-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Reverse Support Ahead Supply

MNI INTERVIEW: US Factories To See Expansion By Feb- ISM

MNI UST Issuance Deep Dive: Jan 2025

MNI ASIA MARKETS ANALYSIS: Picking Up Where Friday Left Off

US TSY SUMMARY: FI Support Evaporates, Focus on Tue' CPI

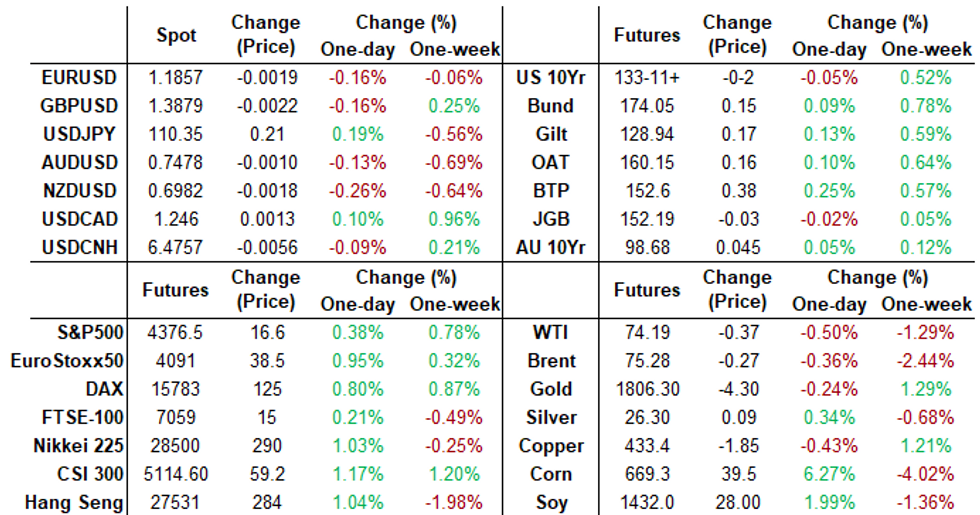

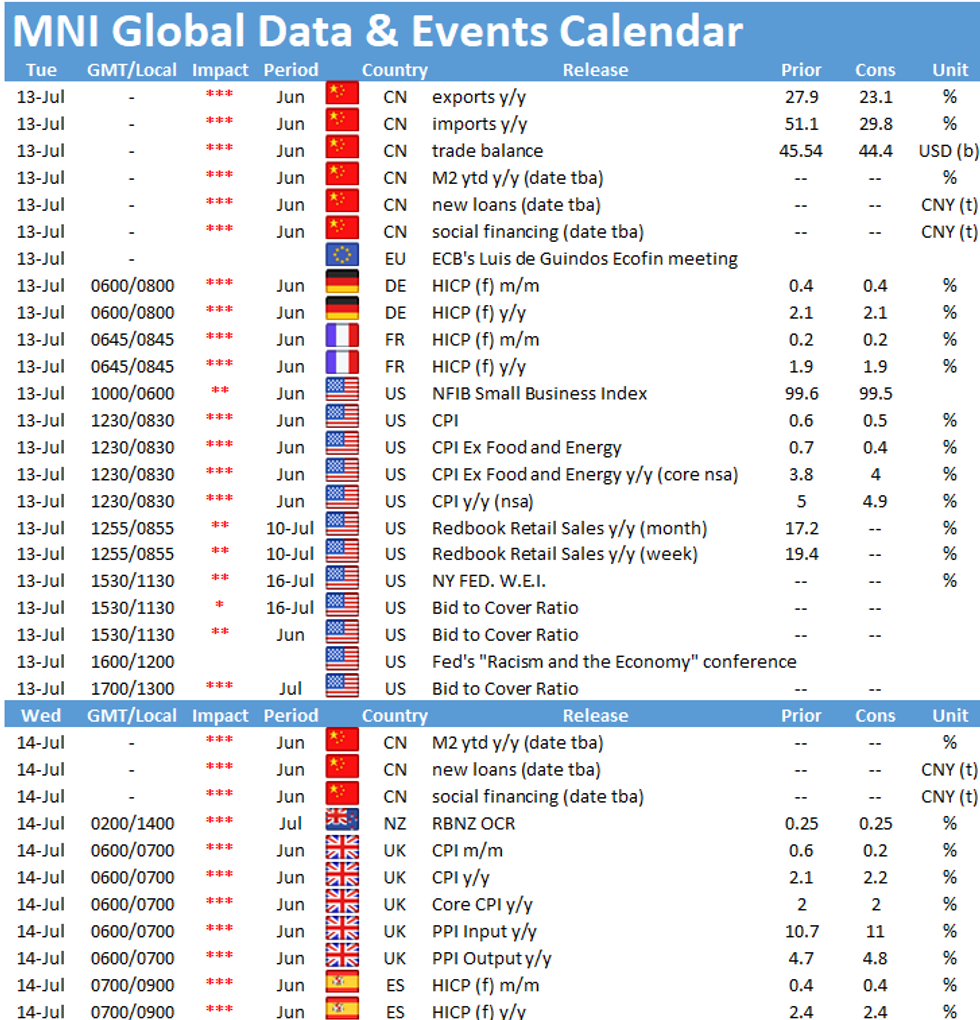

Markets grew quiet over the last hour into the NY FI close, reversing opening levels w/ equities near session highs, Tsys mildly weaker after the bell. No data Monday,

focus on Tue' June CPI: MoM (0.6%, 0.5%); Ex Food and Energy MoM (0.7%, 0.4%).

- Markets did have comments from NY Fed Williams and MN Fed Kashkari to digest. Williams' straightforward "view is the simplest, natural way is to first do a taper or finish that then think about liftoff." Kashkari sees current inflation metrics as transitory.

- Mirroring EGBs, Tsys opened moderately firmer/off late overnight highs, support evaporating by midday. Sources reported carry-over selling in intermediates to long end from Asian real$ accts, pre-auction short sets ahead todays 3Y and 10Y R/O note auctions. US Tsy auction's $24B 30Y Bond re-open Tuesday.

- 3Y note auction tailed: Tsys inched lower after $58B 3Y note auction (91282CCL3) tails: 0.426% high yield vs. 0.422% WI; 2.41x bid-to-cover off 2.46x 5 auction avg. Tsys bounce off lows after $38B 10Y note auction re-open (91282CCB5) trades through: 1.371% high yield vs. 1.375% WI; 2.39x bid-to-cover off 2.43x 5 auction avg.

- Dealers waited until after the Tsy 10Y R/O to launch larger than some had anticipated $6B MUFG 3-parter.

- The 2-Yr yield is up 1.8bps at 0.2307%, 5-Yr is up 1.4bps at 0.7994%, 10-Yr is up 0.8bps at 1.3678%, and 30-Yr is up 0.9bps at 1.9982%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00012 at 0.08675% (+0.00613 total last wk)

- 1 Month -0.00438 to 0.09575% (-0.00275 total last wk)

- 3 Month +0.00425 to 0.13288% (-0.00925 total last wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00338 to 0.15438% (-0.01200 total last wk)

- 1 Year +0.00562 to 0.24450% (-0.00563 total last wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $75B

- Daily Overnight Bank Funding Rate: 0.08% volume: $257B

- Secured Overnight Financing Rate (SOFR): 0.05%, $911B

- Broad General Collateral Rate (BGCR): 0.05%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $330B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.001B accepted vs. $3.931B submission

- Next scheduled purchases:

- Tue 7/13 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 7/14 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 7/14 1500ET Update NY Fed Operational Purchase Schedule

FED: Reverse Repo Operations

NY Fed reverse repo usage recedes to $776.472B from 70 counterparties vs. $780.596B on Friday. Compares to June 30 record high of $991.939B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 Sep 99.81/99.87 put spds, 1.5

- +5,000 Green Mar 99.62 calls, 1.5 vs. 98.92/0.10%

- Overnight trade

- Block: 7,500 Blue Jul 98.87 calls, 1.0 vs. 98.73/0.10%

- 5,000 Green Mar 99.62 calls

- 4,000 Green Sep 99.25 calls

- 3,000 short Sep 99.56/99.68 3x2 put spds

- -2,000 TYU 132/135 strangles, 39-38

- +5,000 TYU 131.5/133 2x1 put spds

- +2,000 TYU 130 puts, 5

- Overnight trade

- +6,500 wk3 TY 133.5 puts, 20

- +21,000 wk3 TY 132 puts, 1

- 3,000 TYQ 131.5 puts, 1.0

- 4,000 TYQ 132/132.25/132.75 broken put trees

EGBs-GILTS CASH CLOSE: Rally Fades With Supply Eyed

The Bund and Gilt curves bull flattened Monday, but yields ended well above the session's lowest levels as equities rebounded. Large supply and US CPI Tuesday also presenting some near-term risk.

- Tuesday will see big issuance: E30bln in euro-denominated supply (including EU syndication), and GBP6bln in 2039 Gilt syndication. Not to mention large US supply today/Tuesday.

- Periphery spreads tightened; Italy 10-Yr spreads have retraced most of last week's widening.

- As expected, the UK authorities announced they were going ahead with plans to end COVID-19 restrictions in England on 19 July.

- Otherwise, no bond supply today and nothing new from ECB speakers.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.4bps at -0.672%, 5-Yr is down 0.2bps at -0.598%, 10-Yr is down 0.2bps at -0.295%, and 30-Yr is down 0.1bps at 0.205%.

- UK: The 2-Yr yield is up 0.7bps at 0.094%, 5-Yr is up 0.1bps at 0.296%, 10-Yr is down 0.4bps at 0.651%, and 30-Yr is down 1.5bps at 1.158%.

- Italian BTP spread down 2.3bps at 103.3bps / Spanish down 1.1bps at 63.6bps

FOREX: G10 FX Holds Narrow Ranges Ahead Of US CPI Data

- Major currency pairs lacked conviction on Monday, as the dollar index made marginal gains, up 0.15%, heading into important US inflation data on Tuesday.

- Despite equity indices resuming their incline, NZD was the Monday laggard, falling 0.3%. Greater weakness had been seen during the European session, with NZDUSD reaching 0.6948 before recovering to 0.6980 as of writing.

- Smaller losses were also seen in EUR, JPY, GBP, AUD and CAD of around 0.15%.

- USDJPY printed a high of 110.40 which was the notable breakdown level last week. What appeared to be strong follow through on July 8th (low of 109.53) has been gradually unwound over the past two trading days. Despite the 110.40 level capping price action today, USDJPY remains well bid, hovering just six pips shy of those best levels.

- More notable moves in the EM space, with strong divergence between high beta currencies. BRL firmed 1.5% following a strong period of weakness, whereas ZAR came under significant pressure following a rapid escalation of pro-Zuma protests and violence.

- The focus tomorrow is firmly on the US June CPI data where the annual headline is expected to dip to 4.9% from 5.0% in May. Later on Tuesday, Fed's Bostic (2021 voter) is due to deliver opening remarks at a webinar presented by all 12 District Banks of the Federal Reserve System.

FOREX/Expiries for Jul13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1740-45(E1.2bln), $1.1875(E605mln), $1.1900-15(E1.3bln)

- USD/JPY: Y109.70-85($883mln), Y110.30($545mln)

- EUR/JPY: Y132.85(E536mln)

PIPELINE: $6B MUFG 3Pt Launched

Dealers waited until after the Tsy 10Y R/O to launch larger than some had anticipated $6B MUFG 3-parter. Note, BC and IADB expected to launch Tuesday.- Date $MM Issuer (Priced *, Launch #)

- 07/12 $6B #MUFG (Mitsubishi UFF Fncl Grp) $2.1B 4NC3 +55, $2.1B 6NC5 +75, $1.8B 11NC10 +95

- On tap:

- 07/13 $Benchmark Province of British Columbia 5Y +6a

- 07/13 $Benchmark IADB 7Y sustainable development bond

- 07/?? $870M Uzbekistan 10Y 4.25%a (includes UZS 3Y)

EQUITIES: Stocks Resume Incline, New Highs Across US and Europe

- Picking up where they left off on Friday, equity markets resumed their incline Monday, resulting in new all-time highs printed across the S&P 500, the NASDAQ-100 and a number of European indices. There were few new macro or economic drivers Monday, allowing prices to gravitate higher on the back of strength in financials, real estate and communication services firms.

- Consumer staples and energy names were the laggards, but losses in these sectors were comfortably countered elsewhere.

- Focus turns to the beginning of Q3 earnings season. Banks and large financial firms are the first focus, with Goldman Sachs and JPMorgan both on the docket Tuesday.

- Full schedule with expectations and timings here: https://roar-assets-auto.rbl.ms/documents/10738/MNIUSEARNINGS090721.pdf

COMMODITIES: Oil Drifts Amid Lack of Macro Cues

- WTI and Brent crude futures traded in minor negative territory Monday, but there remained a distinct lack of market or macro cues to drive prices convincingly in either direction.

- This keeps the technical outlook unchanged, with Brent still vulnerable following last week's downleg. The focus is on $71.24, the Jun 17 low. Gains are considered corrective. WTI has also cleared its 20-day EMA last week and attention turns to $69.54, Jun 17 low.

- In the precious metals space, Gold saw weakness in early US trade, pressuring the price down to $1791.68/oz before recovering. This keeps gold on a firmer tone, with attention on the 50-day EMA that intersects at $1814.1. A clear break of the EMA is required to suggest scope for a stronger rally. This would open $1833.7, 50.0% of the Jun 1 - 29 decline.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.