 low where a break would suggest scope for a deeper corrective pullback.

- The focus for markets turns to Friday's release of US May Non-Farm Payrolls. Fed's Daly tweeted a reminder that the data for the 'next few months will likely be volatile…We have work to do to get to full employment and price stability.'

FX OPTIONS/Expiries for Jun04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E669mln), $1.2150(E603mln), $1.2185-1.2200(E1.2bln-EUR puts)

- USD/JPY: Y107.90-00($800mln), Y109.90-00($796mln)

- EUR/GBP: Gbp0.8550(E680mln)

- AUD/USD: $0.7730-50(A$1.4bln), $0.7780-0.7800(A$1.1bln-AUD puts)

- USD/CNY: Cny6.39($1.2bln), Cny6.40($1.0bln-USD puts), Cny6.41($630mln), Cny6.45($1.0bln-USD puts)

PIPELINE: $5.3B High-Grade Corporate Issuance

- Date $MM Issuer (Priced *, Launch #)

- 06/03 $1.5B *Consolidated Edison $750M each: 10Y +80, 40Y +130

- 06/03 $850M Ares Capital 7Y +165

- 06/03 $750M #Travelers 30Y +75

- 06/03 $700M *Blue Owl Fnc 10Y +165

- 06/03 $500M *Puget Energy 7Y +108

- 06/03 $500M *IADB 10Y FRN SOFR+36

- 06/03 $500M *Council of Europe Development Bank (CoE) 3Y -4

- $18.4B Priced Wednesday

- 06/02 $5.5B *ADB $4B 3Y -3, $1.5B 7Y +10

- 06/02 $3.15B #Citigroup $2.75B 6NC5 +67, $400M 6NC5 FRN SOFR+77

- 06/02 $3B #Indonesia $1.25B 5Y 1.5%, $1B 10Y +2.55%, $ 750M 30Y 3.55% Sukuk

- 06/02 $2.5B #Societe Generale $1.25B each: 6NC5 +100, 11NC10 +130

- 06/02 $2B #Truist Fncl $1B each: 4NC3 FRN SOFR+40, 8NC7 +63

- 06/02 $1.5B #Petrobras 30Y 5.75%

- 06/02 $750M NY Life Ins $400M 5Y +37, $350M 5Y FRN SOFR+48

COMMODITIES: WTI, Brent Give Up Gains as Gas Inventories Surge

- WTI hit a new cycle high early Thursday, with the benchmark printing up at $69.40/bbl - the highest since 2018. This momentum faltered, however, as the DoE crude oil inventories data for the latest week showed a sizeable build in gasoline stocks, coming in well above the expected draw (build of 1.5mln bbls vs. Exp. draw of 1.8mln bbls).

- As such, both Brent and WTI crude futures head into the close in minor negative territory, although the medium-term trend remains bullish.

- Precious metals suffered from the bouncing greenback, which saw gold and silver notch up losses of 2% and 3% respectively, the sharpest decline for both metals in months. This saw gold undo much of the late May rally, narrowing the gap with first key support at the $1,842/oz 200-dma.

EQUITIES: Stocks Buoyed Off Lows as Cross-Aisle Differences Narrow

- Equity markets started the US session poorly, with the e-mini S&P rolling further off the weekly highs to hit new weekly lows of 4,165.25.

- This downside stalled and partially reversed however, as The Washington Post reported that the White House could offer to drop their requested corporate tax rate hike in a proposed infrastructure bill, thereby narrowing the cross-aisle gap and making the legislation a more realistic prospect.

- Recovery off the lows failed to nudge the S&P 500 cash index back into positive territory, with the tech and consumer discretionary sectors slipping, while financials and energy only notched up minor gains.

- European indices were similarly mixed, with Italy's FTSE-MIB and Germany's DAX gaining, while UK, French and Spanish markets closed lower.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.